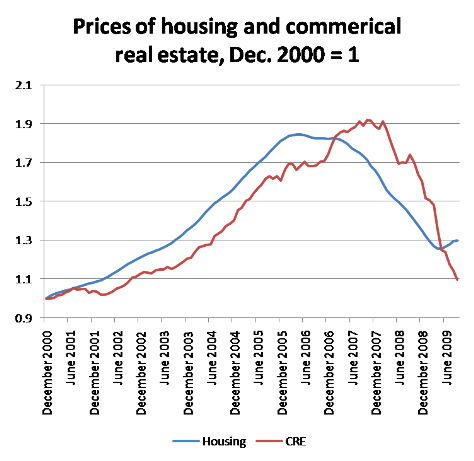

For some reason I haven’t seen this: a comparison of commercial real estate prices from Moody’s/MIT with housing prices from Standard and Poor’s/Case-Shiller. Here it is:

Standard and Poors, Moody’s

Standard and Poors, Moody’s From my perspective, the CRE bubble is highly significant; it gives the lie both to those who blame Fannie/Freddie/Community Reinvestment for the housing bubble, and those who blame predatory lending. This was a broad-based bubble.

Comments are no longer being accepted.