Briefing Paper #381

Executive Summary

While the rate of short-term unemployment (joblessness lasting less than 27 weeks) has fallen to almost pre-Great Recession levels, the rate of long-term unemployment (joblessness lasting for 27 weeks or more) is still significantly elevated from its pre-Great Recession levels. This has led some economic observers to infer that there is actually less labor market slack in the U.S. economy than the overall rate of unemployment would suggest. This argument hypothesizes that movements in the short-term unemployment (STU) rate are largely cyclically determined, but that the long-term unemployment (LTU) rate is now essentially a component of “structural” unemployment. Structural unemployment is when workers don’t have the skills that employers are currently demanding, do not live where jobs using their skills are located, or face some other barrier to finding work that cannot be solved by an increase in aggregate demand relative to potential supply. Cyclical unemployment, conversely, can be addressed by boosting aggregate demand relative to potential supply.

This briefing paper examines competing explanations for the still-elevated long-term unemployment rate (LTUR) and assesses what if anything the elevated LTUR means for estimates of how much slack remains in the U.S. labor market. Following are the key findings of the paper:

- Evidence from outside of labor market indicators strongly suggests that there is still a continuing, large shortfall of aggregate demand relative to potential supply.

- Measures of core inflation remain extraordinarily low even in the face of historically expansionary monetary policy, signaling substantial economic slack.

- Interest rates remain extraordinarily low, even following years of historically large federal budget deficits, signaling that desired savings remain large relative to planned investments—another sign of economic slack.

- Profit margins are at their highest levels since the 1960s and show little sign of having peaked. If economic slack were falling, we would see increasing downward pressure on profit margins as labor’s share of compensation increases.

- Evidence indicating a rise in structural barriers to finding employment is scarce.

- There is no evidence of an increasing skills mismatch that may be reducing the exit rate from unemployment and therefore increasing the share of the labor force that is long-term unemployed.

- The weight of the evidence shows that the long-term unemployed as a group have put downward pressure on wages, which indicates that they are a meaningful component of remaining cyclical weakness and have not “hardened” into structural unemployment. (In other words, they have not moved from being employable if demand picks up to being unemployable because they no longer have the right skills.)

- Currently, the long-term unemployment rate is almost exactly what would be expected given the historical relationship between the long-term unemployment rate and the overall unemployment rate, and since late 2011, the long-term unemployment rate has in fact fallen faster than what would be predicted. What was unusual was the large increase in the LTUR relative to the overall unemployment rate during the Great Recession and its immediate aftermath. But the timing of this rise alone (i.e., during and immediately after the sharpest and longest economic contraction in seven decades) argues strongly for cyclical causes.

Background

Figure A shows the short-term unemployment rate and the long-term unemployment rate since 1979. As the figure shows, the STUR—the share of workers who have been jobless for less than 27 weeks—has fallen to almost pre-Great Recession levels. But the LTUR—the share of workers who have been jobless for 27 weeks or more—is still significantly elevated from its pre–Great Recession levels. This has people debating why long-term unemployment remains so high.

Short-term and long-term unemployment rates, 1979–2014

| Date | Short-term unemployment rate | Long-term unemployment rate |

|---|---|---|

| 1979/01/01 | 5.3% | 0.5% |

| 1979/02/01 | 5.4% | 0.5% |

| 1979/03/01 | 5.3% | 0.6% |

| 1979/04/01 | 5.3% | 0.5% |

| 1979/05/01 | 5.2% | 0.5% |

| 1979/06/01 | 5.2% | 0.5% |

| 1979/07/01 | 5.3% | 0.4% |

| 1979/08/01 | 5.5% | 0.5% |

| 1979/09/01 | 5.3% | 0.5% |

| 1979/10/01 | 5.4% | 0.5% |

| 1979/11/01 | 5.3% | 0.5% |

| 1979/12/01 | 5.4% | 0.5% |

| 1980/01/01 | 5.7% | 0.5% |

| 1980/02/01 | 5.8% | 0.5% |

| 1980/03/01 | 5.8% | 0.6% |

| 1980/04/01 | 6.3% | 0.6% |

| 1980/05/01 | 6.9% | 0.7% |

| 1980/06/01 | 6.8% | 0.7% |

| 1980/07/01 | 6.9% | 0.8% |

| 1980/08/01 | 6.8% | 0.9% |

| 1980/09/01 | 6.6% | 0.9% |

| 1980/10/01 | 6.5% | 1.0% |

| 1980/11/01 | 6.4% | 1.1% |

| 1980/12/01 | 6.1% | 1.1% |

| 1981/01/01 | 6.3% | 1.2% |

| 1981/02/01 | 6.3% | 1.2% |

| 1981/03/01 | 6.3% | 1.1% |

| 1981/04/01 | 6.2% | 1.0% |

| 1981/05/01 | 6.5% | 1.1% |

| 1981/06/01 | 6.3% | 1.0% |

| 1981/07/01 | 6.3% | 1.0% |

| 1981/08/01 | 6.3% | 1.1% |

| 1981/09/01 | 6.6% | 1.0% |

| 1981/10/01 | 6.9% | 1.0% |

| 1981/11/01 | 7.2% | 1.0% |

| 1981/12/01 | 7.5% | 1.1% |

| 1982/01/01 | 7.5% | 1.1% |

| 1982/02/01 | 7.7% | 1.2% |

| 1982/03/01 | 7.9% | 1.2% |

| 1982/04/01 | 8.0% | 1.4% |

| 1982/05/01 | 8.0% | 1.5% |

| 1982/06/01 | 7.9% | 1.6% |

| 1982/07/01 | 8.1% | 1.6% |

| 1982/08/01 | 8.2% | 1.7% |

| 1982/09/01 | 8.4% | 1.8% |

| 1982/10/01 | 8.4% | 2.0% |

| 1982/11/01 | 8.7% | 2.1% |

| 1982/12/01 | 8.5% | 2.3% |

| 1983/01/01 | 8.1% | 2.4% |

| 1983/02/01 | 8.0% | 2.5% |

| 1983/03/01 | 7.7% | 2.5% |

| 1983/04/01 | 7.5% | 2.5% |

| 1983/05/01 | 7.5% | 2.5% |

| 1983/06/01 | 7.3% | 2.6% |

| 1983/07/01 | 7.2% | 2.3% |

| 1983/08/01 | 7.3% | 2.3% |

| 1983/09/01 | 7.1% | 2.2% |

| 1983/10/01 | 6.8% | 2.0% |

| 1983/11/01 | 6.6% | 1.9% |

| 1983/12/01 | 6.5% | 1.8% |

| 1984/01/01 | 6.3% | 1.8% |

| 1984/02/01 | 6.2% | 1.6% |

| 1984/03/01 | 6.2% | 1.6% |

| 1984/04/01 | 6.1% | 1.6% |

| 1984/05/01 | 5.9% | 1.5% |

| 1984/06/01 | 5.8% | 1.4% |

| 1984/07/01 | 6.1% | 1.4% |

| 1984/08/01 | 6.2% | 1.3% |

| 1984/09/01 | 6.1% | 1.3% |

| 1984/10/01 | 6.1% | 1.3% |

| 1984/11/01 | 5.9% | 1.2% |

| 1984/12/01 | 6.1% | 1.2% |

| 1985/01/01 | 6.2% | 1.1% |

| 1985/02/01 | 6.1% | 1.2% |

| 1985/03/01 | 6.1% | 1.2% |

| 1985/04/01 | 6.1% | 1.2% |

| 1985/05/01 | 6.2% | 1.1% |

| 1985/06/01 | 6.2% | 1.1% |

| 1985/07/01 | 6.2% | 1.1% |

| 1985/08/01 | 6.1% | 1.1% |

| 1985/09/01 | 6.1% | 1.1% |

| 1985/10/01 | 6.1% | 1.0% |

| 1985/11/01 | 5.9% | 1.1% |

| 1985/12/01 | 6.0% | 1.0% |

| 1986/01/01 | 5.8% | 0.9% |

| 1986/02/01 | 6.2% | 1.0% |

| 1986/03/01 | 6.2% | 1.0% |

| 1986/04/01 | 6.2% | 1.0% |

| 1986/05/01 | 6.2% | 1.0% |

| 1986/06/01 | 6.1% | 1.1% |

| 1986/07/01 | 6.0% | 1.0% |

| 1986/08/01 | 5.9% | 1.0% |

| 1986/09/01 | 6.0% | 1.0% |

| 1986/10/01 | 5.9% | 1.0% |

| 1986/11/01 | 5.9% | 1.0% |

| 1986/12/01 | 5.7% | 1.0% |

| 1987/01/01 | 5.7% | 1.0% |

| 1987/02/01 | 5.7% | 0.9% |

| 1987/03/01 | 5.6% | 0.9% |

| 1987/04/01 | 5.4% | 0.9% |

| 1987/05/01 | 5.3% | 0.9% |

| 1987/06/01 | 5.3% | 0.9% |

| 1987/07/01 | 5.3% | 0.8% |

| 1987/08/01 | 5.1% | 0.9% |

| 1987/09/01 | 5.1% | 0.8% |

| 1987/10/01 | 5.2% | 0.8% |

| 1987/11/01 | 5.1% | 0.8% |

| 1987/12/01 | 5.0% | 0.7% |

| 1988/01/01 | 5.0% | 0.7% |

| 1988/02/01 | 5.0% | 0.7% |

| 1988/03/01 | 5.0% | 0.7% |

| 1988/04/01 | 4.8% | 0.7% |

| 1988/05/01 | 4.9% | 0.7% |

| 1988/06/01 | 4.7% | 0.7% |

| 1988/07/01 | 4.8% | 0.7% |

| 1988/08/01 | 4.9% | 0.7% |

| 1988/09/01 | 4.7% | 0.7% |

| 1988/10/01 | 4.7% | 0.6% |

| 1988/11/01 | 4.8% | 0.6% |

| 1988/12/01 | 4.7% | 0.6% |

| 1989/01/01 | 4.8% | 0.6% |

| 1989/02/01 | 4.7% | 0.5% |

| 1989/03/01 | 4.5% | 0.5% |

| 1989/04/01 | 4.7% | 0.6% |

| 1989/05/01 | 4.7% | 0.5% |

| 1989/06/01 | 4.8% | 0.5% |

| 1989/07/01 | 4.8% | 0.5% |

| 1989/08/01 | 4.7% | 0.5% |

| 1989/09/01 | 4.8% | 0.5% |

| 1989/10/01 | 4.8% | 0.5% |

| 1989/11/01 | 4.9% | 0.5% |

| 1989/12/01 | 4.8% | 0.5% |

| 1990/01/01 | 4.8% | 0.5% |

| 1990/02/01 | 4.8% | 0.5% |

| 1990/03/01 | 4.8% | 0.5% |

| 1990/04/01 | 4.9% | 0.5% |

| 1990/05/01 | 4.9% | 0.5% |

| 1990/06/01 | 4.8% | 0.5% |

| 1990/07/01 | 5.0% | 0.5% |

| 1990/08/01 | 5.1% | 0.6% |

| 1990/09/01 | 5.2% | 0.6% |

| 1990/10/01 | 5.3% | 0.6% |

| 1990/11/01 | 5.5% | 0.7% |

| 1990/12/01 | 5.6% | 0.7% |

| 1991/01/01 | 5.6% | 0.7% |

| 1991/02/01 | 5.8% | 0.7% |

| 1991/03/01 | 6.1% | 0.8% |

| 1991/04/01 | 5.9% | 0.8% |

| 1991/05/01 | 6.1% | 0.8% |

| 1991/06/01 | 6.1% | 0.9% |

| 1991/07/01 | 5.9% | 0.9% |

| 1991/08/01 | 5.9% | 0.9% |

| 1991/09/01 | 5.9% | 0.9% |

| 1991/10/01 | 6.0% | 1.0% |

| 1991/11/01 | 6.0% | 1.1% |

| 1991/12/01 | 6.1% | 1.2% |

| 1992/01/01 | 6.0% | 1.3% |

| 1992/02/01 | 6.1% | 1.3% |

| 1992/03/01 | 6.0% | 1.4% |

| 1992/04/01 | 5.9% | 1.4% |

| 1992/05/01 | 6.0% | 1.5% |

| 1992/06/01 | 6.2% | 1.7% |

| 1992/07/01 | 6.0% | 1.7% |

| 1992/08/01 | 6.0% | 1.6% |

| 1992/09/01 | 6.0% | 1.6% |

| 1992/10/01 | 5.7% | 1.7% |

| 1992/11/01 | 5.9% | 1.6% |

| 1992/12/01 | 5.9% | 1.6% |

| 1993/01/01 | 5.7% | 1.5% |

| 1993/02/01 | 5.7% | 1.5% |

| 1993/03/01 | 5.6% | 1.4% |

| 1993/04/01 | 5.7% | 1.3% |

| 1993/05/01 | 5.7% | 1.4% |

| 1993/06/01 | 5.7% | 1.4% |

| 1993/07/01 | 5.5% | 1.4% |

| 1993/08/01 | 5.4% | 1.4% |

| 1993/09/01 | 5.4% | 1.4% |

| 1993/10/01 | 5.5% | 1.4% |

| 1993/11/01 | 5.2% | 1.4% |

| 1993/12/01 | 5.2% | 1.4% |

| 1994/01/01 | 5.3% | 1.3% |

| 1994/02/01 | 5.2% | 1.3% |

| 1994/03/01 | 5.1% | 1.4% |

| 1994/04/01 | 4.9% | 1.3% |

| 1994/05/01 | 4.8% | 1.3% |

| 1994/06/01 | 4.9% | 1.2% |

| 1994/07/01 | 4.9% | 1.2% |

| 1994/08/01 | 4.9% | 1.2% |

| 1994/09/01 | 4.7% | 1.2% |

| 1994/10/01 | 4.6% | 1.2% |

| 1994/11/01 | 4.5% | 1.1% |

| 1994/12/01 | 4.4% | 1.0% |

| 1995/01/01 | 4.5% | 1.0% |

| 1995/02/01 | 4.5% | 0.9% |

| 1995/03/01 | 4.4% | 1.0% |

| 1995/04/01 | 4.6% | 1.1% |

| 1995/05/01 | 4.7% | 1.0% |

| 1995/06/01 | 4.6% | 0.9% |

| 1995/07/01 | 4.7% | 0.9% |

| 1995/08/01 | 4.8% | 0.9% |

| 1995/09/01 | 4.7% | 1.0% |

| 1995/10/01 | 4.6% | 0.9% |

| 1995/11/01 | 4.7% | 0.9% |

| 1995/12/01 | 4.7% | 0.9% |

| 1996/01/01 | 4.7% | 0.9% |

| 1996/02/01 | 4.6% | 0.9% |

| 1996/03/01 | 4.5% | 1.0% |

| 1996/04/01 | 4.5% | 1.0% |

| 1996/05/01 | 4.6% | 1.0% |

| 1996/06/01 | 4.3% | 1.0% |

| 1996/07/01 | 4.4% | 1.0% |

| 1996/08/01 | 4.2% | 0.9% |

| 1996/09/01 | 4.3% | 0.9% |

| 1996/10/01 | 4.4% | 0.9% |

| 1996/11/01 | 4.5% | 0.8% |

| 1996/12/01 | 4.4% | 0.9% |

| 1997/01/01 | 4.4% | 0.8% |

| 1997/02/01 | 4.4% | 0.8% |

| 1997/03/01 | 4.4% | 0.8% |

| 1997/04/01 | 4.2% | 0.8% |

| 1997/05/01 | 4.2% | 0.8% |

| 1997/06/01 | 4.2% | 0.8% |

| 1997/07/01 | 4.1% | 0.8% |

| 1997/08/01 | 4.1% | 0.8% |

| 1997/09/01 | 4.1% | 0.8% |

| 1997/10/01 | 4.0% | 0.8% |

| 1997/11/01 | 3.9% | 0.7% |

| 1997/12/01 | 3.9% | 0.7% |

| 1998/01/01 | 3.9% | 0.7% |

| 1998/02/01 | 3.9% | 0.7% |

| 1998/03/01 | 4.1% | 0.7% |

| 1998/04/01 | 3.7% | 0.6% |

| 1998/05/01 | 3.8% | 0.6% |

| 1998/06/01 | 4.0% | 0.6% |

| 1998/07/01 | 3.9% | 0.6% |

| 1998/08/01 | 3.9% | 0.6% |

| 1998/09/01 | 3.9% | 0.7% |

| 1998/10/01 | 3.9% | 0.6% |

| 1998/11/01 | 3.8% | 0.6% |

| 1998/12/01 | 3.7% | 0.6% |

| 1999/01/01 | 3.8% | 0.5% |

| 1999/02/01 | 3.8% | 0.6% |

| 1999/03/01 | 3.7% | 0.5% |

| 1999/04/01 | 3.9% | 0.5% |

| 1999/05/01 | 3.7% | 0.5% |

| 1999/06/01 | 3.7% | 0.6% |

| 1999/07/01 | 3.7% | 0.5% |

| 1999/08/01 | 3.7% | 0.5% |

| 1999/09/01 | 3.7% | 0.5% |

| 1999/10/01 | 3.6% | 0.5% |

| 1999/11/01 | 3.6% | 0.5% |

| 1999/12/01 | 3.5% | 0.5% |

| 2000/01/01 | 3.5% | 0.5% |

| 2000/02/01 | 3.6% | 0.4% |

| 2000/03/01 | 3.7% | 0.5% |

| 2000/04/01 | 3.5% | 0.4% |

| 2000/05/01 | 3.6% | 0.5% |

| 2000/06/01 | 3.5% | 0.4% |

| 2000/07/01 | 3.5% | 0.5% |

| 2000/08/01 | 3.6% | 0.5% |

| 2000/09/01 | 3.5% | 0.5% |

| 2000/10/01 | 3.5% | 0.4% |

| 2000/11/01 | 3.5% | 0.4% |

| 2000/12/01 | 3.5% | 0.4% |

| 2001/01/01 | 3.7% | 0.5% |

| 2001/02/01 | 3.8% | 0.5% |

| 2001/03/01 | 3.9% | 0.5% |

| 2001/04/01 | 4.0% | 0.5% |

| 2001/05/01 | 3.9% | 0.4% |

| 2001/06/01 | 3.9% | 0.5% |

| 2001/07/01 | 4.0% | 0.5% |

| 2001/08/01 | 4.3% | 0.6% |

| 2001/09/01 | 4.4% | 0.6% |

| 2001/10/01 | 4.7% | 0.6% |

| 2001/11/01 | 4.8% | 0.8% |

| 2001/12/01 | 5.0% | 0.8% |

| 2002/01/01 | 4.9% | 0.8% |

| 2002/02/01 | 4.8% | 0.8% |

| 2002/03/01 | 4.9% | 0.9% |

| 2002/04/01 | 5.0% | 1.0% |

| 2002/05/01 | 4.7% | 1.1% |

| 2002/06/01 | 4.7% | 1.1% |

| 2002/07/01 | 4.7% | 1.1% |

| 2002/08/01 | 4.7% | 1.1% |

| 2002/09/01 | 4.6% | 1.1% |

| 2002/10/01 | 4.6% | 1.1% |

| 2002/11/01 | 4.7% | 1.2% |

| 2002/12/01 | 4.7% | 1.3% |

| 2003/01/01 | 4.7% | 1.2% |

| 2003/02/01 | 4.6% | 1.3% |

| 2003/03/01 | 4.6% | 1.2% |

| 2003/04/01 | 4.7% | 1.3% |

| 2003/05/01 | 4.8% | 1.3% |

| 2003/06/01 | 4.8% | 1.4% |

| 2003/07/01 | 4.8% | 1.3% |

| 2003/08/01 | 4.8% | 1.4% |

| 2003/09/01 | 4.7% | 1.4% |

| 2003/10/01 | 4.6% | 1.3% |

| 2003/11/01 | 4.5% | 1.4% |

| 2003/12/01 | 4.4% | 1.3% |

| 2004/01/01 | 4.4% | 1.3% |

| 2004/02/01 | 4.3% | 1.3% |

| 2004/03/01 | 4.4% | 1.4% |

| 2004/04/01 | 4.3% | 1.2% |

| 2004/05/01 | 4.4% | 1.2% |

| 2004/06/01 | 4.3% | 1.3% |

| 2004/07/01 | 4.4% | 1.1% |

| 2004/08/01 | 4.4% | 1.1% |

| 2004/09/01 | 4.2% | 1.2% |

| 2004/10/01 | 4.3% | 1.2% |

| 2004/11/01 | 4.2% | 1.1% |

| 2004/12/01 | 4.3% | 1.1% |

| 2005/01/01 | 4.1% | 1.1% |

| 2005/02/01 | 4.3% | 1.1% |

| 2005/03/01 | 4.0% | 1.1% |

| 2005/04/01 | 4.1% | 1.1% |

| 2005/05/01 | 4.1% | 1.0% |

| 2005/06/01 | 4.1% | 0.9% |

| 2005/07/01 | 4.0% | 0.9% |

| 2005/08/01 | 4.0% | 0.9% |

| 2005/09/01 | 4.1% | 1.0% |

| 2005/10/01 | 4.1% | 0.9% |

| 2005/11/01 | 4.1% | 0.9% |

| 2005/12/01 | 3.9% | 0.9% |

| 2006/01/01 | 3.9% | 0.8% |

| 2006/02/01 | 3.9% | 0.9% |

| 2006/03/01 | 3.8% | 0.9% |

| 2006/04/01 | 3.9% | 0.9% |

| 2006/05/01 | 3.8% | 0.9% |

| 2006/06/01 | 3.8% | 0.8% |

| 2006/07/01 | 3.9% | 0.9% |

| 2006/08/01 | 3.8% | 0.9% |

| 2006/09/01 | 3.7% | 0.8% |

| 2006/10/01 | 3.7% | 0.7% |

| 2006/11/01 | 3.8% | 0.7% |

| 2006/12/01 | 3.7% | 0.7% |

| 2007/01/01 | 3.8% | 0.7% |

| 2007/02/01 | 3.7% | 0.8% |

| 2007/03/01 | 3.6% | 0.8% |

| 2007/04/01 | 3.7% | 0.8% |

| 2007/05/01 | 3.8% | 0.7% |

| 2007/06/01 | 3.8% | 0.7% |

| 2007/07/01 | 3.8% | 0.8% |

| 2007/08/01 | 3.8% | 0.8% |

| 2007/09/01 | 3.9% | 0.8% |

| 2007/10/01 | 3.9% | 0.8% |

| 2007/11/01 | 3.8% | 0.9% |

| 2007/12/01 | 4.1% | 0.9% |

| 2008/01/01 | 4.0% | 0.9% |

| 2008/02/01 | 4.0% | 0.9% |

| 2008/03/01 | 4.2% | 0.9% |

| 2008/04/01 | 4.1% | 0.9% |

| 2008/05/01 | 4.5% | 1.0% |

| 2008/06/01 | 4.6% | 1.0% |

| 2008/07/01 | 4.6% | 1.1% |

| 2008/08/01 | 4.9% | 1.2% |

| 2008/09/01 | 4.8% | 1.3% |

| 2008/10/01 | 5.1% | 1.5% |

| 2008/11/01 | 5.4% | 1.4% |

| 2008/12/01 | 5.6% | 1.7% |

| 2009/01/01 | 6.0% | 1.8% |

| 2009/02/01 | 6.4% | 1.9% |

| 2009/03/01 | 6.6% | 2.1% |

| 2009/04/01 | 6.5% | 2.4% |

| 2009/05/01 | 6.9% | 2.6% |

| 2009/06/01 | 6.9% | 2.8% |

| 2009/07/01 | 6.2% | 3.2% |

| 2009/08/01 | 6.3% | 3.3% |

| 2009/09/01 | 6.2% | 3.6% |

| 2009/10/01 | 6.4% | 3.7% |

| 2009/11/01 | 5.9% | 3.8% |

| 2009/12/01 | 5.9% | 4.0% |

| 2010/01/01 | 5.8% | 4.1% |

| 2010/02/01 | 5.8% | 4.0% |

| 2010/03/01 | 5.6% | 4.3% |

| 2010/04/01 | 5.3% | 4.4% |

| 2010/05/01 | 5.3% | 4.3% |

| 2010/06/01 | 5.3% | 4.3% |

| 2010/07/01 | 5.2% | 4.2% |

| 2010/08/01 | 5.4% | 4.0% |

| 2010/09/01 | 5.5% | 4.0% |

| 2010/10/01 | 5.5% | 4.1% |

| 2010/11/01 | 5.6% | 4.1% |

| 2010/12/01 | 5.2% | 4.2% |

| 2011/01/01 | 5.2% | 4.1% |

| 2011/02/01 | 5.1% | 3.9% |

| 2011/03/01 | 4.9% | 4.0% |

| 2011/04/01 | 5.1% | 3.8% |

| 2011/05/01 | 5.0% | 4.0% |

| 2011/06/01 | 5.1% | 4.0% |

| 2011/07/01 | 5.0% | 4.0% |

| 2011/08/01 | 5.1% | 3.9% |

| 2011/09/01 | 5.0% | 4.1% |

| 2011/10/01 | 5.1% | 3.8% |

| 2011/11/01 | 4.9% | 3.7% |

| 2011/12/01 | 4.9% | 3.6% |

| 2012/01/01 | 4.7% | 3.6% |

| 2012/02/01 | 4.8% | 3.5% |

| 2012/03/01 | 4.8% | 3.4% |

| 2012/04/01 | 4.8% | 3.3% |

| 2012/05/01 | 4.7% | 3.5% |

| 2012/06/01 | 4.8% | 3.4% |

| 2012/07/01 | 4.9% | 3.3% |

| 2012/08/01 | 4.9% | 3.2% |

| 2012/09/01 | 4.6% | 3.1% |

| 2012/10/01 | 4.7% | 3.2% |

| 2012/11/01 | 4.6% | 3.1% |

| 2012/12/01 | 4.8% | 3.1% |

| 2013/01/01 | 4.9% | 3.0% |

| 2013/02/01 | 4.6% | 3.1% |

| 2013/03/01 | 4.6% | 3.0% |

| 2013/04/01 | 4.7% | 2.8% |

| 2013/05/01 | 4.7% | 2.8% |

| 2013/06/01 | 4.8% | 2.8% |

| 2013/07/01 | 4.6% | 2.7% |

| 2013/08/01 | 4.5% | 2.7% |

| 2013/09/01 | 4.5% | 2.7% |

| 2013/10/01 | 4.7% | 2.6% |

| 2013/11/01 | 4.4% | 2.6% |

| 2013/12/01 | 4.1% | 2.5% |

| 2014/01/01 | 4.2% | 2.3% |

| 2014/02/01 | 4.2% | 2.5% |

| 2014/03/01 | 4.3% | 2.4% |

| 2014/04/01 | 4.1% | 2.2% |

| 2014/05/01 | 4.1% | 2.2% |

| 2014/06/01 | 4.0% | 2.0% |

Note: Shaded areas denote recessions.

Source: Authors' analysis of the Current Population Survey public data series from the Bureau of Labor Statistics

To understand why, we need to look at the patterns. While both rates clearly move in tandem over the business cycle, the large increase in the LTUR between the spring of 2008 and the spring of 2010 is striking. This very large increase during (and immediately after) the Great Recession has led to an elevated LTUR over an extended period, even as it has largely followed the STUR down over the official recovery.

The simple timing of these patterns suggests that the real discontinuity with historical patterns that needs to be explained is the large rise in the LTUR during the Great Recession and its immediate aftermath and not the behavior of the LTUR today. This is an important insight for current debates over the extent of labor market slack remaining in the U.S. economy. The argument that slack has been substantially reduced hinges largely on believing that the long-term unemployed are so scarred and disconnected from labor markets that they effectively put no downward pressure on wage and price growth (i.e., they have become unemployable so they are essentially not competing for available jobs). This argument implicitly relies on believing that today’s elevated LTUR is largely “structural,” e.g., reflecting mismatches between workers’ skills or location with the skills or location of available jobs. Further, the argument is often presented as if the LTUR has been stubbornly unresponsive to the modest improvements in the overall economy in recent years.

If instead today’s elevated LTUR is simply a legacy of the very large rise in LTU that occurred during (and immediately after) the Great Recession, then this interpretation should not stand. Particularly, if the LTUR has over the course of the recovery actually fallen at a pace that matches or exceeds the pace that would be predicted by the historical relationship between it and other measures of macroeconomic health, this argues strongly against two key ideas: the idea that the long-term unemployed have metastasized into a group that is largely disconnected from labor markets, and the idea that measures to boost aggregate demand would not continue to reduce the long-term unemployment rate.

A key piece of evidence we will return to often in this report regards the behavior of wage and price inflation. The entire debate regarding the actual remaining degree of productive slack in the U.S. economy is a debate about whether or not further boosts to aggregate demand will spur more economic activity and employment or simply lead to an increase in nominal wages and prices. If elevated unemployment (especially long-term unemployment) since the Great Recession has evolved from cyclical to structural unemployment, then measures to boost demand will indeed just put upward pressure on prices and wages without spurring significant increases in activity and employment.

The rest of this report will consist of three sections. The first examines macroeconomic evidence outside of the labor market to assess the hypothesis that there remains a large gap between aggregate demand and potential supply. If evidence from outside the labor market indicates the presence of such a gap, then it seems quite likely that a large part of remaining labor market weakness is due to this demand shortfall. The next section examines whether labor market indicators point to a growing incidence of “structural” factors that are reducing the exit rate from unemployment and therefore increasing the share of the labor force that is long-term unemployed, which would support the notion that the LTU have hardened into a problem that is not solvable simply by boosting demand. The final section looks directly at the behavior of the unemployment rate and the long-term unemployment rate over the Great Recession and recovery to see whether there are changes in the historical relationship between these rates that would suggest that the long-term unemployed no longer constitute a reliable indicator of labor market slack.

Macroeconomic evidence from outside the labor market strongly suggests a large gap between demand and supply

A key reason why observers have begun to focus on the still-elevated LTUR is that they consider it a possible diagnostic for how much productive slack remains in the U.S. economy. This section examines the issue of slack using a number of indicators from outside the labor market.

Direct estimates of productive capacity

Figure B displays the most direct attempt to measure economic slack—the ratio of actual gross domestic product (GDP) to potential GDP (also known as overall capacity utilization) as measured by the Congressional Budget Office (CBO). Potential GDP is an estimate of how much the U.S. economy could produce if the unemployment rate was at the lowest level consistent with stable inflation. The gap between actual and potential GDP (1 minus the ratio of actual to potential GDP) is the “output gap,” the most direct measure of the demand shortfall in the economy. Hence a falling ratio represents a rising output gap.

Ratio of actual/potential GDP, 2000–2014

| Quarter | Actual/potential GDP |

|---|---|

| 2000/01/01 | 1.025 |

| 2000/04/01 | 1.035 |

| 2000/07/01 | 1.027 |

| 2000/10/01 | 1.024 |

| 2001/01/01 | 1.012 |

| 2001/04/01 | 1.008 |

| 2001/07/01 | 0.996 |

| 2001/10/01 | 0.990 |

| 2002/01/01 | 0.991 |

| 2002/04/01 | 0.988 |

| 2002/07/01 | 0.984 |

| 2002/10/01 | 0.977 |

| 2003/01/01 | 0.975 |

| 2003/04/01 | 0.976 |

| 2003/07/01 | 0.986 |

| 2003/10/01 | 0.990 |

| 2004/01/01 | 0.990 |

| 2004/04/01 | 0.991 |

| 2004/07/01 | 0.994 |

| 2004/10/01 | 0.997 |

| 2005/01/01 | 1.001 |

| 2005/04/01 | 1.000 |

| 2005/07/01 | 1.003 |

| 2005/10/01 | 1.003 |

| 2006/01/01 | 1.009 |

| 2006/04/01 | 1.006 |

| 2006/07/01 | 1.001 |

| 2006/10/01 | 1.003 |

| 2007/01/01 | 0.997 |

| 2007/04/01 | 0.999 |

| 2007/07/01 | 0.999 |

| 2007/10/01 | 0.997 |

| 2008/01/01 | 0.984 |

| 2008/04/01 | 0.984 |

| 2008/07/01 | 0.974 |

| 2008/10/01 | 0.949 |

| 2009/01/01 | 0.931 |

| 2009/04/01 | 0.926 |

| 2009/07/01 | 0.926 |

| 2009/10/01 | 0.931 |

| 2010/01/01 | 0.932 |

| 2010/04/01 | 0.938 |

| 2010/07/01 | 0.941 |

| 2010/10/01 | 0.944 |

| 2011/01/01 | 0.937 |

| 2011/04/01 | 0.940 |

| 2011/07/01 | 0.939 |

| 2011/10/01 | 0.946 |

| 2012/01/01 | 0.947 |

| 2012/04/01 | 0.947 |

| 2012/07/01 | 0.949 |

| 2012/10/01 | 0.945 |

| 2013/01/01 | 0.948 |

| 2013/04/01 | 0.948 |

| 2013/07/01 | 0.955 |

| 2013/10/01 | 0.959 |

| 2014/01/01 | 0.950 |

| 2014/04/01 | 0.955 |

Note: Shaded areas denote recessions.

Source: Current Population Survey public data series

The figure shows that only about half of the historically large output gap between actual and potential GDP that developed during the Great Recession has been closed. Further, even this shrinkage of the CBO-measured output gap may understate remaining slack. Traditionally, output gaps following recessions close as actual GDP grows faster than estimates of long-run trend growth that characterize potential GDP. But actual GDP has not grown faster than estimates of long-run trends that prevailed before the Great Recession. Instead, the CBO has progressively marked down its estimates of this long-run trend, as shown in Figure C.

Actual and CBO estimates of potential GDP, 2008–2014

| 2008 | 2010 | 2012 | 2014 | Actual | |

|---|---|---|---|---|---|

| 2007 Q4 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| 2008 Q1 | 100.7 | 100.6 | 100.6 | 100.6 | 99.3 |

| 2008 Q2 | 101.4 | 101.2 | 101.1 | 101.1 | 99.8 |

| 2008 Q3 | 102.1 | 101.9 | 101.7 | 101.7 | 99.3 |

| 2008 Q4 | 102.7 | 102.4 | 102.2 | 102.2 | 97.2 |

| 2009 Q1 | 103.4 | 103.0 | 102.7 | 102.6 | 95.8 |

| 2009 Q2 | 104.1 | 103.5 | 103.2 | 103.1 | 95.7 |

| 2009 Q3 | 104.8 | 104.0 | 103.6 | 103.5 | 96.0 |

| 2009 Q4 | 105.5 | 104.5 | 104.0 | 103.8 | 97.0 |

| 2010 Q1 | 106.2 | 104.9 | 104.4 | 104.2 | 97.3 |

| 2010 Q2 | 106.8 | 105.3 | 104.7 | 104.5 | 98.3 |

| 2010 Q3 | 107.5 | 105.7 | 105.1 | 104.9 | 99.0 |

| 2010 Q4 | 108.2 | 106.1 | 105.5 | 105.2 | 99.6 |

| 2011 Q1 | 108.9 | 106.5 | 105.9 | 105.6 | 99.3 |

| 2011 Q2 | 109.6 | 107.0 | 106.4 | 106.0 | 100.1 |

| 2011 Q3 | 110.3 | 107.4 | 106.9 | 106.4 | 100.4 |

| 2011 Q4 | 111.1 | 107.9 | 107.3 | 106.8 | 101.6 |

| 2012 Q1 | 111.8 | 108.5 | 107.8 | 107.2 | 102.6 |

| 2012 Q2 | 112.5 | 109.0 | 108.3 | 107.7 | 102.9 |

| 2012 Q3 | 113.2 | 109.6 | 108.8 | 108.1 | 103.6 |

| 2012 Q4 | 114.0 | 110.3 | 109.3 | 108.6 | 103.6 |

| 2013 Q1 | 114.7 | 110.9 | 109.8 | 109.0 | 103.9 |

| 2013 Q2 | 115.4 | 111.6 | 110.3 | 109.5 | 104.6 |

| 2013 Q3 | 116.2 | 112.3 | 110.8 | 109.9 | 105.6 |

| 2013 Q4 | 116.9 | 113.0 | 111.4 | 110.4 | 106.3 |

| 2014 Q1 | 117.7 | 113.7 | 112.0 | 110.9 | 105.5 |

Source: Congressional Budget Office's Budget and Economic Outlook and Bureau of Economic Analysis National Income and Product Accounts (Table 1.1.6)

It is hard to imagine that the CBO would decrease estimates of long-run trend growth for any other reason than for the influence of the Great Recession itself. Long-run economic growth trends generally reflect estimates of labor force growth and productivity (which is the product of investment in human and physical capital as well as technological improvement). Labor force growth absent persistent demand shortfalls should be determined by long-run demographic trends that are relatively easy to predict (and thus not likely a factor in subsequent ratcheting down of growth estimates). This leaves productivity growth as a cause of the decreasing estimates. The decline in CBO estimates of potential output reflects in part the depressed capital investment in recent years—investment that was depressed precisely because of the Great Recession. But if policymakers managed to engineer a robust recovery in aggregate demand, capital investment would surely increase.

This interpretation is buttressed by research from Ball (2009), who examined potential output of 20 countries between 1980 and 2009. A key finding of his research is that declines in potential GDP that are caused by extended periods of slow demand growth (slow relative to growth in potential capacity, that is) can actually be reversed by extended periods of rapid demand growth. Crucially, this extended period of above-trend demand growth does not lead to ever-accelerating inflation, as measured by the nonaccelerating rate of unemployment (NAIRU). 1As Ball (2009) writes:

An important nuance is that the inflation run-ups in the U.K. and elsewhere [which saw increases in potential output following periods of rapid demand growth] were not permanent [emphasis added]. A period of overheating and rising inflation was needed to reduce the NAIRU, but eventually inflation went back down. And when that happened, the NAIRU did not go back up.

Measures of price inflation

Measures of potential output and the corresponding NAIRU are ex ante estimates of the level of output and unemployment consistent with stable inflation. They could, of course, prove to be wrong ex post if inflation begins rising more rapidly before measures of full capacity or full employment are reached. This naturally implies that the previous examination of output gaps should also be accompanied by an examination of the underlying trends in core price inflation.

Figure D shows a number of measures of core price growth. The evidence for the last 12–18 months argues strongly against the view that productive slack in the economy is rapidly being worked off. Normally, any such tightening of productive capacity would lead to discernible upward pressure on prices. Instead, the chart shows little sign that core inflation measures have appreciably accelerated in recent quarters.

Year-over-year change in core prices measures, 1979–2014*

| Core personal consumption expenditures price index* | Core consumer price index* | Unit labor costs** | |

|---|---|---|---|

| 1979 Q1 | 0.067747 | 0.090047 | 0.07408 |

| 1979 Q2 | 0.072511 | 0.093718 | 0.077562 |

| 1979 Q3 | 0.073737 | 0.098187 | 0.084293 |

| 1979 Q4 | 0.076726 | 0.106844 | 0.082682 |

| 1980 Q1 | 0.088185 | 0.121739 | 0.080257 |

| 1980 Q2 | 0.08862 | 0.132768 | 0.09826 |

| 1980 Q3 | 0.092693 | 0.120587 | 0.101734 |

| 1980 Q4 | 0.096462 | 0.121886 | 0.101997 |

| 1981 Q1 | 0.094145 | 0.107235 | 0.089927 |

| 1981 Q2 | 0.090352 | 0.094347 | 0.091502 |

| 1981 Q3 | 0.086208 | 0.114975 | 0.08457 |

| 1981 Q4 | 0.079162 | 0.1023 | 0.086214 |

| 1982 Q1 | 0.071016 | 0.090626 | 0.089879 |

| 1982 Q2 | 0.0654 | 0.086973 | 0.07698 |

| 1982 Q3 | 0.062956 | 0.068257 | 0.072475 |

| 1982 Q4 | 0.059162 | 0.052158 | 0.066085 |

| 1983 Q1 | 0.058278 | 0.047076 | 0.06283 |

| 1983 Q2 | 0.052351 | 0.035989 | 0.048617 |

| 1983 Q3 | 0.051588 | 0.031604 | 0.045335 |

| 1983 Q4 | 0.045361 | 0.042735 | 0.033852 |

| 1984 Q1 | 0.041693 | 0.048706 | 0.024441 |

| 1984 Q2 | 0.04579 | 0.050927 | 0.022244 |

| 1984 Q3 | 0.039806 | 0.050616 | 0.019964 |

| 1984 Q4 | 0.038944 | 0.047541 | 0.019654 |

| 1985 Q1 | 0.04283 | 0.046444 | 0.024234 |

| 1985 Q2 | 0.040075 | 0.044929 | 0.029097 |

| 1985 Q3 | 0.041102 | 0.040887 | 0.028819 |

| 1985 Q4 | 0.040935 | 0.042879 | 0.0334 |

| 1986 Q1 | 0.037882 | 0.04221 | 0.030298 |

| 1986 Q2 | 0.035388 | 0.040233 | 0.030876 |

| 1986 Q3 | 0.03151 | 0.040804 | 0.029698 |

| 1986 Q4 | 0.032505 | 0.038415 | 0.03376 |

| 1987 Q1 | 0.027778 | 0.038416 | 0.032965 |

| 1987 Q2 | 0.03075 | 0.041335 | 0.031235 |

| 1987 Q3 | 0.033021 | 0.041545 | 0.03381 |

| 1987 Q4 | 0.035398 | 0.043353 | 0.030955 |

| 1988 Q1 | 0.038753 | 0.043304 | 0.034862 |

| 1988 Q2 | 0.041415 | 0.043663 | 0.038677 |

| 1988 Q3 | 0.044168 | 0.044382 | 0.040009 |

| 1988 Q4 | 0.044918 | 0.045152 | 0.035032 |

| 1989 Q1 | 0.046039 | 0.047004 | 0.032719 |

| 1989 Q2 | 0.042707 | 0.045368 | 0.032425 |

| 1989 Q3 | 0.038247 | 0.044379 | 0.03163 |

| 1989 Q4 | 0.036229 | 0.043467 | 0.033447 |

| 1990 Q1 | 0.036926 | 0.046731 | 0.034034 |

| 1990 Q2 | 0.039145 | 0.048337 | 0.034129 |

| 1990 Q3 | 0.041982 | 0.053567 | 0.034056 |

| 1990 Q4 | 0.041169 | 0.052324 | 0.038824 |

| 1991 Q1 | 0.038324 | 0.054929 | 0.039923 |

| 1991 Q2 | 0.034708 | 0.050818 | 0.04113 |

| 1991 Q3 | 0.033699 | 0.046443 | 0.041074 |

| 1991 Q4 | 0.033162 | 0.044412 | 0.038502 |

| 1992 Q1 | 0.032155 | 0.038754 | 0.036042 |

| 1992 Q2 | 0.031645 | 0.038452 | 0.031142 |

| 1992 Q3 | 0.028541 | 0.035039 | 0.027899 |

| 1992 Q4 | 0.028168 | 0.034204 | 0.021737 |

| 1993 Q1 | 0.027515 | 0.034791 | 0.018247 |

| 1993 Q2 | 0.028106 | 0.034075 | 0.021328 |

| 1993 Q3 | 0.02779 | 0.032498 | 0.019602 |

| 1993 Q4 | 0.025471 | 0.030838 | 0.016426 |

| 1994 Q1 | 0.023035 | 0.028755 | 0.009565 |

| 1994 Q2 | 0.022113 | 0.028339 | 0.011518 |

| 1994 Q3 | 0.022043 | 0.02929 | 0.012206 |

| 1994 Q4 | 0.021996 | 0.027748 | 0.010446 |

| 1995 Q1 | 0.022648 | 0.029241 | 0.014473 |

| 1995 Q2 | 0.021661 | 0.030549 | 0.010458 |

| 1995 Q3 | 0.020774 | 0.029518 | 0.011697 |

| 1995 Q4 | 0.020708 | 0.030373 | 0.012405 |

| 1996 Q1 | 0.01956 | 0.028828 | 0.018219 |

| 1996 Q2 | 0.018476 | 0.026741 | 0.013865 |

| 1996 Q3 | 0.018377 | 0.026609 | 0.014271 |

| 1996 Q4 | 0.019008 | 0.025998 | 0.016924 |

| 1997 Q1 | 0.018932 | 0.024975 | 0.017789 |

| 1997 Q2 | 0.019422 | 0.025439 | 0.015188 |

| 1997 Q3 | 0.01707 | 0.022905 | 0.014022 |

| 1997 Q4 | 0.014525 | 0.022147 | 0.018965 |

| 1998 Q1 | 0.013366 | 0.021989 | 0.021307 |

| 1998 Q2 | 0.011227 | 0.022052 | 0.025826 |

| 1998 Q3 | 0.012468 | 0.023964 | 0.024667 |

| 1998 Q4 | 0.012405 | 0.023424 | 0.022778 |

| 1999 Q1 | 0.012872 | 0.021903 | 0.020919 |

| 1999 Q2 | 0.012942 | 0.020998 | 0.023307 |

| 1999 Q3 | 0.012885 | 0.01995 | 0.022485 |

| 1999 Q4 | 0.014384 | 0.020217 | 0.018743 |

| 2000 Q1 | 0.016691 | 0.022003 | 0.030139 |

| 2000 Q2 | 0.016868 | 0.024151 | 0.020008 |

| 2000 Q3 | 0.018021 | 0.025578 | 0.027254 |

| 2000 Q4 | 0.018297 | 0.025612 | 0.025982 |

| 2001 Q1 | 0.018446 | 0.026726 | 0.034791 |

| 2001 Q2 | 0.019072 | 0.026161 | 0.029748 |

| 2001 Q3 | 0.017337 | 0.026774 | 0.028867 |

| 2001 Q4 | 0.017605 | 0.02716 | 0.025848 |

| 2002 Q1 | 0.014767 | 0.025307 | 0.005524 |

| 2002 Q2 | 0.016742 | 0.024417 | 0.014929 |

| 2002 Q3 | 0.019091 | 0.022683 | 0.006047 |

| 2002 Q4 | 0.017462 | 0.020408 | 0.009943 |

| 2003 Q1 | 0.017033 | 0.017807 | -0.00149 |

| 2003 Q2 | 0.014787 | 0.015247 | 0.004489 |

| 2003 Q3 | 0.013655 | 0.013447 | 0.003763 |

| 2003 Q4 | 0.013676 | 0.011826 | 0.007043 |

| 2004 Q1 | 0.016692 | 0.013338 | 0.011155 |

| 2004 Q2 | 0.019163 | 0.01778 | 0.013479 |

| 2004 Q3 | 0.019725 | 0.018094 | 0.019938 |

| 2004 Q4 | 0.020929 | 0.021141 | 0.017049 |

| 2005 Q1 | 0.021916 | 0.023248 | 0.016475 |

| 2005 Q2 | 0.021165 | 0.02154 | 0.016725 |

| 2005 Q3 | 0.020717 | 0.020819 | 0.020297 |

| 2005 Q4 | 0.0226 | 0.021209 | 0.020372 |

| 2006 Q1 | 0.021283 | 0.020882 | 0.027283 |

| 2006 Q2 | 0.022716 | 0.024572 | 0.022473 |

| 2006 Q3 | 0.023936 | 0.028188 | 0.019732 |

| 2006 Q4 | 0.021577 | 0.026372 | 0.025048 |

| 2007 Q1 | 0.023628 | 0.026091 | 0.036782 |

| 2007 Q2 | 0.020362 | 0.022688 | 0.032584 |

| 2007 Q3 | 0.019906 | 0.021601 | 0.027974 |

| 2007 Q4 | 0.022482 | 0.02314 | 0.027951 |

| 2008 Q1 | 0.021117 | 0.023644 | 0.02891 |

| 2008 Q2 | 0.022659 | 0.023278 | 0.025444 |

| 2008 Q3 | 0.02226 | 0.02508 | 0.025091 |

| 2008 Q4 | 0.016417 | 0.01994 | 0.027146 |

| 2009 Q1 | 0.011791 | 0.017407 | 0.003733 |

| 2009 Q2 | 0.011621 | 0.018213 | 0.008133 |

| 2009 Q3 | 0.009904 | 0.014937 | 0.00738 |

| 2009 Q4 | 0.014156 | 0.017431 | 0.002938 |

| 2010 Q1 | 0.015539 | 0.013328 | -0.00896 |

| 2010 Q2 | 0.01329 | 0.009231 | -0.00204 |

| 2010 Q3 | 0.012923 | 0.008547 | -0.00444 |

| 2010 Q4 | 0.009707 | 0.007277 | -0.01161 |

| 2011 Q1 | 0.010544 | 0.010776 | 0.008996 |

| 2011 Q2 | 0.013995 | 0.014947 | 0.004577 |

| 2011 Q3 | 0.016613 | 0.014853 | 0.010323 |

| 2011 Q4 | 0.018617 | 0.02161 | 0.003996 |

| 2012 Q1 | 0.020486 | 0.022364 | 0.015753 |

| 2012 Q2 | 0.019036 | 0.022628 | 0.01198 |

| 2012 Q3 | 0.017079 | 0.024133 | 0.010141 |

| 2012 Q4 | 0.016499 | 0.019446 | 0.02181 |

| 2013 Q1 | 0.014828 | 0.019389 | 0.008003 |

| 2013 Q2 | 0.012712 | 0.016774 | 0.011558 |

| 2013 Q3 | 0.013169 | 0.017316 | 0.006576 |

| 2013 Q4 | 0.013048 | 0.017061 | 0.014853 |

| 2014 Q1 | 0.012461 | 0.016151 | 0.012735 |

* Data reflect year-over-year changes starting in the change from 1978Q1–1979Q1.

** Data reflect rolling averages of two-year changes starting with the change from 1977Q1–1979Q1.

Source: Authors' analysis of Bureau of Economic Analysis National Income and Product Accounts (Table 2.1), Current Population Survey Current Price Index Series and Bureau of Labor Statistics Total Economy Productivity and Costs Program unpublished data

What makes the extraordinarily slow price growth since the Great Recession even more remarkable is that it has occurred against a backdrop of a historically large increase in the monetary base of the United States (reserves held by banks of the Federal Reserve). Figure E shows the change in reserves as a share of U.S. GDP from 1985 to January 2014. The reason for the large increase in the monetary base since the middle of the recession is the Federal Reserve’s historically aggressive attempts to halt a widening of the output gap by providing monetary stimulus. The Fed’s large-scale asset purchases (LSAPs) have largely been financed by crediting financial institutions with reserves held at the Fed.

Monetary base and inflation, 1985–2014

| Inflation | Monetary base | |

|---|---|---|

| 1985/01/01 | 0.04647 | 0.045977 |

| 1985/04/01 | 0.04431 | 0.046262 |

| 1985/07/01 | 0.04136 | 0.046432 |

| 1985/10/01 | 0.04284 | 0.046911 |

| 1986/01/01 | 0.04236 | 0.046878 |

| 1986/04/01 | 0.04061 | 0.047736 |

| 1986/07/01 | 0.04042 | 0.048297 |

| 1986/10/01 | 0.03869 | 0.049224 |

| 1987/01/01 | 0.03501 | 0.049663 |

| 1987/04/01 | 0.03833 | 0.049774 |

| 1987/07/01 | 0.03748 | 0.049486 |

| 1987/10/01 | 0.03811 | 0.049364 |

| 1988/01/01 | 0.03973 | 0.049425 |

| 1988/04/01 | 0.03917 | 0.049454 |

| 1988/07/01 | 0.04033 | 0.049443 |

| 1988/10/01 | 0.04115 | 0.049041 |

| 1989/01/01 | 0.04123 | 0.048356 |

| 1989/04/01 | 0.03960 | 0.047977 |

| 1989/07/01 | 0.03885 | 0.047640 |

| 1989/10/01 | 0.03943 | 0.047785 |

| 1990/01/01 | 0.04171 | 0.047505 |

| 1990/04/01 | 0.04435 | 0.048027 |

| 1990/07/01 | 0.04903 | 0.048761 |

| 1990/10/01 | 0.04799 | 0.049952 |

| 1991/01/01 | 0.04906 | 0.051122 |

| 1991/04/01 | 0.04380 | 0.051345 |

| 1991/07/01 | 0.03901 | 0.051579 |

| 1991/10/01 | 0.03725 | 0.052018 |

| 1992/01/01 | 0.03239 | 0.052374 |

| 1992/04/01 | 0.03279 | 0.052726 |

| 1992/07/01 | 0.02972 | 0.053497 |

| 1992/10/01 | 0.02947 | 0.054205 |

| 1993/01/01 | 0.02857 | 0.055007 |

| 1993/04/01 | 0.02943 | 0.055745 |

| 1993/07/01 | 0.02841 | 0.056813 |

| 1993/10/01 | 0.02665 | 0.057270 |

| 1994/01/01 | 0.02429 | 0.057896 |

| 1994/04/01 | 0.02239 | 0.057892 |

| 1994/07/01 | 0.02307 | 0.058283 |

| 1994/10/01 | 0.02174 | 0.058074 |

| 1995/01/01 | 0.02401 | 0.058279 |

| 1995/04/01 | 0.02517 | 0.058868 |

| 1995/07/01 | 0.02582 | 0.058501 |

| 1995/10/01 | 0.02707 | 0.058186 |

| 1996/01/01 | 0.02611 | 0.057930 |

| 1996/04/01 | 0.02413 | 0.057332 |

| 1996/07/01 | 0.02355 | 0.057545 |

| 1996/10/01 | 0.02327 | 0.057434 |

| 1997/01/01 | 0.02230 | 0.057429 |

| 1997/04/01 | 0.02329 | 0.057289 |

| 1997/07/01 | 0.02175 | 0.057161 |

| 1997/10/01 | 0.02093 | 0.057612 |

| 1998/01/01 | 0.02233 | 0.057856 |

| 1998/04/01 | 0.02084 | 0.057878 |

| 1998/07/01 | 0.02165 | 0.057587 |

| 1998/10/01 | 0.02193 | 0.057811 |

| 1999/01/01 | 0.01999 | 0.058332 |

| 1999/04/01 | 0.01988 | 0.059025 |

| 1999/07/01 | 0.02030 | 0.059029 |

| 1999/10/01 | 0.02066 | 0.061334 |

| 2000/01/01 | 0.02241 | 0.060494 |

| 2000/04/01 | 0.02356 | 0.058717 |

| 2000/07/01 | 0.02474 | 0.058480 |

| 2000/10/01 | 0.02497 | 0.058377 |

| 2001/01/01 | 0.02613 | 0.058919 |

| 2001/04/01 | 0.02621 | 0.059124 |

| 2001/07/01 | 0.02631 | 0.061265 |

| 2001/10/01 | 0.02709 | 0.062006 |

| 2002/01/01 | 0.02527 | 0.062693 |

| 2002/04/01 | 0.02418 | 0.063302 |

| 2002/07/01 | 0.02271 | 0.063802 |

| 2002/10/01 | 0.02039 | 0.064150 |

| 2003/01/01 | 0.01868 | 0.064634 |

| 2003/04/01 | 0.01477 | 0.064923 |

| 2003/07/01 | 0.01364 | 0.064162 |

| 2003/10/01 | 0.01154 | 0.063792 |

| 2004/01/01 | 0.01307 | 0.063548 |

| 2004/04/01 | 0.01803 | 0.063258 |

| 2004/07/01 | 0.01820 | 0.063526 |

| 2004/10/01 | 0.02177 | 0.063015 |

| 2005/01/01 | 0.02288 | 0.062301 |

| 2005/04/01 | 0.02132 | 0.061852 |

| 2005/07/01 | 0.02047 | 0.061464 |

| 2005/10/01 | 0.02087 | 0.060958 |

| 2006/01/01 | 0.02119 | 0.060865 |

| 2006/04/01 | 0.02474 | 0.060619 |

| 2006/07/01 | 0.02823 | 0.060240 |

| 2006/10/01 | 0.02689 | 0.059540 |

| 2007/01/01 | 0.02623 | 0.059522 |

| 2007/04/01 | 0.02272 | 0.058935 |

| 2007/07/01 | 0.02111 | 0.058682 |

| 2007/10/01 | 0.02307 | 0.058131 |

| 2008/01/01 | 0.02385 | 0.058407 |

| 2008/04/01 | 0.02344 | 0.058025 |

| 2008/07/01 | 0.02461 | 0.059578 |

| 2008/10/01 | 0.02002 | 0.096490 |

| 2009/01/01 | 0.01745 | 0.115915 |

| 2009/04/01 | 0.01817 | 0.124171 |

| 2009/07/01 | 0.01493 | 0.120357 |

| 2009/10/01 | 0.01731 | 0.137261 |

| 2010/01/01 | 0.01321 | 0.142642 |

| 2010/04/01 | 0.00983 | 0.136930 |

| 2010/07/01 | 0.00922 | 0.134071 |

| 2010/10/01 | 0.00634 | 0.130878 |

| 2011/01/01 | 0.01092 | 0.145840 |

| 2011/04/01 | 0.01493 | 0.167295 |

| 2011/07/01 | 0.01472 | 0.172797 |

| 2011/10/01 | 0.02165 | 0.166311 |

| 2012/01/01 | 0.02192 | 0.168291 |

| 2012/04/01 | 0.02341 | 0.164062 |

| 2012/07/01 | 0.02411 | 0.163492 |

| 2012/10/01 | 0.01910 | 0.160913 |

| 2013/01/01 | 0.01991 | 0.172375 |

| 2013/04/01 | 0.01610 | 0.186891 |

| 2013/07/01 | 0.01753 | 0.201347 |

| 2013/10/01 | 0.01747 | 0.213488 |

| 2014/01/01 | 0.01605 | 0.225456 |

Note: Shaded areas denote recessions.

Source: Authors' analysis of data from Federal Reserve Economic Database of St. Louis Federal Reserve public data series

It is widely agreed that during times not characterized by productive slack in the economy, such a large increase in monetary base would reliably lead to a significant increase in inflation, as it would result in more money chasing a fixed amount of goods. Yet over the past seven years, a consistent increase in the monetary base has not led to reliable inflation gains, as the rise in the monetary base has actually just pushed back against deflationary pressures in large part by helping to spur some spending that would not have happened absent the monetary stimulus. When “more money” can be matched with “more goods,” then inflationary pressures can remain tame even in the face of a rising monetary base.

The failure of prices to rise in line with the very large increase in the monetary base is the strongest possible diagnostic demonstrating that the U.S. economy continues to have a large shortfall between aggregate demand and productive capacity.

Evidence from interest rates

Another sign of an economy with rapidly dwindling economic slack would be a closing of the gap between planned investment and desired savings, with investment rising and savings falling. As a decline in savings can be thought of (too simply) as a fall in the supply of loanable funds, while rising investment should entail an increase in the demand for loanable funds, the simplest textbook prediction of a tightening economy would be an increase in the price of loanable funds (interest rates).

Figure F examines evidence on real (inflation-adjusted) interest rates. While they have picked up a bit from the lowest levels, real rates remain historically low, arguing again that there is little evidence of a rapid closing of the gap between planned investment and desired savings.

Federal budget deficits and interest rates, 1962–2014

| Date | Federal net lending as a percent of GDP | Real interest rates |

|---|---|---|

| 1962/01/01 | -2.77218 | 2.66 |

| 1962/04/01 | -2.73813 | 2.34 |

| 1962/07/01 | -2.59186 | 2.29 |

| 1962/10/01 | -2.67493 | 2.23 |

| 1963/01/01 | -2.10374 | 2.08 |

| 1963/04/01 | -1.74106 | 2.30 |

| 1963/07/01 | -2.00000 | 2.37 |

| 1963/10/01 | -1.89371 | 2.41 |

| 1964/01/01 | -2.36889 | 2.66 |

| 1964/04/01 | -3.01116 | 2.56 |

| 1964/07/01 | -2.48268 | 2.70 |

| 1964/10/01 | -2.03322 | 2.62 |

| 1965/01/01 | -1.33482 | 2.52 |

| 1965/04/01 | -1.35172 | 2.57 |

| 1965/07/01 | -2.38603 | 2.56 |

| 1965/10/01 | -2.34122 | 2.78 |

| 1966/01/01 | -1.86881 | 3.12 |

| 1966/04/01 | -1.90783 | 2.97 |

| 1966/07/01 | -2.38791 | 3.27 |

| 1966/10/01 | -2.63505 | 3.02 |

| 1967/01/01 | -3.64066 | 2.51 |

| 1967/04/01 | -3.41910 | 2.83 |

| 1967/07/01 | -3.58874 | 3.18 |

| 1967/10/01 | -3.28351 | 3.57 |

| 1968/01/01 | -2.83174 | 3.36 |

| 1968/04/01 | -2.93709 | 3.40 |

| 1968/07/01 | -2.00567 | 3.03 |

| 1968/10/01 | -1.89671 | 3.07 |

| 1969/01/01 | -0.76351 | 3.32 |

| 1969/04/01 | -0.84042 | 3.24 |

| 1969/07/01 | -1.55039 | 3.56 |

| 1969/10/01 | -1.71039 | 4.13 |

| 1970/01/01 | -2.65781 | 4.20 |

| 1970/04/01 | -3.44828 | 4.40 |

| 1970/07/01 | -3.94120 | 3.99 |

| 1970/10/01 | -4.39762 | 3.10 |

| 1971/01/01 | -3.87590 | 2.13 |

| 1971/04/01 | -4.64033 | 2.27 |

| 1971/07/01 | -4.52427 | 2.50 |

| 1971/10/01 | -4.26441 | 1.89 |

| 1972/01/01 | -3.58243 | 1.92 |

| 1972/04/01 | -4.18865 | 2.10 |

| 1972/07/01 | -3.12258 | 2.25 |

| 1972/10/01 | -4.11411 | 2.30 |

| 1973/01/01 | -2.67256 | 2.65 |

| 1973/04/01 | -2.96981 | 2.98 |

| 1973/07/01 | -2.17149 | 3.34 |

| 1973/10/01 | -2.08911 | 3.00 |

| 1974/01/01 | -2.29477 | 3.25 |

| 1974/04/01 | -1.89024 | 3.50 |

| 1974/07/01 | -2.53934 | 3.88 |

| 1974/10/01 | -3.33125 | 3.32 |

| 1975/01/01 | -4.92714 | 3.00 |

| 1975/04/01 | -8.11398 | 3.36 |

| 1975/07/01 | -5.77664 | 3.43 |

| 1975/10/01 | -5.69681 | 2.93 |

| 1976/01/01 | -4.88353 | 2.23 |

| 1976/04/01 | -4.36211 | 2.00 |

| 1976/07/01 | -4.50145 | 1.64 |

| 1976/10/01 | -4.71007 | 0.83 |

| 1977/01/01 | -3.84442 | 0.98 |

| 1977/04/01 | -3.72779 | 0.86 |

| 1977/07/01 | -3.85884 | 0.75 |

| 1977/10/01 | -3.90557 | 1.32 |

| 1978/01/01 | -4.01594 | 2.23 |

| 1978/04/01 | -2.95729 | 2.82 |

| 1978/07/01 | -2.88882 | 3.36 |

| 1978/10/01 | -2.65490 | 3.96 |

| 1979/01/01 | -2.13699 | 4.28 |

| 1979/04/01 | -2.16110 | 4.31 |

| 1979/07/01 | -2.38167 | 4.31 |

| 1979/10/01 | -2.52682 | 5.30 |

| 1980/01/01 | -3.02521 | 6.43 |

| 1980/04/01 | -3.95371 | 4.81 |

| 1980/07/01 | -4.17133 | 5.14 |

| 1980/10/01 | -3.49424 | 6.53 |

| 1981/01/01 | -3.03659 | 6.85 |

| 1981/04/01 | -2.99002 | 7.46 |

| 1981/07/01 | -2.85171 | 8.40 |

| 1981/10/01 | -4.09319 | 7.50 |

| 1982/01/01 | -4.57267 | 7.61 |

| 1982/04/01 | -4.91400 | 7.11 |

| 1982/07/01 | -5.92795 | 6.31 |

| 1982/10/01 | -6.70521 | 3.77 |

| 1983/01/01 | -6.82987 | 3.91 |

| 1983/04/01 | -6.04944 | 4.17 |

| 1983/07/01 | -6.67064 | 5.47 |

| 1983/10/01 | -6.11680 | 5.81 |

| 1984/01/01 | -5.46923 | 6.42 |

| 1984/04/01 | -5.53674 | 7.90 |

| 1984/07/01 | -5.63684 | 7.85 |

| 1984/10/01 | -6.04687 | 7.28 |

| 1985/01/01 | -5.01770 | 7.43 |

| 1985/04/01 | -6.25479 | 6.82 |

| 1985/07/01 | -5.64557 | 6.60 |

| 1985/10/01 | -5.78024 | 6.26 |

| 1986/01/01 | -5.57315 | 5.06 |

| 1986/04/01 | -5.91851 | 4.37 |

| 1986/07/01 | -6.29708 | 4.25 |

| 1986/10/01 | -5.24907 | 4.06 |

| 1987/01/01 | -5.25105 | 4.18 |

| 1987/04/01 | -4.15854 | 5.44 |

| 1987/07/01 | -4.31997 | 5.98 |

| 1987/10/01 | -4.32437 | 6.33 |

| 1988/01/01 | -4.13114 | 5.58 |

| 1988/04/01 | -3.91344 | 6.08 |

| 1988/07/01 | -3.61921 | 6.20 |

| 1988/10/01 | -3.65806 | 6.14 |

| 1989/01/01 | -3.18962 | 6.79 |

| 1989/04/01 | -3.44681 | 6.31 |

| 1989/07/01 | -3.55248 | 5.67 |

| 1989/10/01 | -3.53784 | 5.22 |

| 1990/01/01 | -3.98418 | 5.20 |

| 1990/04/01 | -3.91993 | 5.30 |

| 1990/07/01 | -3.84609 | 5.25 |

| 1990/10/01 | -4.55564 | 5.05 |

| 1991/01/01 | -3.62192 | 4.59 |

| 1991/04/01 | -4.52341 | 4.63 |

| 1991/07/01 | -5.03506 | 4.42 |

| 1991/10/01 | -4.97985 | 3.80 |

| 1992/01/01 | -5.49931 | 3.70 |

| 1992/04/01 | -5.54657 | 3.99 |

| 1992/07/01 | -5.62362 | 3.33 |

| 1992/10/01 | -5.30347 | 3.32 |

| 1993/01/01 | -5.35995 | 3.11 |

| 1993/04/01 | -4.72648 | 2.59 |

| 1993/07/01 | -4.82460 | 2.04 |

| 1993/10/01 | -4.23018 | 2.41 |

| 1994/01/01 | -3.77091 | 3.06 |

| 1994/04/01 | -3.35222 | 4.43 |

| 1994/07/01 | -3.65605 | 5.00 |

| 1994/10/01 | -3.54974 | 5.50 |

| 1995/01/01 | -3.50947 | 5.09 |

| 1995/04/01 | -3.29130 | 4.23 |

| 1995/07/01 | -2.90923 | 3.88 |

| 1995/10/01 | -2.91557 | 3.48 |

| 1996/01/01 | -2.99249 | 3.49 |

| 1996/04/01 | -2.34944 | 4.34 |

| 1996/07/01 | -2.13384 | 4.43 |

| 1996/10/01 | -1.54941 | 4.05 |

| 1997/01/01 | -1.39729 | 4.29 |

| 1997/04/01 | -0.86063 | 4.30 |

| 1997/07/01 | -0.76510 | 3.92 |

| 1997/10/01 | -0.78741 | 3.51 |

| 1998/01/01 | -0.16311 | 3.16 |

| 1998/04/01 | 0.06559 | 3.31 |

| 1998/07/01 | 0.31815 | 2.96 |

| 1998/10/01 | 0.24663 | 2.41 |

| 1999/01/01 | 0.57458 | 2.73 |

| 1999/04/01 | 0.64530 | 3.31 |

| 1999/07/01 | 0.70174 | 3.53 |

| 1999/10/01 | 0.63832 | 3.85 |

| 2000/01/01 | 1.69887 | 4.36 |

| 2000/04/01 | 1.39444 | 4.01 |

| 2000/07/01 | 1.44831 | 3.75 |

| 2000/10/01 | 1.36321 | 3.49 |

| 2001/01/01 | 1.19762 | 2.88 |

| 2001/04/01 | 0.74801 | 3.05 |

| 2001/07/01 | -1.39793 | 2.74 |

| 2001/10/01 | -0.51856 | 2.46 |

| 2002/01/01 | -2.37698 | 2.67 |

| 2002/04/01 | -2.75736 | 2.67 |

| 2002/07/01 | -2.85784 | 1.80 |

| 2002/10/01 | -3.30101 | 1.42 |

| 2003/01/01 | -3.45746 | 1.33 |

| 2003/04/01 | -4.18946 | 0.97 |

| 2003/07/01 | -4.67734 | 1.62 |

| 2003/10/01 | -3.98105 | 1.68 |

| 2004/01/01 | -4.24638 | 1.45 |

| 2004/04/01 | -3.85603 | 2.25 |

| 2004/07/01 | -3.65337 | 2.18 |

| 2004/10/01 | -3.59525 | 2.21 |

| 2005/01/01 | -3.07033 | 2.25 |

| 2005/04/01 | -2.97864 | 1.98 |

| 2005/07/01 | -3.38924 | 1.78 |

| 2005/10/01 | -2.70113 | 1.79 |

| 2006/01/01 | -2.36047 | 2.11 |

| 2006/04/01 | -2.37414 | 2.51 |

| 2006/07/01 | -2.23141 | 2.36 |

| 2006/10/01 | -1.54033 | 2.12 |

| 2007/01/01 | -2.10467 | 1.93 |

| 2007/04/01 | -2.39038 | 2.16 |

| 2007/07/01 | -2.64619 | 1.84 |

| 2007/10/01 | -2.65283 | 1.53 |

| 2008/01/01 | -3.31427 | 0.91 |

| 2008/04/01 | -5.79061 | 0.83 |

| 2008/07/01 | -5.18785 | 0.79 |

| 2008/10/01 | -6.96172 | 0.07 |

| 2009/01/01 | -9.26557 | -0.41 |

| 2009/04/01 | -10.97329 | 0.49 |

| 2009/07/01 | -10.51903 | 1.32 |

| 2009/10/01 | -10.21210 | 1.34 |

| 2010/01/01 | -10.46175 | 1.55 |

| 2010/04/01 | -10.47771 | 1.41 |

| 2010/07/01 | -9.84996 | 0.21 |

| 2010/10/01 | -9.59643 | 0.28 |

| 2011/01/01 | -9.04093 | 0.86 |

| 2011/04/01 | -9.51435 | 0.30 |

| 2011/07/01 | -8.83947 | 0.57 |

| 2011/10/01 | -8.66759 | 0.65 |

| 2012/01/01 | -7.50112 | 0.79 |

| 2012/04/01 | -7.68855 | 0.71 |

| 2012/07/01 | -7.42847 | -0.46 |

| 2012/10/01 | -7.29767 | -0.66 |

| 2013/01/01 | -5.59651 | -0.23 |

| 2013/04/01 | -4.32447 | 0.02 |

| 2013/07/01 | -5.44732 | 0.78 |

| 2013/10/01 | -4.10835 | 0.56 |

| 2014/01/01 | -4.57276 | 0.24 |

Note: Shaded areas denote recessions. Real rates calculated by subtracting 12-quarter weighted average of inflation, with higher weights on most recent quarter.

Source: Authors' analysis of Bureau of Economic Analysis National Income and Product Accounts (Table 5.1) Federal Reserve Economic Data public data series, and Bureau of Labor Statistics Consumer Price Index program public data series

Further, much like the evidence on tame inflation in the face of a rapidly expanding monetary base, interest rates provide even more powerful evidence of continued slack when one considers the broader economic context: Figure F also shows that until 2013, U.S. federal budget deficits were quite a bit larger than historical averages. It is widely agreed that if deficits of that size were run during periods with no productive slack in the economy, the resulting excess demand for loanable funds would lead to significant increases in interest rates. Yet no such upward pressure on interest rates materialized, because desired private savings were so large that ferocious downward pressure was put on these rates.

Evidence from corporate profits

The final non–labor-market indicators examined in this section are profit margins and profit shares in the nonfinancial corporate (NFC) sector. A long empirical literature has identified the “full employment profit squeeze” as an explanation for business cycle dynamics. The hypothesis argues that profit shares (and margins) fall sharply during recessions, but fully recover well before other macroeconomic indicators. As recoveries continue and strengthen, falling unemployment leads to greater bargaining power for workers, which tends to increase labor’s share of national (or NFC-sector) income later in business cycles.

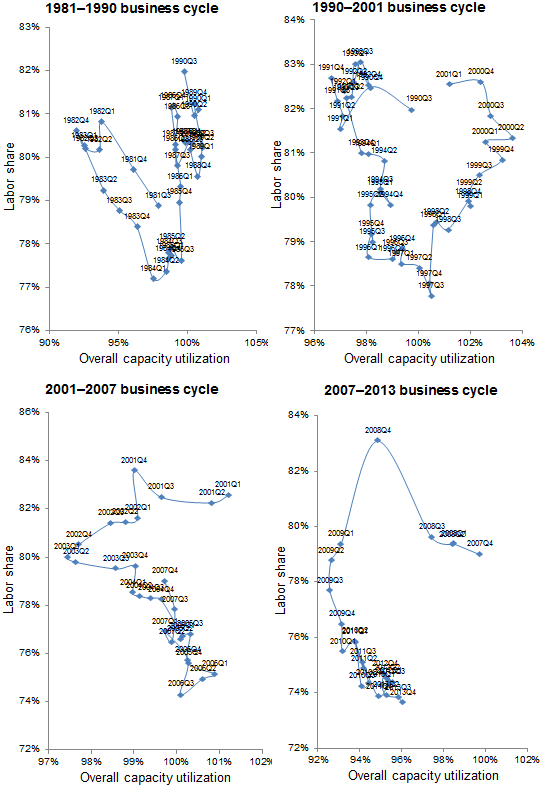

Barbosa-Filho and Taylor (2007) provide evidence that this pattern generally fits the empirical facts for the U.S. economy from 1954 to 2002. Figure G shows the trajectory of the labor share of corporate-sector income and overall capacity utilization (the ratio of actual to potential GDP) over the last four business cycles. In each of the three business cycles preceding the Great Recession, one sees the labor share rise during the recession (as profits fall much faster than wage incomes during downturns), then fall significantly in the early stages of recovery before rising again late in the expansion. By the end of 2013, however, there was little evidence that the labor share has even begun any reliable rise following its long fall in the early stages of recovery from the Great Recession.

Trajectory of labor share of corporate-sector income and overall capacity utilization over last four business cycles, 1981–2013

Note: Overall capacity utilization is the ratio of actual to potential GDP.

Source: Authors' analysis of Bureau of Economic Analysis National Income and Product Accounts (Table 1.1.6 and 1.14) and Congressional Budget Office Budget and Economic Outlook

The economic logic of this rising labor share of income in the late stage of business cycle expansions requires a reduction in economic slack sufficient to give workers enough bargaining power to spur significant real wage growth. If there is no evidence of much downward pressure on profit margins, then it seems hard to argue that economic slack has rapidly dwindled. Figure H shows the profit margin in the nonfinancial corporate sector. By the end of 2013 the after-tax profit margin was still higher than any level that prevailed before the Great Recession since 1966 and showed little sign that it had peaked.2

Nonfinancial corporate sector profit margins, 1947–2013

| Before tax | After tax | |

|---|---|---|

| 1947/01/01 | 16.4% | 6.8% |

| 1947/04/01 | 18.2% | 9.4% |

| 1947/07/01 | 17.7% | 9.1% |

| 1947/10/01 | 17.8% | 9.4% |

| 1948/01/01 | 19.7% | 10.9% |

| 1948/04/01 | 20.1% | 11.3% |

| 1948/07/01 | 19.2% | 11.1% |

| 1948/10/01 | 19.7% | 12.1% |

| 1949/01/01 | 18.9% | 11.7% |

| 1949/04/01 | 18.1% | 11.4% |

| 1949/07/01 | 18.8% | 12.0% |

| 1949/10/01 | 16.8% | 10.0% |

| 1950/01/01 | 18.5% | 9.5% |

| 1950/04/01 | 20.0% | 10.0% |

| 1950/07/01 | 21.0% | 9.2% |

| 1950/10/01 | 22.0% | 10.0% |

| 1951/01/01 | 20.7% | 6.3% |

| 1951/04/01 | 19.9% | 8.5% |

| 1951/07/01 | 20.0% | 9.5% |

| 1951/10/01 | 20.3% | 9.0% |

| 1952/01/01 | 18.9% | 9.0% |

| 1952/04/01 | 17.5% | 8.5% |

| 1952/07/01 | 17.4% | 8.0% |

| 1952/10/01 | 18.4% | 9.0% |

| 1953/01/01 | 18.5% | 8.5% |

| 1953/04/01 | 18.0% | 8.1% |

| 1953/07/01 | 17.5% | 7.5% |

| 1953/10/01 | 14.2% | 6.6% |

| 1954/01/01 | 15.6% | 8.1% |

| 1954/04/01 | 16.2% | 8.6% |

| 1954/07/01 | 17.1% | 9.0% |

| 1954/10/01 | 18.1% | 9.5% |

| 1955/01/01 | 19.5% | 10.5% |

| 1955/04/01 | 19.5% | 10.5% |

| 1955/07/01 | 18.9% | 9.9% |

| 1955/10/01 | 19.1% | 9.8% |

| 1956/01/01 | 18.0% | 9.2% |

| 1956/04/01 | 17.4% | 9.2% |

| 1956/07/01 | 17.2% | 9.0% |

| 1956/10/01 | 17.1% | 9.0% |

| 1957/01/01 | 17.3% | 8.9% |

| 1957/04/01 | 16.7% | 8.8% |

| 1957/07/01 | 16.2% | 8.8% |

| 1957/10/01 | 15.0% | 8.0% |

| 1958/01/01 | 13.1% | 7.0% |

| 1958/04/01 | 13.5% | 7.4% |

| 1958/07/01 | 14.8% | 8.3% |

| 1958/10/01 | 16.5% | 8.7% |

| 1959/01/01 | 17.2% | 9.1% |

| 1959/04/01 | 18.2% | 9.5% |

| 1959/07/01 | 15.9% | 8.6% |

| 1959/10/01 | 15.9% | 9.1% |

| 1960/01/01 | 16.7% | 9.0% |

| 1960/04/01 | 15.5% | 8.6% |

| 1960/07/01 | 15.0% | 8.6% |

| 1960/10/01 | 14.2% | 8.2% |

| 1961/01/01 | 13.7% | 7.7% |

| 1961/04/01 | 15.0% | 8.5% |

| 1961/07/01 | 15.8% | 9.0% |

| 1961/10/01 | 16.6% | 9.4% |

| 1962/01/01 | 16.6% | 9.8% |

| 1962/04/01 | 16.2% | 9.8% |

| 1962/07/01 | 16.2% | 9.8% |

| 1962/10/01 | 16.5% | 10.2% |

| 1963/01/01 | 16.5% | 10.2% |

| 1963/04/01 | 17.4% | 10.6% |

| 1963/07/01 | 17.4% | 10.6% |

| 1963/10/01 | 17.6% | 10.5% |

| 1964/01/01 | 18.1% | 11.3% |

| 1964/04/01 | 17.6% | 11.3% |

| 1964/07/01 | 17.6% | 10.9% |

| 1964/10/01 | 17.6% | 10.9% |

| 1965/01/01 | 18.7% | 12.0% |

| 1965/04/01 | 18.6% | 12.0% |

| 1965/07/01 | 18.6% | 12.0% |

| 1965/10/01 | 18.9% | 11.9% |

| 1966/01/01 | 19.3% | 12.3% |

| 1966/04/01 | 18.7% | 11.8% |

| 1966/07/01 | 18.1% | 11.3% |

| 1966/10/01 | 18.0% | 11.6% |

| 1967/01/01 | 17.1% | 11.2% |

| 1967/04/01 | 16.7% | 10.8% |

| 1967/07/01 | 16.5% | 10.6% |

| 1967/10/01 | 16.8% | 10.5% |

| 1968/01/01 | 16.3% | 9.7% |

| 1968/04/01 | 16.5% | 10.0% |

| 1968/07/01 | 16.4% | 9.9% |

| 1968/10/01 | 16.2% | 9.8% |

| 1969/01/01 | 15.2% | 8.9% |

| 1969/04/01 | 14.7% | 8.5% |

| 1969/07/01 | 13.8% | 8.0% |

| 1969/10/01 | 12.6% | 7.2% |

| 1970/01/01 | 11.4% | 6.4% |

| 1970/04/01 | 11.6% | 7.0% |

| 1970/07/01 | 11.2% | 6.3% |

| 1970/10/01 | 10.4% | 5.9% |

| 1971/01/01 | 12.0% | 7.2% |

| 1971/04/01 | 12.2% | 7.1% |

| 1971/07/01 | 12.1% | 7.4% |

| 1971/10/01 | 12.4% | 7.7% |

| 1972/01/01 | 12.6% | 7.9% |

| 1972/04/01 | 12.5% | 7.9% |

| 1972/07/01 | 12.7% | 8.2% |

| 1972/10/01 | 13.2% | 8.1% |

| 1973/01/01 | 13.4% | 8.0% |

| 1973/04/01 | 12.6% | 7.2% |

| 1973/07/01 | 12.3% | 7.4% |

| 1973/10/01 | 12.3% | 6.9% |

| 1974/01/01 | 11.2% | 6.2% |

| 1974/04/01 | 11.0% | 5.8% |

| 1974/07/01 | 10.3% | 4.7% |

| 1974/10/01 | 9.7% | 4.9% |

| 1975/01/01 | 9.8% | 5.8% |

| 1975/04/01 | 10.9% | 6.8% |

| 1975/07/01 | 12.5% | 7.4% |

| 1975/10/01 | 12.8% | 7.6% |

| 1976/01/01 | 13.8% | 8.3% |

| 1976/04/01 | 13.2% | 8.0% |

| 1976/07/01 | 13.1% | 7.9% |

| 1976/10/01 | 12.6% | 7.5% |

| 1977/01/01 | 12.6% | 7.4% |

| 1977/04/01 | 13.7% | 8.3% |

| 1977/07/01 | 14.3% | 8.9% |

| 1977/10/01 | 13.5% | 8.2% |

| 1978/01/01 | 12.4% | 7.7% |

| 1978/04/01 | 13.9% | 8.6% |

| 1978/07/01 | 13.8% | 8.5% |

| 1978/10/01 | 13.9% | 8.4% |

| 1979/01/01 | 12.8% | 7.8% |

| 1979/04/01 | 12.3% | 7.4% |

| 1979/07/01 | 11.7% | 6.9% |

| 1979/10/01 | 11.1% | 6.5% |

| 1980/01/01 | 10.6% | 5.6% |

| 1980/04/01 | 9.0% | 5.3% |

| 1980/07/01 | 9.6% | 5.3% |

| 1980/10/01 | 10.4% | 6.1% |

| 1981/01/01 | 10.7% | 6.5% |

| 1981/04/01 | 10.5% | 6.9% |

| 1981/07/01 | 11.1% | 7.4% |

| 1981/10/01 | 10.3% | 7.0% |

| 1982/01/01 | 9.3% | 6.7% |

| 1982/04/01 | 9.7% | 6.9% |

| 1982/07/01 | 9.6% | 6.9% |

| 1982/10/01 | 8.7% | 6.5% |

| 1983/01/01 | 9.4% | 7.0% |

| 1983/04/01 | 10.4% | 7.4% |

| 1983/07/01 | 11.0% | 7.5% |

| 1983/10/01 | 11.4% | 7.9% |

| 1984/01/01 | 12.5% | 8.6% |

| 1984/04/01 | 12.3% | 8.6% |

| 1984/07/01 | 11.9% | 8.7% |

| 1984/10/01 | 11.9% | 8.8% |

| 1985/01/01 | 11.6% | 8.6% |

| 1985/04/01 | 11.4% | 8.4% |

| 1985/07/01 | 11.9% | 8.9% |

| 1985/10/01 | 10.8% | 7.8% |

| 1986/01/01 | 10.0% | 7.0% |

| 1986/04/01 | 9.5% | 6.5% |

| 1986/07/01 | 9.0% | 5.9% |

| 1986/10/01 | 8.8% | 5.5% |

| 1987/01/01 | 9.2% | 5.9% |

| 1987/04/01 | 9.8% | 6.1% |

| 1987/07/01 | 10.3% | 6.6% |

| 1987/10/01 | 10.0% | 6.5% |

| 1988/01/01 | 10.2% | 6.8% |

| 1988/04/01 | 10.1% | 6.6% |

| 1988/07/01 | 10.0% | 6.5% |

| 1988/10/01 | 10.5% | 6.9% |

| 1989/01/01 | 9.6% | 5.9% |

| 1989/04/01 | 9.2% | 5.9% |

| 1989/07/01 | 9.1% | 5.9% |

| 1989/10/01 | 8.3% | 5.2% |

| 1990/01/01 | 8.5% | 5.5% |

| 1990/04/01 | 8.8% | 5.6% |

| 1990/07/01 | 8.0% | 4.8% |

| 1990/10/01 | 7.8% | 4.8% |

| 1991/01/01 | 8.4% | 5.4% |

| 1991/04/01 | 8.3% | 5.6% |

| 1991/07/01 | 8.3% | 5.6% |

| 1991/10/01 | 8.0% | 5.4% |

| 1992/01/01 | 8.3% | 5.6% |

| 1992/04/01 | 8.5% | 5.7% |

| 1992/07/01 | 8.3% | 5.5% |

| 1992/10/01 | 8.9% | 6.0% |

| 1993/01/01 | 8.7% | 5.9% |

| 1993/04/01 | 9.6% | 6.3% |

| 1993/07/01 | 9.6% | 6.8% |

| 1993/10/01 | 10.6% | 7.1% |

| 1994/01/01 | 10.7% | 7.6% |

| 1994/04/01 | 11.1% | 7.8% |

| 1994/07/01 | 11.4% | 7.9% |

| 1994/10/01 | 11.9% | 8.1% |

| 1995/01/01 | 11.5% | 7.8% |

| 1995/04/01 | 11.5% | 8.1% |

| 1995/07/01 | 12.2% | 8.7% |

| 1995/10/01 | 12.2% | 8.8% |

| 1996/01/01 | 12.5% | 9.1% |

| 1996/04/01 | 12.6% | 9.0% |

| 1996/07/01 | 12.5% | 9.0% |

| 1996/10/01 | 12.8% | 9.1% |

| 1997/01/01 | 12.8% | 9.4% |

| 1997/04/01 | 12.7% | 9.3% |

| 1997/07/01 | 13.2% | 9.6% |

| 1997/10/01 | 12.7% | 9.2% |

| 1998/01/01 | 11.6% | 8.2% |

| 1998/04/01 | 11.5% | 8.2% |

| 1998/07/01 | 11.7% | 8.5% |

| 1998/10/01 | 11.0% | 8.0% |

| 1999/01/01 | 11.2% | 7.8% |

| 1999/04/01 | 11.1% | 7.7% |

| 1999/07/01 | 10.3% | 7.0% |

| 1999/10/01 | 9.8% | 6.5% |

| 2000/01/01 | 9.3% | 6.0% |

| 2000/04/01 | 9.2% | 5.9% |

| 2000/07/01 | 8.5% | 5.7% |

| 2000/10/01 | 7.8% | 4.9% |

| 2001/01/01 | 7.3% | 5.1% |

| 2001/04/01 | 7.4% | 5.3% |

| 2001/07/01 | 7.1% | 5.0% |

| 2001/10/01 | 6.1% | 4.3% |

| 2002/01/01 | 7.7% | 6.2% |

| 2002/04/01 | 8.2% | 6.4% |

| 2002/07/01 | 8.5% | 6.7% |

| 2002/10/01 | 9.4% | 7.4% |

| 2003/01/01 | 9.7% | 7.3% |

| 2003/04/01 | 10.1% | 7.9% |

| 2003/07/01 | 10.5% | 8.2% |

| 2003/10/01 | 10.7% | 8.1% |

| 2004/01/01 | 11.7% | 8.9% |

| 2004/04/01 | 12.2% | 9.2% |

| 2004/07/01 | 12.5% | 9.3% |

| 2004/10/01 | 12.2% | 9.0% |

| 2005/01/01 | 12.8% | 8.6% |

| 2005/04/01 | 13.5% | 9.4% |

| 2005/07/01 | 12.8% | 8.8% |

| 2005/10/01 | 14.2% | 9.8% |

| 2006/01/01 | 14.4% | 10.2% |

| 2006/04/01 | 14.3% | 9.9% |

| 2006/07/01 | 15.3% | 10.7% |

| 2006/10/01 | 14.1% | 9.8% |

| 2007/01/01 | 13.4% | 9.1% |

| 2007/04/01 | 13.6% | 9.3% |

| 2007/07/01 | 12.0% | 8.2% |

| 2007/10/01 | 11.9% | 7.9% |

| 2008/01/01 | 10.9% | 7.5% |

| 2008/04/01 | 11.0% | 7.5% |

| 2008/07/01 | 12.4% | 8.8% |

| 2008/10/01 | 10.7% | 8.5% |

| 2009/01/01 | 10.1% | 7.7% |

| 2009/04/01 | 9.7% | 7.3% |

| 2009/07/01 | 10.2% | 7.7% |

| 2009/10/01 | 11.8% | 8.7% |

| 2010/01/01 | 12.9% | 9.9% |

| 2010/04/01 | 13.2% | 10.1% |

| 2010/07/01 | 14.2% | 11.1% |

| 2010/10/01 | 13.7% | 10.7% |

| 2011/01/01 | 13.1% | 10.2% |

| 2011/04/01 | 14.5% | 11.6% |

| 2011/07/01 | 14.5% | 11.6% |

| 2011/10/01 | 14.7% | 11.9% |

| 2012/01/01 | 14.5% | 11.3% |

| 2012/04/01 | 14.7% | 11.5% |

| 2012/07/01 | 14.3% | 11.3% |

| 2012/10/01 | 14.7% | 11.3% |

| 2013/01/01 | 14.6% | 11.3% |

| 2013/04/01 | 14.9% | 11.7% |

| 2013/07/01 | 14.9% | 11.7% |

| 2013/10/01 | 14.9% | 11.7% |

Note: Shaded areas denote recessions.

Source: Authors' analysis of Bureau of Economic Analysis National Income and Product Accounts (Table 1.15)

The macroeconomic evidence surveyed above argues strongly that a large gap between aggregate demand and potential supply persists even five years after the official end of the Great Recession. Given this large demand shortfall, one would be surprised indeed if the overall unemployment was not elevated. The remaining sections of this paper focus more strongly on why this elevation of overall unemployment has largely been driven by elevation of the LTUR.

Is there evidence that the long-term unemployed have hardened into the structurally unemployed?

This section examines whether there is evidence of a growing incidence of “structural” factors that are reducing the exit rate from unemployment and therefore increasing the share of the labor force that is long-term unemployed. One factor we examine is whether there has been an increasing “skills mismatch,” in which workers do not have the skills for the jobs that are available. Additionally, a common (and largely admirable) concern voiced by those arguing for more aggressive policy actions to boost demand and lower unemployment is that absent such actions, unemployment that began as a result of cyclical weakness may harden into structural unemployment as workers who have been jobless for extended periods lose skills and/or social networks. This view in particular is sometimes invoked to argue that, whatever the original cause of the rise in long-term unemployment, this group should essentially be treated as structurally unemployed going forward. Taking this position would mean that the LTU should largely be discounted when measuring the degree of labor market slack remaining in the economy, and it assumes that further policy measures to boost demand would largely fail to bring down the LTUR.

No sign of an increasing skills mismatch

We first consider whether there has been an increasing skills mismatch, which would reduce the exit rate from unemployment and thereby increase the share of the labor force that is long-term unemployed. There is a sizeable literature on whether a skills mismatch has increased since the start of the Great Recession, with the consensus being that the weak labor market recovery is not due to a skills mismatch but instead to weakness in aggregate demand. For example, Lazear and Spletzer (2012) state:

An analysis of labor market data suggests that there are no structural changes that can explain movements in unemployment rates over recent years. Neither industrial nor demographic shifts nor a mismatch of skills with job vacancies is behind the increased rates of unemployment. … The patterns observed are consistent with unemployment being caused by cyclic phenomena that are more pronounced during the current recession than in prior recessions.

We provide additional evidence below. The key insight unpinning the evidence presented here is that if today’s high long-term unemployment were a problem of a skills mismatch, we would expect to find some types of workers or sectors or occupations of meaningful size now facing tight labor markets relative to before the recession started. The “signature” of an increasing skills mismatch would be shortages relative to 2007 in some consequentially sized groups of workers.

Table 1 shows the long-term unemployment rate by education, age, gender, race/ethnicity, occupation, and industry. For each category, the table shows the long-term unemployment rate in 2007, the long-term unemployment rate in 2013, and ratio of the 2013 to the 2007 rates. It demonstrates that while there is considerable variation in long-term unemployment rates across groups—which is of course always true, in periods of both labor market strength and weakness—for all groups, the long-term unemployment rate in 2013 was substantially higher than it was before the recession started. The long-term unemployment rate in 2013 was between 2.9 and 4.3 times higher than it was in 2007 for all age, education, occupation, industry, gender, and racial and ethnic groups. In particular, today’s long-term unemployment crisis is not confined to workers who have less education or who happen to be looking for work in specific occupations or industries where jobs aren’t available. Appendix Table B1 shows the long-term unemployment rate by state in both 2007 and 2013 and shows further that long-term unemployment is elevated relative to 2007 in every state. The sign of a skills mismatch—workers in some group of meaningful size experiencing tight labor markets relative to 2007—is plainly missing. Elevated long-term unemployment for all groups, as we see today, is, instead, the sign of weak aggregate demand.

Long-term unemployment rates of various groups, 2007 and 2013

| 2007 | 2013 | Ratio (2013/2007) | |

|---|---|---|---|

| All | 0.8% | 2.8% | 3.4 |

| Educational attainment | |||

| Less than high school | 1.6% | 5.1% | 3.1 |

| High school | 1.0% | 3.6% | 3.6 |

| Some college | 0.7% | 2.7% | 3.8 |

| College | 0.5% | 1.7% | 3.7 |

| Advanced degree | 0.4% | 1.3% | 3.3 |

| Age | |||

| 16–24 | 1.3% | 3.9% | 3.1 |

| 25–34 | 0.8% | 2.8% | 3.5 |

| 35–44 | 0.7% | 2.5% | 3.6 |

| 45–54 | 0.8% | 2.5% | 3.3 |

| 55–64 | 0.7% | 2.7% | 3.6 |

| 65+ | 0.6% | 2.4% | 4.1 |

| Gender | |||

| Male | 0.9% | 2.9% | 3.4 |

| Female | 0.8% | 2.6% | 3.4 |

| Race/ethnicity | |||

| White | 0.6% | 2.2% | 3.5 |

| Black | 2.0% | 5.7% | 2.9 |

| Hispanic | 0.8% | 3.2% | 3.9 |

| Occupation | |||

| Management, business, and financial occupations | 0.4% | 1.5% | 4.1 |

| Professional and related occupations | 0.4% | 1.3% | 3.3 |

| Service occupations | 1.0% | 3.2% | 3.2 |

| Sales and related occupations | 0.8% | 2.8% | 3.4 |

| Office and administrative support occupations | 0.7% | 3.0% | 4.3 |

| Construction and extraction occupations | 1.1% | 4.2% | 3.9 |

| Installation, maintenance and repair occupations | 0.6% | 2.2% | 3.7 |

| Production occupations | 1.1% | 3.6% | 3.2 |

| Transportation and material moving occupations | 1.2% | 3.4% | 2.9 |

| Industry | |||

| Mining | 0.3% | 1.3% | 3.9 |

| Construction | 1.0% | 3.7% | 3.7 |

| Manufacturing | 0.9% | 2.8% | 3.1 |

| Wholesale and retail trade | 0.8% | 2.9% | 3.6 |

| Transportation and utilities | 0.8% | 2.4% | 3.1 |

| Information | 0.8% | 2.6% | 3.1 |

| Financial activities | 0.5% | 1.9% | 3.8 |

| Professional and business services | 0.9% | 3.1% | 3.6 |

| Educational and health services | 0.4% | 1.7% | 4.0 |

| Leisure and hospitality | 1.1% | 3.2% | 2.9 |

| Other services | 0.6% | 2.3% | 3.6 |

| Public administration | 0.4% | 1.4% | 3.4 |

Note: The ratio may not reflect the quotient of 2013 over 2007 column data due to rounding. The long-term unemployment rate is the share of the labor force that has been unemployed for 27 weeks or more.

Source: Authors' analysis of basic monthly Current Population Survey microdata

Another place to look for evidence of a skills mismatch that might be boosting long-term unemployment by reducing unemployed workers’ likelihood of finding a job is in wage trends. If certain skills are in short supply, the simple logic of supply and demand implies wages should be increasing substantially in occupations where there is a shortage. In other words, employers who face shortages of suitable, interested workers should be responding by bidding up wages to attract the workers they need. Figure I shows current average hourly wages as a percentage of average hourly wages in 2007 by occupation, along with productivity growth over this same period as a benchmark for the rate at which average wages should grow. In no occupation is there evidence of wages being bid up in a way that would indicate tight labor markets or labor shortages; in no occupation have average wages even kept pace with overall productivity growth over this period. Again, this pattern of productivity growth outstripping wage growth across the board is a sign of weak aggregate demand for labor, not a skills mismatch that may be reducing the exit rate from unemployment and therefore increasing the share of the labor force that is long-term unemployed.

Current real average hourly wages, as a share of 2007 wages, by occupation

| Occupation | Current real average hourly wages, as a share of 2007 |

|---|---|

| Productivity growth from 2007–present | 108.0% |

| Business and financial | 105.4% |

| Farming, fishing, and forestry | 105.0% |

| Architecture and engineering | 104.3% |

| Legal | 102.5% |

| Arts, design, entertainment, sports, media | 102.4% |

| Computer and mathematical | 101.5% |

| Healthcare practicitioners | 100.4% |

| Transportation and material moving | 100.1% |

| Construction and extraction | 100.0% |

| Management | 99.9% |

| Education, training, and library | 99.7% |

| Community and social service | 99.7% |

| Office and administrative support | 99.5% |

| Protectice service | 98.8% |

| Food preparation and service | 97.1% |

| Production | 97.0% |

| Healthcare support | 96.4% |

| Life, physical, and social science | 95.9% |

| Installation, maintenance, and repair | 95.8% |

| Building and grounds cleaning | 95.5% |

| Personal care and service | 94.4% |

| Sales and related | 94.4% |

Note: Current is latest 12-month average, 2013Q3–2014Q2.

Source: Authors' analysis of Current Population Survey Outgoing Rotation Group microdata

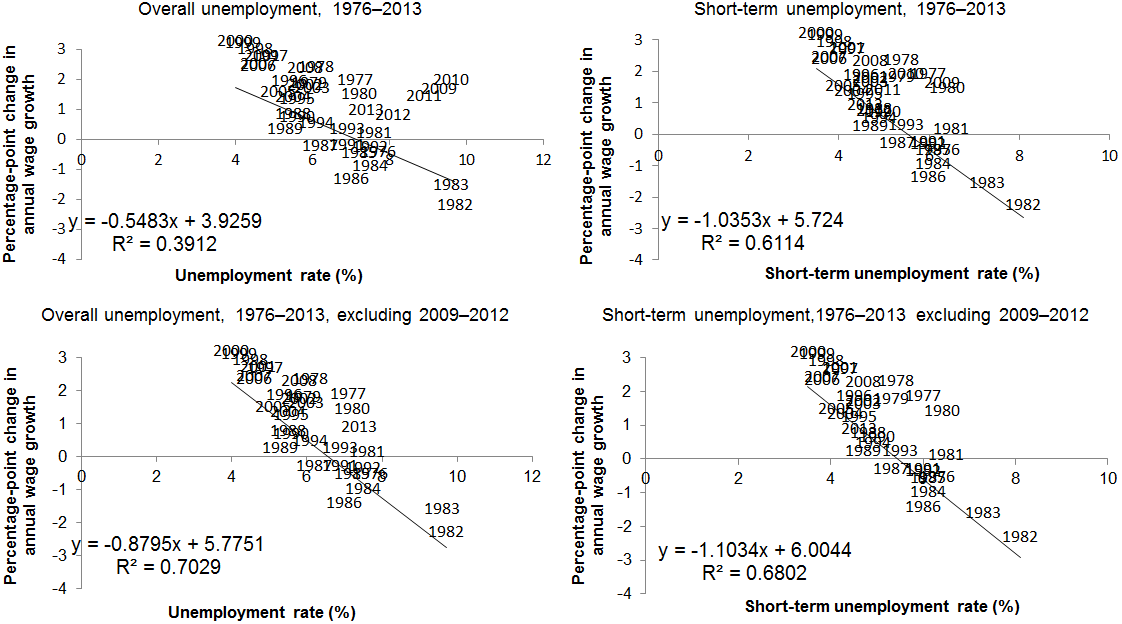

Unemployment insurance extensions led to a trivial increase in the time it took to take another job