Disney's (DIS) New Division to Focus on Adult Animation

The Walt Disney DIS announced the launch of an adult animation division, 20th Television Animation, which will be led by long-time animation executive, Marci Proietto, according to Variety report.

The new division will focus on developing, growing and maintaining the vast 20th Century Fox animation library.

The unit already has 11 series in production, including Koala Man and Solar Opposites for Disney streamer Hulu, as well as The Great North for Fox, Central Park for Apple’s AAPL Apple TV+ and The Prince for AT&T T owned WarnerMedia’s HBO Max. The unit will also oversee legacy titles such as The Simpsons, Family Guy, American Dad and Bob’s Burgers.

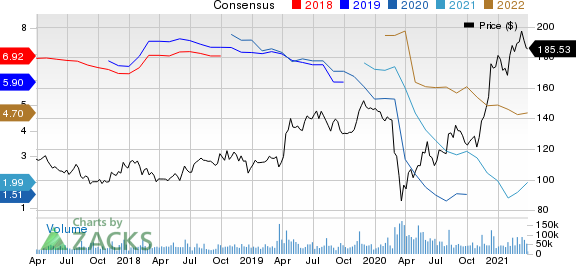

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Studio Restructuring to Bolster Disney’s Content Focus

Similar to the newly formed Walt Disney Television Alternative led by Rob Mills and Disney Branded TV division headed by Disney Channel's Gary Marsh, Proietto and her new production unit are part of corporate restructuring efforts in favour of centralized groups focused on content under Disney's General Entertainment Content chairman, Peter Rice.

The move comes just month after Disney announced that the company will be centralizing media businesses into a single organization that will be responsible for content distribution, ad sales and Disney+ to further accelerate the direct-to-consumer strategy.

Studios Content will include the content engines of The Walt Disney Studios, including Disney live action and Walt Disney Animation Studios, Pixar Animation Studios, Marvel Studios, Lucasfilm, 20th Century Studios and Searchlight Pictures.

However, coronavirus-led disruption has negatively impacted the majority of Disney’s businesses including Media and Entertainment Distribution, Theme Parks, cruise and advertising.

Nonetheless, Disney’s top-line growth is expected to benefit from the upcoming movie release slate for 2021, which will be launched simultaneously in theaters and Disney+. Markedly, while Cruella is set to release on May 28, the highly anticipated Marvel Studios’ Black Widow is now set to release on Jul 9.

Other notable movie releases include Free Guy (Aug 13), Shang Chi and the Legend of the Ten Rings (Sep 3), The King’s Man (Dec 22), Deep Water (Jan 14, 2022) and Death on the Nile (Feb 11, 2022).

Moreover, the reopening of two California theme parks on Apr 30 is expected to boost Parks, Experiences and Products segment’s revenues in second-half fiscal 2021. Further, the Zacks Rank #3 (Hold) company is expected to resume some of its cruise operations in the fall. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disney Ramps Up Production for Streaming Content

The media giant has been focusing on the direct-to-consumer business that comprises Disney+, ESPN+ and Hulu (part of Disney bundle) to counter coronavirus-led business disruptions.

Disney plans to spend $14-$16 billion in global direct-to-consumer content expenses across Disney+, Hulu, and ESPN+ in fiscal 2024 as it ramps up original series as well as films. The company plans to release 100 new titles per year that include 10 Marvel series, 10 Star Wars series, 15 Disney live-action, Disney Animation and Pixar series, along with an equal number of films, each.

In fact, Disney now expects to see between 230 million and 260 million subscribers on Disney+ by 2024, which basically triples its prior expectation of reaching between 60 million and 90 million subscribers by 2024.

Disney’s bullish projections for the streaming service are based in part on the high-profile, and higher-cost shows and movies that it is making for Disney+ through Marvel and Lucas film productions.

Disney+ has already gained significant traction by garnering more than 100 million paying subscribers within a short span of 16 months (since its launch in November 2020) despite stiff competition from the likes of Netflix NFLX and Amazon Prime Video, driven by strong content portfolio.

5G Revolution: 3 Stocks to Make Your Move

With super high data speed, it will make current cell phones obsolete and unlock the full potential of big data, cloud computing, and artificial intelligence. In the next few years this industry is predicted to create 22 million jobs and a stunning $12.3 trillion in revenue.

Today you have an historic chance to pursue almost unimaginable gains like Microsoft, Netflix, and Apple in their early phases. Zacks has released a Special Report that reveals our . . .

Smartest stock for 5G telecom

Safest investment in 5G hardware

Single best 5G buy of all!

Download now. Today the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research