By JONATHAN WEISMAN And DAMIAN PALETTA

Republicans on Capitol Hill responded with hostility Tuesday to a White House proposal to allow cash-strapped states to raise unemployment-insurance taxes. But in some states struggling with rising debt and empty coffers, officials said the plan should be considered.

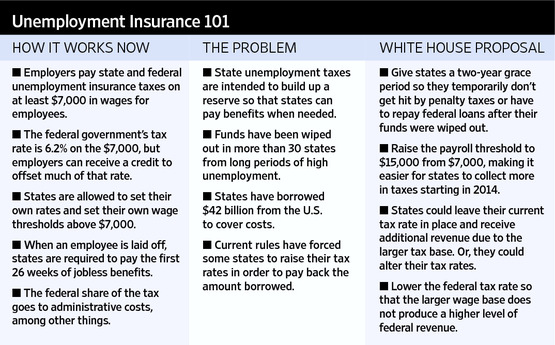

Administration officials say the proposal, to be included in President Barack Obama's budget plan for the next fiscal year, is intended to help states that so far have borrowed $42.4 billion from the federal government to keep benefits flowing after exhausting the reserves used to pay unemployment benefits.

Some of those 31 states have borrowed so heavily, and repaid the loans so slowly, that they triggered automatic tax increases designed to reimburse the federal government.

Already, employers in three states—Michigan, Indiana and South Carolina—are paying higher federal unemployment taxes because of state debts to Washington. More than half the states could be hit by the end of the year.

It is unclear whether trade groups and state GOP leaders will favor the deal and pressure congressional Republicans at least to negotiate over the plan, especially as employers in more states incur penalty taxes. An Obama administration economist said those rising taxes would feel like "a gun to the head" of employers in those states.

Mr. Obama's plan would waive penalties and interest payments owed to Washington for two years, as states try to shore up the finances of their strained unemployment programs.

Then, in 2014, under the proposal, the federal government would more than double the amount of a worker's income subject to unemployment taxes paid by employers, from $7,000 a year to $15,000.

The Nation's Unemployed

See state-by-state unemployment rates, dating back to the end of the recent recession.

States in the Red

See state-by-state details on tax revenue shortfalls and budget gaps.

Under current rules, states would be forced to raise their own wage caps to at least the same level, which could produce more revenues. However, states could adjust the level of new income by altering their tax rates.

Washington would lower its 6.2% unemployment tax rate so that total federal tax revenues wouldn't change.

"This policy, if enacted, would prevent further federal tax increases, would help states make up for shortfalls and give them time to rationalize what they offer and how they pay for it," said White House press secretary Robert Gibbs.

On Tuesday, Republicans in Congress criticized the proposal as a tax hike.

"We need to reform our unemployment programs, but any plan that relies on more than doubling the tax base and then raising payroll taxes in perpetuity isn't going anywhere in the House," said Rep. Dave Camp (R., Mich.), chairman of the House Ways and Means Committee.

Sen. Orrin Hatch of Utah, the ranking Republican on the Senate Finance Committee, said the Democratic-backed stimulus law already has expanded eligibility for unemployment. Now, he said, the White House is moving to impose tax hikes on employers to pay for it. "I strongly urge the White House to reconsider this job-destroying proposal," Mr. Hatch said.

For many states, the deal is worth discussing, said Patrick Kiely, president of the Indiana Manufacturers Association. Indiana imposed a tax increase and slight benefit cut this month to deal with its more than $2 billion in debt to the federal government. An additional surcharge on new hires was put into effect to pay the interest on that debt.

"We would look very positively on a two-year delay on those interest payments," Mr. Kiely said. "That's about a $339 million savings to employers."

In California, which owes the federal government almost $10 billion, Gov. Jerry Brown reacted favorably.

"Anything less that we have to spend is helpful, because we are already $25 billion in the red," Mr. Brown told reporters in Sacramento on Tuesday. "If the president can delay the unemployment funds that we are supposed to pay, then great."

Mark Wilson, a principal at Applied Economic Strategies and a former Bush administration Labor Department official, estimated that annual employer taxes would increase by an average of $183 per worker under the Obama proposal. At a plant of 500, that would total $91,500, effectively two full-time positions.

"This is a tax on labor," said Bill Rys, tax counsel for the National Federation of Independent Business, the small-business lobby. "It's a tax increase that you know is somewhere down the line, whether it's today or tomorrow."

Officials in states that have kept their unemployment insurance funds solvent also bristled, not at the tax inducements but at the grace period on repaying debts to the federal government.

Laurie Warner, director of the Oregon Employment Department, said that indebted states are being rewarded while states like hers that have raised taxes to stay solvent are getting nothing.

Paul Trause, employment security commissioner for Washington State, said, "The current proposal provides no recognition or reward for the employers in our state that have paid higher taxes for a number of years to ensure that our trust fund remains solvent during tough economic times."

—John D. McKinnon and Vauhini Vara contributed to this article.Write to Jonathan Weisman at jonathan.weisman@wsj.com and Damian Paletta at damian.paletta@wsj.com

![[SUBSTATES]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/OB-MK971_SUBSTA_D_20110209011631.jpg)

![[pjharvey]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/ED-AN059_pjharv_C_20110214160321.jpg)

![[SP_SPORTSTALK]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/PJ-AZ379A_SP_SP_C_20110214165352.jpg)

![[workout1]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/PJ-AZ390A_worko_C_20110214165445.jpg)

![[BARBIE6]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/NY-AU066_BARBIE_C_20110214174036.jpg)

![[0214vday05]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/OB-MN504_0214vd_C_20110213211142.jpg)

![[0213iphone]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/OB-MN384_0213ip_C_20110213143753.jpg)

![[MK-BJ843_SP_FEA_C_20110213181400.jpg]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/MK-BJ843_SP_FEA_C_20110213181400.jpg)

![[PF-AA183_smvale_C_20110211165739.jpg]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/PF-AA183_smvale_C_20110211165739.jpg)

![[NY-AT372_ASSESS_C_20110201184608.jpg]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/NY-AT372_ASSESS_C_20110201184608.jpg)

![[0211whoopie14]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/OB-MN111_0211wh_C_20110211191036.jpg)

![[OB-MN753_dog021_C_20110214110554.jpg]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/OB-MN753_dog021_C_20110214110554.jpg)

![[DETSCHOOL1]](https://web.archive.org/web/20110215130107im_/http://si.wsj.net/public/resources/images/NA-BK283_DETSCH_C_20110213181759.jpg)

Most Recommended

“He stated the mandate 'was not a...;”

“Hey Barack,

If you read...;”

“The U.S. should go back to being...;”

“A few days after taking office,...;”

“I do not believe that Obama is...;”