Alaska Oil Tax Cuts Veto Referendum, Ballot Measure 1 (August 2014)

| ||||||||||||

| ||||||||||||

The Alaska Oil Tax Cuts Veto Referendum, Ballot Measure 1 was on the August 19, 2014, primary ballot in Alaska as a veto referendum, where it was defeated.

With 100 percent of precincts reporting, the election results were too close to call for approximately a week due to outstanding absentee and early voting ballots, though it appeared the state's voters had opted to reject the measure, with about 52 percent voting "no".[1] It was finally determined that the measure was, indeed, defeated.[2] The referendum sought to repeal Senate Bill 21, also known as the Oil and Gas Production Tax and the More Alaska Production Act (MAPA), which was passed by the Alaska State Legislature and granted tax breaks to oil companies.[3][4]

To land the referendum on the ballot, supporters had to collect at least 30,169 valid signatures by July 13, 2013. They ultimately collected more than 52,000 signatures by the deadline, 45,664 of which were confirmed valid by the state's Division of Elections.[3][5][6][7][8]

Those who supported the referendum and sought to repeal SB 21 believed the tax breaks would only benefit oil companies and not the citizens of Alaska. Those who were against the referendum believed the tax cuts outlined in SB 21 were necessary to incentivize these companies to continue drilling for oil in Alaska. At the time of the election, a majority of Alaska's budget was balanced using revenue from oil taxation.[3] As of July 2014, the opposition campaign had outraised the support campaign by a margin of one hundredfold.[8][9] Had Ballot Measure 1 been approved and SB 21 repealed, the former oil and gas tax structure, Alaska’s Clear and Equitable Share (ACES), would have been reinstated. The change back to ACES would have taken place 30 days after the approval of Ballot Measure 1.[4][10] However, the measure was defeated, thereby keeping the MAPA tax structure in place.[2]

The full text of SB 21 can be found here.[11]

Election results

In Alaska, veto referendums are worded in such a way that a "yes" vote repeals the law in question, while a "no" vote upholds it.

Below are the certified election results.

| Alaska Ballot Measure 1 (2014) | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 99,855 | 52.7% | |||

| Yes | 89,608 | 47.3% | ||

Election results via: State of Alaska Division of Elections

Text of measure

In Alaska, veto referendums are worded in such a way that a "yes" vote repeals the law in question, while a "no" vote upholds it.

Ballot title

The official ballot title of this measure appeared as follows:[12]

| “ |

Ballot Measure No. 1: Referendum An Act Relating to the Oil and Gas Production Tax, Interest Rates on Overdue Taxes, and Tax Credits[13] |

” |

Ballot summary

The full ballot summary, as prepared by Attorney General Michael C. Geraghty (R), can be read here.[12]

Background

- See also: Alaska state budget and finances

State budget and oil revenue

At the time of the election, Alaska did not have a state income tax or statewide sales tax, but it still maintained the lowest tax burden of all 50 states.[14][15] The vast majority of its budget came from oil and gas activity. Eighty-two percent of Alaska’s estimated state revenues for 2010 were from oil taxes, royalties and fees.[16][17] In fiscal year 2013, revenue from oil and gas activities, including production taxes, corporate income taxes, property taxes and conservation surcharges, totaled $4,621,125,244 or 91.34 percent of state revenue. Oil and gas production alone accounted for 78.53 percent of the state's revenue in fiscal year 2013. Additionally, a vast majority of this revenue came from a limited number of companies. Out of the 12,086 corporations that filed tax returns in the state in 2013, only 18 were oil and gas companies.[18] Alaska, therefore, relied heavily on revenue from oil to balance its budget. Taxes from the oil and gas industry provided 90 percent of discretionary funds and were used to compensate teachers, some law enforcement officers, roads and snowplows, health care, and state social workers.[3][8]

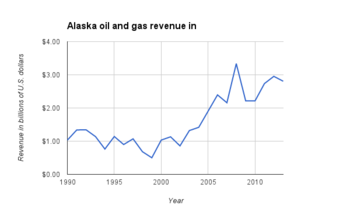

The chart above and to the left shows oil and gas production revenue from rents, royalty payments, bonuses, bids, federal payments and settlements in billions of U.S. dollars from 1990 through 2013 on state lands. In 1990, $1.032 billion was collected from oil and gas activity on state lands. This revenue peaked in 2008, when $3.336 billion was collected. In 2013, the most recent year for which data were available at the time of the vote on Ballot Measure 1, $2.807 billion was collected.[19]

At the time of the election, the remaining portion of Alaska's budget was supplemented by federal funds that primarily financed specific services such as Medicare, Medicaid and infrastructure projects.[17] [20]

| Budget policy is a major issue in Alaska. To learn more, see "Alaska state budget." |

Tax code changes

Under the previous tax code, ACES, oil companies paid a base rate of 25 percent on the first $30 of net profits from a barrel of oil, plus a 0.4 percentage point increase in tax rate for each subsequent $1 in profit per barrel. Under SB 21, oil companies pay a base rate of 35 percent, but the additional add-on tax matching the market price of oil is removed. Given the new provisions detailed in SB 21, it is estimated that the tax on oil will be approximately 14 percent.[5]

Use of veto referendums in Alaska

Since this issue successfully made the ballot, it marked the fourth time Alaskans employed their right of veto referendum. They used it first in 1968, with the Voter Registration Referendum, again in 1976, with the Compensation and Retirement Referendum, and most recently in 2000, with the Alaska Land-And-Shoot Referendum.

Support for "yes" vote

- See also: Alaska Ballot Measure 1 campaign ads

Supporters of the referendum created two separate campaigns. One campaign was Stop the Giveaway - Vote yes on Prop 1, whose supporters included Hal Gazaway (D), Barb Gazaway and former Alaska representative Ray Metcalfe.[21] The second campaign was called Vote Yes! Repeal the Giveaway! The referendum's proponents included former Fairbanks mayor, Jim Whitaker, former governor and state representative Jay Hammond's widow, Bella, and former senator, Vic Fischer.[22] Supporters claimed SB 21 only benefited oil companies, not Alaskan citizens. They were confident oil companies would come to Alaska with or without the added incentive of a tax break.[3] After the measure was officially certified in early September 2013, Whitaker said, "I think all Alaskans should be pleased that we have a chance to make a decision individually about something that is going to affect the future of our state for a long time. And this is our shot. This is our chance to do what we think is right."[23]

Supporters

- Hal Gazaway (D)

- Barb Gazaway

- Ray Metcalfe (R)

- Jim Whitaker (R)

- Bella Hammond

- Victor Fischer

- Sarah Palin (R), Former governor of Alaska[10]

- Kevin Banks, former director of the DNR’s Division of Oil and Gas[24]

Arguments

"Thumbs up for Proposition 1," published by Vote Yes! Repeal the Giveaway!

|

Vote Yes - Repeal the Oil Giveaway developed a slideshow that supplied seven reasons to oppose the oil tax cuts and support the veto referendum. The following is an excerpt from the slideshow:

| “ |

1. It’s a massive giveaway of our wealth with no strings attached.

2. It violates Alaska’s Constitution.

3. It will drain Alaskans’ savings and push us off a fiscal cliff.

4. Our current tax system workers and is fair to all parties.

5. It will discourage investment in Alaska.

6. It was built on myths and distortions, at best.

7. Alaskans deserve a say in a decision of this magnitude.

|

” |

| —Vote Yes - Repeal the Oil Giveaway | ||

Kevin Banks, former director of the DNR’s Division of Oil and Gas, said he would be voting to repeal SB 21:[24]

| “ | A yes vote will reinstate the ACES tax system that SB 21 was purported to “reform.” ACES was all about investment. ACES offered tax credits and tax deductions for new exploration and capital expenditures. But in order to get these credits, industry had to invest here -- in Alaska. In return for these generous credits the ACES tax system allowed the state to share in future upside returns with industry.

SB 21 has no such mechanism to assure that tax savings realized by oil industry will be plowed back into Alaska. Instead, its advocates have had to appeal to forces of the free market to achieve this goal. But while the oil industry in Alaska is a free market, it is not a competitive market. In a truly competitive market (the Bakken shale oil play in North Dakota?) overall industry investment behavior is more predictable. The decisions taken by a single company have only a small impact on the industry as a whole. But the Alaska oil industry is dominated by the decisions taken by just three companies. We take it on faith that the Big Three always rely on cold calculations of rates of return and other investment metrics to budget for their Alaska projects, but overall corporate policies and the views of Wall Street stock analysts also hold sway in these decisions. Access to resources, divestment opportunities and basin control have substantial impact on the investment decisions of Alaska’s Big Three. ConocoPhillips has pursued exploration opportunities in the National Petroleum Reserve-Alaska but the pace to develop these has been stymied by environment opposition. ExxonMobil has finally now moved ahead to develop Point Thomson. As a result, ExxonMobil, as the largest holder of North Slope gas reserves, will dictate the pace of development and the ownership of the gas line. In the aftermath of the Macondo well disaster, BP is divesting its Alaska assets -- the sale of its ownership in Milne Point, Northstar, Endicott and Liberty to Hilcorp is the case in point. Easing taxes under SB 21 will have little influence on these decisions. So we debate how SB 21 will affect state tax revenues and a hope for more production. As Richard Mauer suggests, those are facts that are debatable. The central fact about Ballot Measure 1 is simple: it is about political influence. We face a choice to assert what we believe is best for ourselves and our political future or cede substantial control over this future to the oil industry. The massive campaign spending from industry has made this so. We don’t need economic models and forecasts to answer the question, “What future candidate for any elective office will ignore the impact of this tidal wave of cash?” If this future candidate were to take even a moderate position unfavorable to the industry or assert too strongly to seek the “maximum benefit” of oil development for Alaskans, she will face an opponent overwhelmingly funded by oil industry corporate donations. What choices will these candidates then offer? In the face of looming budget deficits, what programs will they propose to cut? Education? Public safety? Roads? Will industry outsource these services to government just as it outsources catering and accounting services? I’m voting yes on Ballot Measure 1 because I want a future where I can debate issues with my neighbors that are important to us without the one-sided, disproportionately funded noise of endless political ads dividing us. We need to preserve the independence that is so much our character as Alaskans. I urge you to vote Yes on One on Aug. 19. [13] |

” |

| —Kevin Banks | ||

Campaign contributions

| Total campaign cash as of August 19, 2014 | |

| $488,090 | |

| $14,221,602 | |

As of August 19, 2014, two campaign organizations had received an aggregate total of $488,090 in contributions.[26][9]

PAC info:

| PAC/Ballot measure group | Amount raised | Amount spent |

|---|---|---|

| Vote Yes! Repeal the Giveaway | $476,840 | $574,727 |

| Stop the Giveaway! Vote Yes on Prop 1 | $11,250 | $6,959 |

| Total | $488,090 | $581,686 |

Disclaimer: According to campaign finance reports published by the state of Alaska, the group, Vote Yes! Repeal the Giveaway, spent more than it raised. This was possible because the group was able to accrue debt.

Top 5 contributors:

| Donor | Amount |

|---|---|

| BJ Gottstein | $310,000 |

| Alaska State Employees Association | $20,000 |

| International Brotherhood of Electrical Workers | $20,000 |

| Robin Brena | $15,000 |

| Barnard Gottstein | $10,000 |

Former Alaska Senate president Chancy Croft, one of the referendum's supporters, predicted in early 2014 that the opposition campaign would outspend the "Vote Yes" campaign 10-to-1. Upon hearing that the opposition campaign had raised $3.5 million by early February, he remarked, "So I was wrong. They are going to outspend us 50-to-1."[8] As of July 2014, the opposition had outraised supporters by approximately 100-to-1.[9]

Opposition to "yes" vote

Four campaign organizations formed to oppose the veto referendum, including Vote No on 1, Keep Alaska Competitive - Vote No on 1, No One On One and We Are Alaska.[27][28][29][30]

Gov. Sean Parnell (R) sponsored and strongly supported Senate Bill 21 and, therefore, was against the effort to repeal it. The governor claimed the tax break would entice oil companies to come to Alaska and boost production. At the time of the election, Alaska relied heavily on revenue from oil to balance its budget, as oil taxes were the state's primary source of income. They provided for 90 percent of discretionary funds and were used to compensate teachers, some law enforcement officers, health care and state social workers, and pay for roads and snowplows.[3][8]

Opponents

Officials

Former officials

- Rick Mystrom (R), Former Anchorage Mayor[31]

- Leslie Hajdukovich, Former President of the Fairbanks North Star Borough School Board

Organizations

- Alaska Republican Party[31]

- Alaska Libertarian Party

- Alaska Federation of Republican Women

- Anchorage Republican Women's Club

- Make Alaska Competitive Coalition

- Alaska Alliance for Cruise Travel

- Alaska Bankers Association

- Alaska Cruise Association

- Alaska Forest Association

- Alaska Miners Association

- Alaska Oil & Gas Association

- Alaska Trucking Association

- Alaska State Home Building Association

- Associated Builders & Contractors of Alaska

- Associated General Contractors of Alaska

- Consumer Energy Alliance Alaska

- Council of Alaska Producers

- The Alaska Support Industry Alliance

- Resource Development Council for Alaska, Inc.

- Anchorage Economic Development Corporation

- Fairbanks Economic Development Corporation

- Alaska Teamsters

- First Things First Alaska Foundation

- Mat-Su Business Alliance

- Mat-Su Home Builders Association

- Southeast Conference

- Anchorage Tea Party

- ProsperityAlaska.org

Chambers of Commerce

A Vote No on 1 online ad titled, "Oil tax reform matters to Alaska's schools."

|

- Alaska Chamber[31]

- Anchorage Chamber of Commerce

- Chugiak Eagle River Chamber of Commerce

- Greater Fairbanks Chamber of Commerce

- Greater Ketchikan Chamber of Commerce

- Greater Palmer Chamber of Commerce

- Greater Wasilla Chamber of Commerce

- Juneau Chamber of Commerce

- Kenai Chamber of Commerce

- Seward Chamber of Commerce

- Soldotna Chamber of Commerce

Businesses

- Alaska Cruises, Inc.[31]

- BP Exploration Alaska

- Bristol Bay Native Corporation

- Chevron

- ConocoPhillips

- Denali Drilling

- ExxonMobil

- Halliburton

- Nabors Alaska Drilling, Inc.

- Pioneer Natural Resources, USA

- Puget Sound Pipe & Supply Co.

- Repsol

- Samson Electric

Arguments

Keep Alaska Competitive - Vote No on 1 issued a frequently asked questions sheet that detailed responses to questions about the oil tax cuts. The following is an excerpt from that sheet:

| “ |

Q: What is the goal of oil tax reform? Q: Hasn’t Alaska benefited from high oil prices in recent years? Q: How does a 35 percent tax on production compare with other oil and gas provinces? Q: Isn’t the new legislation a $2 billion giveway? Q: Has oil tax reform produced any results? Q: Isn’t the new oil tax responsible for the projected FY 2014 and FY 2015 deficits? Q: Doesn’t the state constitution require Alaska to get maximum benefit from our oil? |

” |

| —Keep Alaska Competitive - Vote No on 1 | ||

Campaign contributions

As of August 19, 2014, four campaign organizations had received an aggregate total of $14,221,602 in contributions.[26][9]

A Vote No on 1 television ad.

|

PAC info:

| PAC/Ballot measure group | Amount raised | Amount spent |

|---|---|---|

| Vote No on One | $12,785,724 | $12,388,590 |

| No One on One | $711,402 | $764,736 |

| Keep Alaska Competitive - Vote No on 1 | $648,519 | $585,853 |

| We Are Alaska - No on One | $75,957 | $32,398 |

| Total | $14,221,602 | $13,771,577 |

Disclaimer: According to campaign finance reports published by the state of Alaska, the group, No One on One spent more than it raised. This was possible because the group was able to accrue debt.

Top 6 contributors:

| Donor | Amount |

|---|---|

| BP Exploration (Alaska) Inc. | $3,625,408 |

| ExxonMobil | $3,606,132 |

| ConocoPhillips Alaska | $2,541,584 |

| ConocoPhillips | $1,471,077 |

| Repsol | $729,432 |

| Chevron | $300,000 |

Reports and analyses

Goldsmith ISER report

Scott Goldsmith, professor emeritus of economics at University of Alaska Anchorage Institute of Social and Economic Research (ISER), published a study in May 2014. The study was funded by a grant from Northrim Bank, which sponsored ISER’s Investing for Alaska’s Future research initiative. Goldsmith's study examined the effect of SB 21 and the impact it would have to uphold versus repeal it. The following were Goldsmith's four main points:

| “ |

|

” |

| —Scott Goldsmith | ||

Response by Liden Companies

Jim Jensen, chairman of Liden Companies, used Goldsmith's report to bolster the company's claim that the "$2 billion giveaway" was a myth in a June 2014 meeting at the Bethel Community Services Building.[34]

Response by Rep. Les Gara

Rep. Les Gara (D-18) wrote an editorial widely published throughout the state in May 2014, in which he generally opposed SB 21, but also specifically addressed Goldsmith's report. Rep. Gara pointed out that the report, which was seen by some as refuting the need to repeal SB 21, "concedes SB 21 would have reduced Alaska revenue by more than $1 billion/year if it were in place at 2012 and 2013’s higher oil prices."[35][36] Other supporters of the passage of Ballot Measure 1 were quick to point out this part of Goldsmith's report, as well.[37]

MAPA vs. ACES

SB 21 (MAPA) vs. ACES

|

Much of the debate surrounding whether to repeal Senate Bill 21 came down to which tax system would be most beneficial to the state:

- More Alaska Production Act (MAPA), which is outlined in SB 21, or

- Alaska’s Clear and Equitable Share (ACES), the former structure implemented in 2007.

Had Ballot Measure 1 been approved, the state would have switched back to the former tax system outlined under ACES. However, since it was defeated, the MAPA tax structure will stay in place. The following are explanations from media sources regarding the differences between the two systems:

- Eric Feige (R-6) wrote an editorial for the Frontiersman in which he compared and contrasted MAPA against ACES, arguing that MAPA is better for the state, due in part to fluctuating oil prices. His full analysis can be read here.[38]

- Richard Mauer, a reporter for the Alaska Dispatch News, wrote an article discussing the ambiguity surrounding which tax system is ultimately more beneficial for Alaska, citing politicians' and economists' arguments for and against repealing SB 21. The full report can be read here.[4]

- An article by the Associated Press (AP) reported that, if Ballot Measure 1 is approved and SB 21 is overturned, it may be challenging and expensive for Alaska to switch back to the ACES tax system within 30 days. It also detailed why former governor Sarah Palin is in favor of repealing SB 21. The full article can be read here.[10]

- Sam Bishop, assistant managing editor of the Fairbanks Daily News-Miner, wrote an editorial for the paper in which he discusses an interview with Mike Pawlowski, the state Department of Revenue’s oil and gas development project manager. Based on information provided by Pawlowski, Bishop concludes MAPA would bring in $115 million more in fiscal 2015 than would ACES. The full report can be read here.[39]

Media editorial positions

Support

- The Juneau Empire said,

| “ | Voting “Yes” will have consequences. Some oil projects will be canceled in the short term. In the long term, Alaska will be better off by voting “Yes.” The Alaska Legislature will be charged with creating a new oil tax system that treats the state with the same care as industry. This is not a call to divorce Alaska from Big Oil: It is a call to try again. Unfortunately, Ballot Measure 1 is written as an all or nothing proposition. We wish we could take parts of both [MAPA and ACES], but that isn’t an option on Tuesday. It will be up to the legislature to do that.[13] | ” |

| —Juneau Empire[40] | ||

- The Frontiersman said,

| “ | We understand that some 90 percent of unrestricted general fund revenue comes from the oil industry. But that money is generated for bringing to market oil that we own under Alaska law. As the multi-millionaire owners of this resource, we should never approach industry with our hat in hand. To us, that’s how a “no” vote feels, a collective sigh and resignation that we cannot negotiate better terms for the production of this non-renewable resource. We do not believe that Senate Bill 21 meets the constitutional charge to responsible stewardship of resources. There is a better way. And we believe it starts with a yes vote.[13] | ” |

| —Frontiersman[41] | ||

Polls

- See also: Polls, 2014 ballot measures

According to a report put out by Public Policy Polling, "The tightest race on the ballot this year in Alaska could be on the August primary ballot where voters will decide whether or not to repeal SB 21. This measure is tied at 42% yes and 42% no while 16% of the electorate is still undecided. The fate of this measure may rest on which party’s voters show up on Election Day. Democrats support the repeal 65/22 but Republicans oppose it by nearly the same margin, 63/23." The question asked of poll respondents read as follows:[42]

| “ |

On the August primary election ballot, there will be a veto referendum on Senate Bill 21, also known as the Oil and Gas Production Tax. If the election was today would you vote 'yes,' to repeal Senate Bill 21, or 'no,' to leave it in place? [13] |

” |

| Alaska Measure 1 (2014) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Support | Oppose | Undecided | Margin of error | Sample size | ||||||||||||||

| Public Policy Polling 7/31/2014 - 8/3/2014 | 42% | 42% | 16% | +/-3.8 | 673 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

Path to the ballot

Senator Hollis French asks you to sign the Stop the Giveaway Petition - Repeal SB21.

|

In order to get the referendum on the August 2014 ballot, supporters were required to gather at least 30,169 valid signatures. The campaign had to obtain these signatures from at least 10 percent of the number of voters who participated in the prior general election, and signatures had to be gathered in 30 of the 40 House districts, with at least 7 percent of eligible voters in each district signing. The deadline for these signatures was July 13, 2013.[3][43][5]

Supporters collected over 52,000 signatures - well above the number required - and surpassed their goal by more than 50 percent. Pat Lavin, one of the referendum effort's organizers, stated, "It's exceeded my expectations." Though support for the referendum was strong, a 2005 measure that sought to ban aerial wolf hunting still maintained the record for the highest number of signatures collected, at the time of the election. That measure, which was ultimately successful at the polls, garnered more than 55,000 signatures. On September 3, 2013, Division of Elections Director Gail Fenumiai officially certified the referendum, noting that supporters had met all signature requirements.[23][8]

Legislative action

On March 20, 2013, the Senate passed SB 21 with a vote of 11-9.[44] On April 13, 2013, the House passed the bill 24-15.[44] The bill was signed into law by Gov. Parnell on May 21, 2013 and took effect on January 1, 2014.

| Alaska Oil and Gas Production Tax, SB 21 Senate Vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 11 | 55% | |||

| No | 9 | 45% | ||

| Alaska Oil and Gas Production Tax, SB 21 House Vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 24 | 62% | |||

| No | 15 | 38% | ||

See also

- Alaska 2014 ballot measures

- 2014 ballot measures

- List of Alaska ballot measures

- Alaska Legislature

- Alaska state budget and finances

External links

Basic information

- Referendum Proposed Ballot Summary and Title

- More Alaska Production Act (MAP Act)

- Senate Bill No. 21

Support

- Stop the Giveaway - Vote Yes on Prop 1

- Stop the Giveaway - Vote Yes on Prop 1 Facebook

- Vote Yes - Repeal the Oil Giveaway

- Vote Yes - Repeal the Oil Giveaway Facebook

- Vote Yes! Repeal the Giveaway YouTube channel

Opposition

Additional reading

- Fairbanks Daily News-Miner, "ExxonMobil updates chamber on Point Thomson, makes case against oil tax repeal," June 4, 2014

- Juneau Empire, "Native corps join to oppose SB21 repeal," May 29, 2014

- Juneau Empire, "My Turn: SB 21: A definite maybe," May 28, 2014

- Fairbanks Daily News-Miner, "Alaska should vote no on Measure 1," May 4, 2014

- Fairbanks Daily News-Miner, "SB 21 sleight-of-hand is becoming more evident," May 3, 2014

Footnotes

- ↑ NewsMiner.com, "Repeal of Alaska oil tax trails with most votes counted," August 20, 2014

- ↑ 2.0 2.1 New York Times, "Alaska Referendum Upholds Tax System for Oil Companies," August 27, 2014

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 Anchorage Daily News, "Critics of oil tax cuts move ahead with referendum to repeal the legislation," April 18, 2013

- ↑ 4.0 4.1 4.2 Alaska Dispatch News, "Revenue forecasts: 'Facts' used in oil tax debate may not be," August 4, 2014

- ↑ 5.0 5.1 5.2 Alaska Dispatch, "Deadline looming, Alaska oil tax repeal petition gains momentum," June 11, 2013

- ↑ Alaska Public Media, "Repeal Group Exceeds 45,000 Signatures For Referendum," July 12, 2013

- ↑ Alaska Dispatch, "Oil-tax repeal backers claim 51,000 Alaska signatures, far more than needed," July 13, 2013

- ↑ 8.0 8.1 8.2 8.3 8.4 8.5 Anchorage Daily News, "Oil companies are spending millions to stop repeal of Alaska tax cuts," February 9, 2014

- ↑ 9.0 9.1 9.2 9.3 Alaska Dispatch News, "Oil tax repeal opponents outspending supporters 100 to 1," July 21, 2014

- ↑ 10.0 10.1 10.2 THOnline.com, "Palin urges repeal of Alaska's oil tax structure," August 2, 2014

- ↑ The Alaska State Legislature, "28th Legislature(2013-2014): Bill Text 28th Legislature, Senate Bill 21," accessed March 27, 2014

- ↑ 12.0 12.1 State of Alaska Division of Elections, "Proposed Ballot Summary and Title from Attorney General Opinion," accessed March 28, 2014

- ↑ 13.0 13.1 13.2 13.3 13.4 13.5 13.6 13.7 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Tax Foundation "Monday Maps: State and Local Tax Burdens vs. State Tax Collections" May 2010

- ↑ Tax Foundation "Monday Maps: State and Local Tax Burdens vs. State Tax Collections" May 2010

- ↑ Reuters, “Alaska sees $1.25 billion budget gap on oil price drop,” February 19, 2009

- ↑ 17.0 17.1 AlaskaBudget.com, "Understanding Alaska’s Revenue," accessed August 13, 2014

- ↑ Alaska Department of Revenue, Tax Division, "2013 Annual Report," accessed August 13, 2014

- ↑ Alaska Department of Natural Resources, "Oil & Gas Revenue," accessed July 29, 2014

- ↑ Tax Foundation "Monday Maps: State and Local Tax Burdens vs. State Tax Collections" May 2010

- ↑ YesOn1, "Stop the Giveaway - Vote Yes on Prop 1," Sept 13, 2012

- ↑ Alaska Dispatch, "Referendum to repeal governor's oil tax cut takes another step," April 18, 2013

- ↑ 23.0 23.1 Alaska Public Media, "Oil Tax Referendum to Appear on Ballot," September 5, 2013

- ↑ 24.0 24.1 Alaska Dispatch News, "Former oil and gas commissioner: Why I'm voting Yes to repeal SB21," August 21, 2014

- ↑ Vote Yes - Repeal the Oil Giveaway, "Slideshow," accessed May 28, 2014

- ↑ 26.0 26.1 State of Alaska, "Campaign Disclosure: Forms," accessed August 13, 2014

- ↑ Vote No on 1

- ↑ Keep Alaska Competitive - Vote No on 1

- ↑ KTUU, "Alaska Native Corporations Move to Protect Oil Tax Reform," May 28, 2014

- ↑ We Are Alaska

- ↑ 31.0 31.1 31.2 31.3 31.4 Vote No on 1, "Coalition for Alaska's Future," accessed May 28, 2014

- ↑ Keep Alaska Competitive - Vote No on 1, "FAQ," accessed May 28, 2014

- ↑ UAA ISER, "Alaska’s Oil Production Tax: Comparing the Old and the New," May 2014

- ↑ The Tundra Drums, "Oil tax debate comes to town," June 12, 2014

- ↑ Mat-Su Valley Frontiersman, "Don’t be fooled by rosy oil tax reform talk," May 23, 2014

- ↑ Anchorage Daily News, "Paul Jenkins: Tax cut repeal backers target Goldsmith over giveaway claim," May 31, 2014 (dead link)

- ↑ Homer Tribune, "Alaska: ‘Owner’ state or ‘owned’ state?" accessed June 13, 2014

- ↑ Frontiersman, "Ballot Measure 1 — What’s up with that?" August 10, 2014

- ↑ Fairbanks Daily News Miner, "Forecast scrambles conventional wisdom," December 8, 2013

- ↑ Juneau Empire, "Empire Editorial: A vote on trust," August 17, 2014

- ↑ Frontiersman, "Vote yes, then insist on real fix," August 15, 2014

- ↑ Public Policy Polling, "Begich Leads Challengers in Re-Election Bid," August 5, 2014

- ↑ Homer News, "Parnell spares budget vetoes, signs SB21," May 29, 2013

- ↑ 44.0 44.1 OpenStates.org, "SB 21, Alaska Senate Bill," accessed April 25, 2013

|

State of Alaska Juneau (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2024 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |