Bitcoin: The Derivative Bomb

Bitcoin trading is now dominated by highly leveraged derivatives positions, eclipsing the spot market. We owe this trend to big institutions. A particular kind of «institutional adoption».

BTCUSD Perpetual Swap. That is the name of the most popular derivative contract traded on bitcoin, with a leverage factor of up to 125x. Derivatives markets are the place where the bitcoin action happens. They now lead bitcoin notional trading volumes and dominate spot markets. The largest crypto derivatives exchanges are Binance, Huobi, OKEx, BitMEX. Toghether they control 71% of the market, measured in terms of open interest and volume. The majority of bitcoin futures are traded using high leverage, which amplifies price movements.

Understanding how derivatives now control the market provides some cues about the recent correction. Bitcoin lost 24% within a few hours, between January 10 and 11. The question is what made the bitcoin price drop so abruptly. We could argue that, by drawing so much attention, bitcoin and other cryptocurrencies became the target of regulators. On January 11, a UK financial regulator warned that consumers investing in cryptocurrencies should «be prepared to lose all their money». Another threat came from a new US Treasury rule that plans to require custodians and exchanges to collect anti-money laundering information.

The derivates market is the most important driver

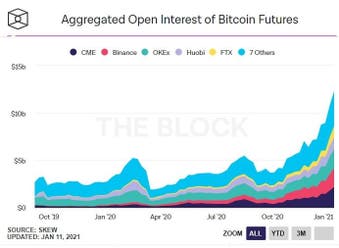

But the most important price driver is the derivatives market and its highly leveraged positions, creating huge instability. The volume of trading in bitcoin through futures contracts has been skyrocketting. As of January 10, there was about 13 billion dollars in open futures contracts betting on BTC price, an all-time record.

«CME Bitcoin futures have surpassed $100 billion in total notional value traded since their launch in December 2017», according to the CME Group. Since 2017, the Chicago Mercantile Exchange (CME) and other derivatives exchanges (BitMEX, OKEx, Huobi) have become the main gateway for big institutional investors to play with the bitcoin price. It is rarely acknowledged that the lion’s share of institutional trading in bitcoin is being done without owning any single bitcoin. As it happens, many institutional and retail traders that have inflated the price of bitcoin prefer trading its futures contracts, rather than directly buying it, holding it and experimenting the blockchain. They are happy with betting on the price through futures contracts that settle in cash.

The effect of the derivative market on the underlying spot market is huge. Already in 2017, when trading in bitcoin derivatives started on regulated exchanges (CME), unprecedented price movements happened, while a huge spike in the value of outstanding derivative contracts blew up bitcoin's volatility.

Derivative vs. spot

According to a study by the Blockchain Lab of Massachusetts Institute of Technology, «the derivative market leads price discovery of bitcoin more frequently than the spot markets. The spot market is more likely to indicate the direction of the price movement while the derivatives market is more likely to lead the magnitude of the price movement», says the report.

Derivative strategies abound. One basic game consists in pumping your way up – with leverage – and shorting your way out on a regular basis to make short-term profits. That was routine during this December-January bubble. Experts on Coindesk described how sophisticated investors such as hedge funds have been looking at capturing spreads by exploiting price inefficiencies. This is done with leveraged funds investing in CME bitcoin futures, that «made new record shorts almost on a weekly basis in the last quarter of 2020».

Those trades entertain a speculative relationship with bitcoin that cannot exactly be called «institutional adoption». Here, the famous expression «not your keys, not your coins», so essential to the crypto ownership philosophy, is a remote concept. When you trade bitcoin derivatives, it could as well be refrigerators. Speculators might be interested in the fundamentals of bitcoin, but they can get away with focusing on sheer price movements and margins. These kinds of trades, playing with volatility, capturing spreads, follow pure finance strategies that relate more to deltas and gammas, than to blockchains and private keys.

The bitcoin derivative boom was encouraged by the fact that you can get 2 to 3 times leverage on the CME, and more than 100 x leverage on native crypto derivative exchanges. The derivatives market will eventually grow bigger than the spot market, the director of financial markets at OKEx, Lennix Lai, was quoted saying last March (Coinslate), as the last bubble was starting: «I won’t be surprised if the derivatives space will be 5 or 10 times bigger than spot markets in less than two or three years». This is what happened in the equities markets. Over the past 17 years, global equity futures have grown at nearly 2 times the rate of the spot market for equities.

The same trend is going on in the crypto space. In 2020, the ratio between bitcoin futures and spot volumes has increased from 2,3 to 4,6 in 2019, according to an October report by Kraken, indicating that the futures volume is outpacing the spot volume. «Since 2018, derivatives have completely replaced spot as the dominant market», says the Kraken report.

«The growth in derivatives volumes is stark in contrast with that of spot volumes», according to the report. Spot crypto trading has declined since the height of the industry's last euphoric bull market, while derivatives trading has taken the spotlight: «From Q2 2017 to Q1 2018, spot volume rose sharply from a low of roughly $ 58 billion to a high of $ 570 billion, before dropping off significantly to a low of $104 billion nearly two years later. Since then, derivatives have completely replaced spot as the dominant market, while spot volumes have failed to make a full recovery. Derivatives notional volume exploded from below $ 6 billion in Q2 2017 to over $ 1700 billion by Q3 2020.»

Regulated vs. Unregulated exchanges

According to Kraken, most of the volumes go through the unregulated crypto exchanges, operating offshore, with agressive offerings and high leverage: they require as little as a 1% initial margin on their contracts, versus 40% for regulated platforms like the CME. And, with all the talk about anti-money laundering regulations in the UK and the US, the reality is that those unregulated platforms largely escape constraints and have loose know your customer measures. Because of these lax rules, the unregulated market notional volumes are at least 40 times greater than those of the regulated derivatives market.

As we have explained before, cheap credit is favoring this speculative boom. We are seeing unprecedented liquidity. It is hard to believe that 30% of the US dollars issued in the entire history of that currency were created between March 2020 and December 2020. And it is hard not to see a direct cause for the doubling of the bitcoin price in 2 weeks, helped by the derivative market credit, where you can borrow money dirt cheap, and buy at a high leverage - with money you don't own - assets you don't own. The Kraken report warns of the dangers of having derivatives markets dominate spot markets. «This can create a vicious circle, where sell-offs in derivatives markets lead price declines in spot markets, and thereafter create further liquidation risks in derivatives markets, which rely on spot index pricing».

Beware of cascades of liquidations

Derivatives markets are the most fragile in times of correction, triggering a cascade of liquidations, as was seen on March 12, 2020 («Black Thursday») when several funds had to close shop. At that time, several billion dollars worth of outstanding derivative contracts had to be marked-to-market in real time (real-time margining) and rapidly liquidated in the midst of free-falling spot prices, with only tens of millions of dollars of liquidity. That happens because liquidity on the crypto spot exchanges is much smaller than the open interest on derivative markets, and couldn’t possibly cover this amount of risk. It is exactly the same type of systemic risks and collateral failure we’ve seen in 2008 in the derivative subprime real estate market.

Bitcoin was supposed to be the ultimate ownership security guarantor; derivatives made it a fickle borrowed speculative delta.

Myret Zaki