“It’s tough to make predictions, especially about the future,” quipped Yogi Berra. I keep his wise admonition in mind as I make predictions about our energy future, but we have many reasons for optimism when it comes to the future growth of solar.

Here’s the summary: solar is taking over. We can now see many years into the future when it comes to energy. And that future is primarily solar-powered.

Why am I so optimistic about solar's prospects? Well, let me explain.

The “solar singularity” will, by my definition, occur when solar prices become so cheap that solar becomes the default power source based on cost alone. We aren’t there yet, but we’re probably just a few years away from that point, particularly since energy storage costs are already declining strongly. (I’m not going to address storage in this article further, but, of course, a grid can’t run on variable solar power alone, so we’ll need storage and other backup technologies to ensure reliable grids as solar power penetration grows.)

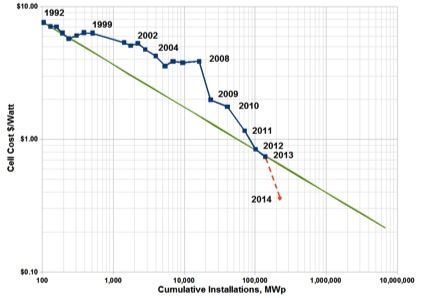

Swanson's law, named after the founder of SunPower, states that the price of solar panels generally drops by 20 percent with every doubling of shipped panels. This has been the general trend since solar became a viable technology -- hence its designation as a “law,” even though there are times when some deviations from the trend take place. For example, from the mid-1990s until 2008, solar costs declined by relatively little, primarily due to stubbornly high silicon prices against a backdrop of increasing commodity prices across many markets, until the crash of 2008. Since 2008, however, panel cost declines have accelerated, and the general trend has returned with a vengeance.

Figure 1: Swanson’s Law Says Solar Panel Prices Decline 20 Percent With Every Doubling of Shipped Panels

Source: Wikipedia

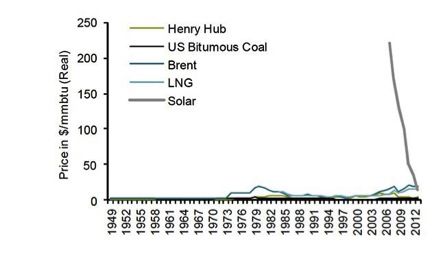

When we compare recent cost declines for solar to other energy prices, we get a pretty picture indeed, and this is why solar is now getting very serious attention from investors and pundits alike.

Figure 2: Comparing Solar Panel Price Declines With Those of Other Types of Energy

Source: Bernstein Research

Swanson provided some interesting additional insights into the nature of his eponymous law in a 2014 email in response to an earlier article of mine:

[“Swanson’s law”] is not really a “law” but merely expresses the fact that manufactured goods tend to follow a straight line on a log-log plot of price versus cumulative unit volume. To the best of my knowledge, no one knows why this is so. It is curious that it usually continues to be so, even when the costs become largely commodity items like glass and steel. This has led some in the past to assume that the cost reductions would flatten out when commodity material costs dominate. In fact, this has not been observed, in part because people find ways to use less materials, and because materials themselves follow a learning curve

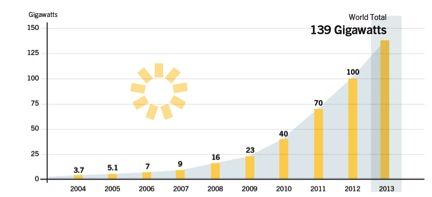

REN21, a nonprofit organization, releases an annual report on the global status of renewable energy. Its 2014 report showed a phenomenal 39 percent growth in solar power, with 39 gigawatts added. REN21 hasn’t released its figures for 2014 yet, but we can expect similar figures for 2014 to those we saw in 2013. It must be satisfying for Swanson to see his predictions come true in spades. When he wrote his 2006 paper, global solar installations totaled only about 5 gigawatts. We are now, in early 2015, at almost 200 gigawatts, about 40 times the installations in 2006, with prices declining much as he predicted.

Figure 3: Global Solar Power Growth Through 2013

Source: REN21

Total U.S. installations now stand at about 20 gigawatts, or 10 percent of the total and enough power for about 4 million U.S. homes.

What about subsidies?

Subsidies have been a big part of getting solar to where it is today, but subsidies are becoming increasingly unnecessary as solar prices plummet. California’s residential and commercial solar rebate program (the California Solar Initiative, or CSI) is all but gone as the rebates have been used up, yet California’s retail solar market is still growing strongly.

On the wholesale side, the federal 30 percent Investment Tax Credit (ITC) is set to decline to 10 percent at the beginning of 2017. The conventional wisdom is that we’ll see a big drop in installations when this happens. However, a silver lining to the Republican-controlled Congress and their antipathy to green power is that there is little hope at this point that the 30 percent ITC will be extended.

This means, contrary to the similar discussion with respect to wind power’s tax credits over the last decade (they’ve expired a number of times, leading to a slowdown in installations for a year and then a rebound when the credit is renewed), there won’t be a slowdown in anticipation of an eventual renewal of the tax credit. We should see solar companies simply adjust to the lower tax benefit and keep on trucking.

SunPower, a major player in today’s markets, is already predicting little impact from the reduced ITC, based on the ability to develop profitable projects even with the reduced ITC of 10 percent.

James Smith, an investment analyst at Catapult Research, recently issued a very bullish report on solar, providing some good corroboration of my predictions here. He stated in his report, excerpted here: “I’m saying that if the cost of solar drops 20 percent in price every time the installed base doubles, it is only a matter of time before solar takes over from fossil fuels. My best guess is that it starts to really happen from 2017 onward.”

Is the past a reliable guide to the future?

Making predictions (especially about the future) is difficult, because there is no guarantee, of course, that the past is a reliable guide to the future. However, when it comes to solar power, we see the very clear trend of price reductions continuing for some time, because there are no inherent limits to further reductions. Jeremy Rifkin has made the case that solar panels will become practically free with zero marginal cost for production in his book The Zero Marginal Cost Society. As we’ll see below, this is a reasonable prediction.

Solar panels are not the only cost component for solar systems, and they are increasingly becoming a minor cost because of ongoing panel cost reductions. The main components of overall costs are now soft costs like labor and the “balance-of-system” costs for equipment like inverters, racks and wiring. However, these other costs are also declining substantially, and groups like GTM Research predict further major cost reductions.

The basis for my predictions is, however, quite simple: we have reached the point where low costs are driving installations higher, which in turn drives costs lower, which in turn drives installations higher. The virtuous circle seems to be locked in and based on history, we can expect further 20 percent cost reductions with each doubling of capacity, with no inherent limit to cost reductions over time.

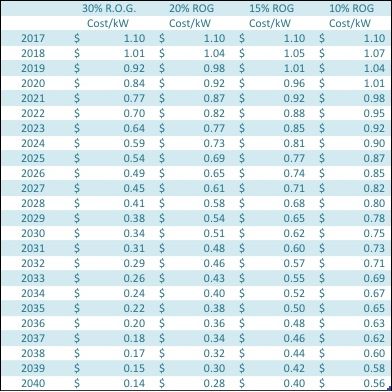

Under this trend, we can expect by 2020, under a 30 percent global rate of growth, to see total solar costs for utility-scale systems at around $0.84 per watt, based on GTM Research’s projected $1.10 per watt for 2017. By 2025, the cost drops to about $0.54 per watt, and by 2030 it will be a practically free cost of $0.34 per watt. By 2040, we can expect under these trends to see costs at about 14 cents per watt. A 5-kilowatt home-size system would cost only $700.

That counts as free in my book, because that system will provide power for about 25 years at almost no cost above the initial installation cost. Twenty-five years of production for $700 equates to about 2.8 cents per kilowatt-hour. For comparison, the average retail cost of power in California today is about 15 cents per kilowatt-hour, so this future cost of solar power will be less than one-fifth the cost of today’s power. And this analysis leaves out inflation. If we include inflation, the comparison is even more favorable.

What could derail the solar singularity?

While I’m fairly confident in the coming solar singularity, I’d be foolish not to recognize some inherent uncertainties about making such predictions. I’ll discuss a couple of the biggest uncertainties here.

The biggest source of uncertainty is the rate of growth in installations. In my calculations above, I assumed a 30 percent rate of growth, which is reasonable given the far higher rates of growth we’ve seen in recent years (this results in approximately a 2.3-year doubling time). However, it is likely that we’ll see growth rates decline for a variety of reasons. If installations increase at only 20 percent per year, we see about $0.54 per watt by 2030 and 28 cents per watt by 2040. At only 10 percent growth we see about $0.75 per watt by 2030 and $0.56 per watt by 2040. At these price and installation levels, the singularity still arrives, but it’s delayed.

Figure 4. Projected Cost Declines Based on Swanson’s Law (Ignoring Inflation)

Source: Tam Hunt

The second biggest source of uncertainty is the degree to which there are fundamental limitations in how fast power generation fleets can turn over. Most power generation assets are financed (amortized) over the course of many years, and these investments often require long power sales contracts to justify such investments. This means that a lot of the fleet is locked in contractually at any given time. If a ton of solar is installed in any particular grid system, the threat of “stranded costs” -- costs that are at risk of not being recovered due to under-utilization or an early shutdown -- becomes high.

Only time will tell how the stranded-cost issue shakes out in each country, but there is good reason to believe that even if some grids see a slowdown in solar installations because of concerns about stranded costs, or other problems, that other countries will take up the slack and the general global trend of ever-increasing solar will continue apace.

One issue that I don’t think will be a real problem in the next couple of decades is lack of space for new solar. For all practical purposes, the space for installing solar around the world is infinite. We’ll run out of power demand long before we’ll run out of space for solar. As costs plummet for solar, more and more countries will see solar become economically viable, and more and more locations, such as roadways, areas over metro rail lines, etc., will be covered in solar.

In sum, we have some very good reasons to believe that the solar singularity is indeed nigh. What does a world of free or practically free energy look like? That is a topic for another column.

***

Tam Hunt is author of the upcoming book, The Solar Singularity: Why Our Energy Future Is So Bright. Hunt is a lawyer and owner of Community Renewable Solutions LLC, a renewable energy consulting and law firm that focuses on policy advocacy and solar and energy storage project development.