Olivier Blanchard, normally at MIT but currently the chief economist at the IMF, has released an interesting and important paper on how the crisis has changed, or should have changed, how we think about macroeconomic policy. The most surprising conclusion, presumably, is the idea that central banks have been setting their inflation targets too low:

Higher average inflation, and thus higher nominal interest rates to start with, would have made it possible to cut interest rates more, thereby probably reducing the drop in output and the deterioration of fiscal positions.

To be a bit more precise, I’m not that surprised that Olivier should think that; I am, however, somewhat surprised that the IMF is letting him say that under its auspices. In any case, I very much agree.

I would add, however, that there’s another case for a higher inflation rate — an argument made most forcefully by Akerlof, Dickens, and Perry (pdf). It goes like this: even in the long run, it’s really, really hard to cut nominal wages. Yet when you have very low inflation, getting relative wages right would require that a significant number of workers take wage cuts. So having a somewhat higher inflation rate would lead to lower unemployment, not just temporarily, but on a sustained basis.

Or to put it a bit differently, the long-run Phillips curve isn’t vertical at very low inflation rates.

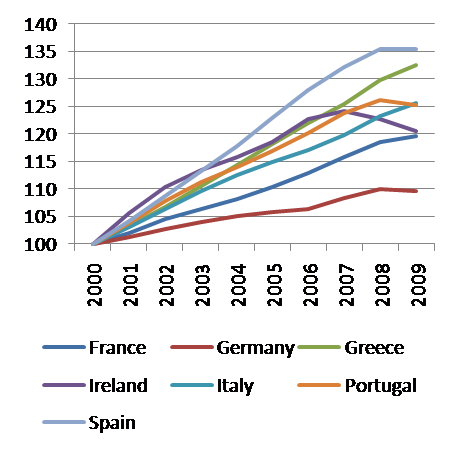

I think this is especially important in the European context. As I’ve been writing in a number of posts, the period 2000-2008 saw a huge divergence in price levels between the capital-inflow nations of the European periphery and the European core. Here are deflators, 2000=100:

GDP DEFLATORS, 2000=100

IMF

IMF Almost surely, that divergence now has to be reduced. Yet with a low overall inflation rate for the eurozone, that means large-scale deflation in the overvalued economies if convergence is to happen any time in, say, the next 5-10 years. (Actually, in Eurospeak I think this is cohesion rather than convergence, but never mind).

The task would be a lot easier if the eurozone had 4 percent inflation instead of 2.

So yes, let’s have modestly higher inflation. Alas, Ben Bernanke — at least when speaking publicly — doesn’t agree. And I can only imagine what Trichet would say.