Joe Nocera writes about Thursday’s New York Revie/PEN event on the economy, but fails to mention what I found the most depressing aspect of the whole thing: further confirmation that we’re living in a Dark Age of macroeconomics, in which hard-won knowledge has simply been forgotten.

What’s the evidence? Niall Ferguson “explaining” that fiscal expansion will actually be contractionary, because it will drive up interest rates. At least that’s what I think he said; there were so many flourishes that it’s hard to tell. But in any case, this is really sad: John Hicks knew far more about this in 1937 than people who think they’re sophisticates know now.

In any case, I thought it might be useful to re-explain why our current predicament can be thought of as a global excess of desired savings — which means that fiscal deficits won’t drive up interest rates unless they also expand the economy.

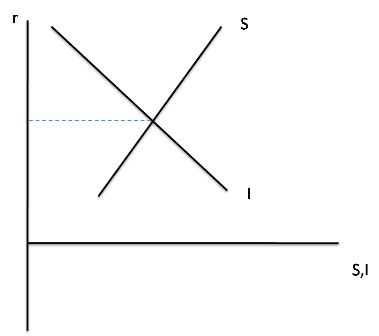

Here’s what I imagine Niall Ferguson was thinking: he was thinking of the interest rate as determined by the supply and demand for savings. This is the “loanable funds” model of the interest rate, which is in every textbook, mine included. It looks like this:

where S is savings, I investment spending, and r the interest rate.

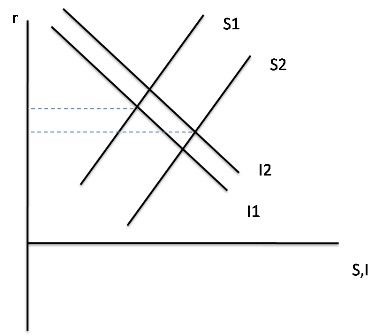

What Keynes pointed out was that this picture is incomplete if you allow for the possibility that the economy is not at full employment. Why? Because saving and investment depend on the level of GDP. Suppose GDP rises; some of this increase in income will be saved, pushing the savings schedule to the right. There may also be a rise in investment demand, but ordinarily we’d expect the savings rise to be larger, so that the interest rate falls:

So supply and demand for funds doesn’t tell you what the interest rate is — not by itself. It tells you what the interest rate would be conditional on the level of GDP; or to put it another way, it defines a relationship between the interest rate and GDP, like this:

This is the IS curve, taught in Econ 101. Now, we usually explain how this curve is derived in a different way: we say that given the interest rate, you can determine investment demand, and then through the multiplier process this determines GDP. What you’re supposed to understand, however, is that the derivation I’ve just given is just a different way of arriving at the same result. It’s just different presentations of the same model.

So what determines the level of GDP, and hence also ties down the interest rate? The answer is that you need to add “liquidity preference”, the supply and demand for money. In the modern world, we often take a shortcut and just assume that the central bank adjusts the money supply so as to achieve a target interest rate, in effect choosing a point on the IS curve.

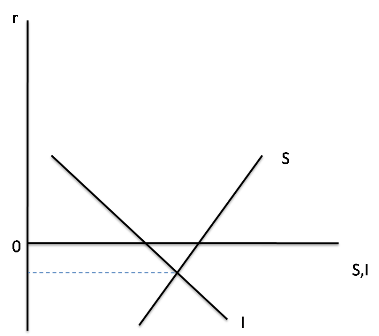

Which brings us to the current state of affairs. Right now the interest rate that the Fed can choose is essentially zero, but that’s not enough to achieve full employment. As shown above, the interest rate the Fed would like to have is negative. That’s not just what I say, by the way: the FT reports that the Fed’s own economists estimate the desired Fed funds rate at -5 percent.

What does this situation look like in terms of loanable funds? Draw the supply and demand for funds that would obtain if we were at full employment. They look like this:

In effect, we have an incipient excess supply of savings even at a zero interest rate. And that’s our problem.

So what does government borrowing do? It gives some of those excess savings a place to go — and in the process expands overall demand, and hence GDP. It does NOT crowd out private spending, at least not until the excess supply of savings has been sopped up, which is the same thing as saying not until the economy has escaped from the liquidity trap.

Now, there are real problems with large-scale government borrowing — mainly, the effect on the government debt burden. I don’t want to minimize those problems; some countries, such as Ireland, are being forced into fiscal contraction even in the face of severe recession. But the fact remains that our current problem is, in effect, a problem of excess worldwide savings, looking for someplace to go.

Comments are no longer being accepted.