Coda entered the market with an ambitious, but simple, mission. Since its founding in 2014, it has seemingly forged a path to realizing its vision with $140 million in funding and 25,000 teams across the globe using the platform.

Coda is simple in that its focus is on the document, one of the oldest content formats/tools on the internet, and indeed in the history of software. Its ambition lies in the fact that there are massive incumbents in this space, like Google and Microsoft.

Co-founder and CEO Shishir Mehrotra told TechCrunch that that level of competition wasn’t a hindrance, mainly because the company was very good at communicating its value and building highly effective flywheels for growth.

Mehrotra was generous enough to let us take a look through his pitch doc (not deck!) on a recent episode of Extra Crunch Live, diving not only into the factors that have made Coda successful, but how he communicated those factors to investors.

A screenshot from Coda’s pitch doc.

Extra Crunch Live also features the ECL Pitch-off, where founders in the audience come “onstage” to pitch their products to our guests. Mehrotra and his investor, Madrona partner S. Somasegar, gave their live feedback on pitches from the audience, which you can check out in the video (full conversation and pitch-off) below.

As a reminder, Extra Crunch Live takes place every Wednesday at 3 p.m. EDT/noon PDT. Anyone can hang out during the episode (which includes networking with other attendees), but access to past episodes is reserved exclusively for Extra Crunch members. Join here.

The soft circle

Like many investors and founders, Mehrotra and Somasegar met well before Mehrotra was working on his own project. They met when both of them worked at Microsoft and maintained a relationship while Mehrotra was at Google.

In their earliest time together, the conversations centered around advice on the Seattle tech ecosystem or on working with a particular team at Microsoft.

“Many people will tell you building relationships with investors … you want to do it outside of a fundraise as much as possible,” said Mehrotra.

Eventually, Mehrotra got to work on Coda and kept in touch with Somasegar. He even pitched him for Series B fundraising — and ultimately got a no. But the relationship persisted.

“It allows for you to build up context when the moment comes and you say, ‘Hey, we’re ready to talk about financing,'” said Mehrotra.

Somasegar describes Mehrotra as a man who is formal in his point of view while maintaining that he’s open to feedback. “But he’s a guy with a point of view,” he added.

At the time of their first financing conversations, Coda was showing growth and product-market fit, but wasn’t yet monetizing. Mehrotra wanted six months to build the right set of capabilities and the right user experience. To him, the product still needed some final touches.

Somasegar described pushing Mehrotra to start testing the waters.

“Nope, I need six more months,” Mehrotra responded, according to Somasegar’s retelling. But it was all for the best: Another firm came in to lead the Series B, and it gave Mehrotra a way to take in feedback from Madrona specifically, which made the reapproach a much more clear-cut endeavor.

“You learn a lot in the process of how one goes through that experience and explores an investment,” said Mehrotra. “It’s really important to understand the feedback and stay in touch, so you can come back when the moment is right. By the time we got around to our Series C, all of Madrona’s questions had been answered very clearly.”

But equally important to maintaining relationships outside of investment cycles is truly understanding the nature of the relationship with these investors.

“Soma is one of those investors who is helpful whether he’s invested or not,” said Mehrotra. “He’s going to be super helpful to your company. It’s so much easier when you’re making a list of people to ask for financing to call the people who are helpful anyway, with the expectation that they’ll be even more helpful.”

The same page

According to Mehrotra, the first part of any conversation with an investor is sharing the overall mission and thesis. In the case of Coda, Mehrotra had two fundamental beliefs.

The first is that, despite the proliferation of productivity and workflow apps, most folks do the majority of their work in documents and spreadsheets. The second belief is that the document hasn’t really been rethought for 20 or 30 years.

“I always like to start with the key observations about the world, the key mission of the company, and a little taste of what the product feels like,” said Mehrotra, showing us the first page of his pitch doc. (You can see what was shared in the doc in the video below.)

Naturally, Coda pitched with a doc and not a deck. Not only does this accomplish Mehrotra’s goal of giving a taste of the product, but Coda was also designed as a discussion tool rather than a storytelling tool, meaning he can navigate through the content and rearrange the order based on the audience he’s talking to.

Mehrotra established his major observations early on as a way to filter out investors that didn’t agree with them. But once you get through that litmus test, it’s important to move into what matters most to investors.

Closing the loop

For Coda, it was important to not only show the growth of the company but to focus on the metrics that are core to the long-term vision.

Somasegar explained that, as an investor, it’s critical that he not only sees metrics that are up and to the right, but that he sees the same metrics that the founder is looking at every single day.

“You want CEOs who understand what’s going on,” said Somasegar. “They understand the nitty-gritty details of what is going on, what is important, and are able to stay on top of that day in and day out. A founder’s selection of KPIs offers an indication for us of what that is for each business.”

Both Mehrotra and Somasegar explained that metrics increase in significance as a company grows. In other words, early-stage companies should think less about the numbers themselves and focus more on conveying why certain metrics are the ones that they’re looking at every day.

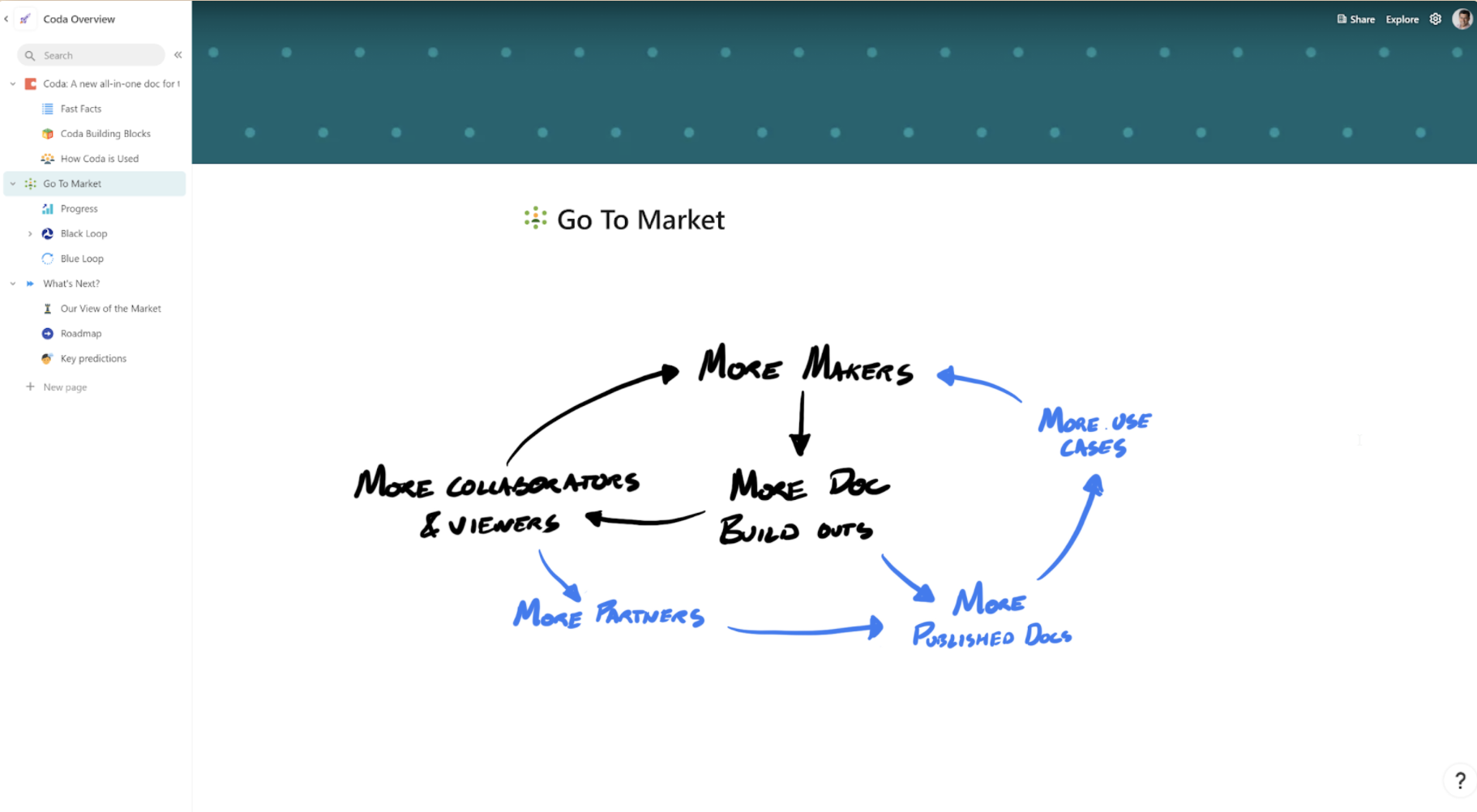

One of the reasons that Mehrotra’s metrics were so compelling to investors is the growth flywheel that Coda had established. Mehrotra calls them the black loop and the blue loop.

The black loop is what you’d expect from a doc: It is essentially a representation of how the software spreads through an organization or team. Someone creates a doc, distributes it to others, who become viewers or editors. Over time, that person goes to create their own doc and chooses Coda. They go on to share that doc with new people, and the loop continues.

“I sometimes refer to this loop as the Office loop or the Google Docs loop,” said Mehrotra. “It’s sort of the endemic virality that comes from documents in that the two core viral actions are to share a doc and to create a doc. And once you get that loop started, it moves very, very fast.”

The blue loop is different in that, instead of someone sharing a doc within an organization, they share it with the world. Companies or people will publish documents on Coda as easily as they can share them within an organization.

Mehrotra likens it to publishing a video on YouTube, which is where he worked before Coda. He said the emotion of publishing a doc is similar to publishing a YouTube video, and that the reasons people do it are all different.

Some folks do it to generate leads, or share an idea, or for monetary incentives, or for community or social reasons. But whatever the reason, it’s the primary way that people find Coda.

“The dominant way that new users come to the platform is through these documents around the internet,” said Mehrotra. “And they don’t even realize it’s Coda until they get through to the inside of it, and hit copy, and they turn into new makers. These two loops feed each other, and these loops are the anchors of how I talk about the business.”

Coda Investor Doc by Jordan Crook on Scribd

Mehrotra and Somasegar discussed a number of other topics on the episode, such as how they work together in their founder/investor relationship and how they think about pricing and packaging products. You can check out the full conversation, and the ECL Pitch-off, in the video below.