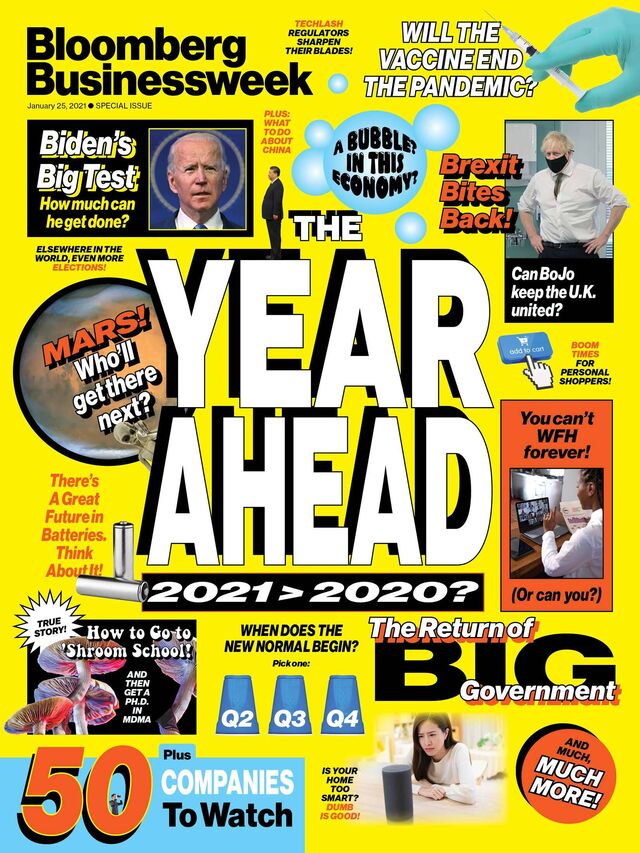

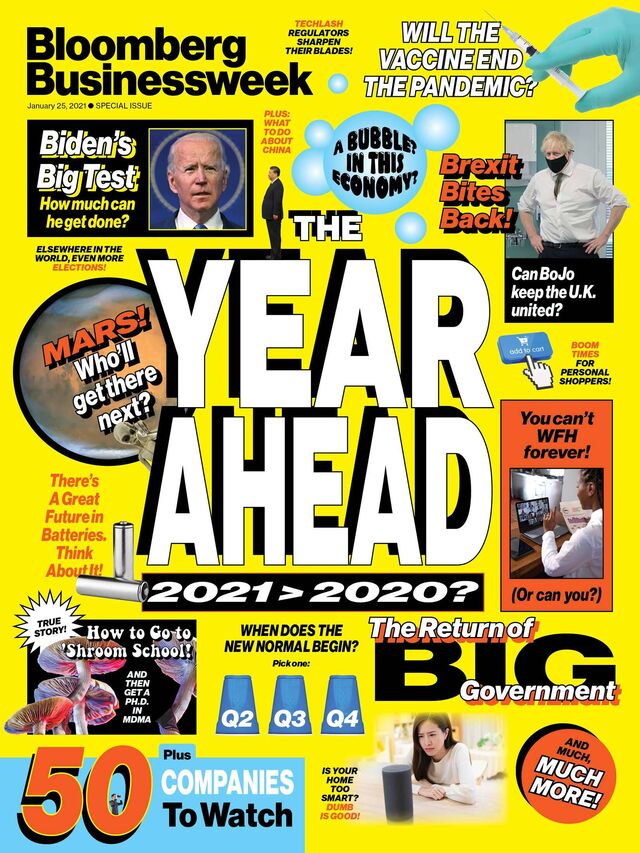

50

Companies

to Watch

The analysts at Bloomberg Intelligence—who track about 2,000 companies in fields including finance, retail, energy, and technology—have identified 50 worth watching carefully in the year ahead. When building the list, the analysts considered factors including company size and growth opportunities, management changes, scheduled releases of noteworthy products and services, and, of course, the impact of the Covid-19 pandemic and other sweeping economic forces.

Consumer Staples

AB InBev

Market value (USD)

$139.4B

3-year annualized total return

-13.83%

12-month sales (USD)

$47.1B

Sales growth, 2019

-1%

Female board membership

33%

CEO

Carlos Alves de Brito

Anheuser-Busch InBev SA remains dogged by the $85 billion in net debt it accrued in an acquisition binge of smaller rivals over the past decade. But the brewing giant has managed obligations well, paying only 4% interest on its loans to 2033, and it’s focused on maximizing the profitability of existing assets. —Duncan Fox

Materials

Albemarle

Market value (USD)

$18.9B

3-year annualized total return

12.06%

12-month sales (USD)

$3.2B

Sales growth, 2019

6%

Female board membership

23%

CEO

J. Kent Masters

As a leading supplier of lithium—a key ingredient in batteries—Albemarle Corp. will benefit from surging investment in electric vehicles, which will likely triple demand for the mineral by 2025. The company already controls about 30% of a market worth more than $3 billion annually, and in 2021 it will wrap up multiyear expansion projects in Australia and Chile, setting the stage for profitable growth over the next decade. As the pandemic tapers off, prices are bound to recover and supply-chain disruptions should dissipate. Albemarle’s long-term contracts mean the company is on course to reap substantial benefits in 2022 and beyond. It can tap its ample resources in the U.S. and Australia as demand accelerates, while redirecting cash generated by its units that make bromine (found in flame retardants and tires) and refinery catalysts (used to transform crude oil into fuels and plastics) toward higher-return lithium projects. —Christopher Perrella

Health Care

Alibaba Health

Market value (USD)

$39.5B

3-year annualized total return

78.41%

12-month sales (USD)

$1.8B

Sales growth, 2019

88%

Female board membership

13%

CEO

Zhu Shunyan

The health arm of Chinese tech giant Alibaba is well positioned to dominate online drug sales in China. The country’s push to separate drug dispensaries from hospitals and improve reimbursements will unlock major potential in a market projected to expand at least 30% a year through 2024. —Nikkie Lu

Financials

Aon

Market value (USD)

$46.2B

3-year annualized total return

15.17%

12-month sales (USD)

$11B

Sales growth, 2019

2%

Female board membership

27%

CEO

Gregory “Greg” Case

Aon Plc should be able to endure an antitrust probe of its deal to acquire rival Willis Towers Watson Plc, creating the world’s largest insurance broker. Profit margins at the combined company stand to benefit from Aon’s own operational improvements and cost-cutting acumen. —Matthew Palazola

Materials

ArcelorMittal

Market value (USD)

$27.3B

3-year annualized total return

-12.30%

12-month sales (USD)

$54.6B

Sales growth, 2019

-7%

Female board membership

33%

CEO

Lakshmi Mittal

Increasing numbers of steel-intensive wind turbines make ArcelorMittal SA one of the more intriguing 2021 plays on the European Green Deal. A cleaner balance sheet after debt reduction and the divestiture of low-margin, high-carbon-emitting U.S. assets should improve the Luxembourg-based steelmaker’s cash returns and stabilize its dividend. —Grant Sporre

Industrials

Boeing

Market value (USD)

$116.7B

3-year annualized total return

-13.32%

12-month sales (USD)

$60.8B

Sales growth, 2019

-24%

Female board membership

31%

CEO

David “Dave” Calhoun

Recertification of Boeing’s 737 Max sets the stage for better profits in 2021 as the company begins to deliver its 450 waiting Maxes and production rates rise. Orders will be weak at first, but increased air travel driven by Covid vaccinations should improve demand for more planes. —George Ferguson

Financials

Capitec

Market value (USD)

$10.6B

3-year annualized total return

12.90%

12-month sales (USD)

$1.9B

Sales growth, 2019

15%

Female board membership

9%

CEO

Gerhardus “Gerrie” Metselaar Fourie

Founded in 2001, Capitec Bank Holdings Ltd. has led a low-cost, high-growth assault on the South African banking system with innovations such as its all-inclusive, technologically advanced Global One platform. Like its global peers, Capitec grappled with rising bad debts in 2020 as the pandemic hit household income. But its profitability is poised to bounce back as the bank wins new markets, namely business lending. The 2019 acquisition of Mercantile Bank, a specialist in business banking, is helping the company to replicate its retail successes in small-business loans and rapidly gain market share. As a relative newcomer, Capitec has a nimble, custom-built branch network and isn’t saddled with outdated systems and an expensive head office, giving it a significant cost advantage over FirstRand, Standard Bank, and other large rivals. Capitec uses that edge to pursue a high-growth strategy through discount pricing, positioning it to outperform peers on revenue, cost-to-income ratios, and earnings. New insurance products, such as funeral finance, and a focus on higher-income customers through discounted pricing complement Capitec’s growth opportunities. —Philip Richards

Industrials

Cathay Pacific

Market value (USD)

$6B

3-year annualized total return

-12.36%

12-month sales (USD)

$10.4B

Sales growth, 2019

-4%

Female board membership

6%

CEO

Tang “Augustus” Kin Wing

Sure, air travel is likely to rebound now that vaccines are becoming available, but Cathay Pacific Airways Ltd.’s heavy reliance on premium corporate traffic makes it a riskier 2021 story than other Asian carriers. A full international-flight recovery isn’t expected until 2024, and the continuing political turmoil in Hong Kong has made the carrier’s hub a less attractive destination. —James Teo

Industrials

Central Japan Railway

Market value (USD)

$28.3B

3-year annualized total return

-11.18%

12-month sales (USD)

$11.4B

Sales growth, 2019

-2%

Female board membership

N/A

CEO

Shin Kaneko

With business travelers increasingly accustomed to virtual meetings, social distancing will remain a threat to Central Japan Railway Co. even as the Covid pandemic eases. Weaker passenger flow between Nagoya, Osaka, and Tokyo could cap the recovery for its mainstay Tokaido bullet train and cloud the outlook for its 9 trillion-yen ($87 billion) Chuo Maglev rail project. —Denise Wong

Health Care

Chi-Med

Market value (USD)

$5.3B

3-year annualized total return

-2.73%

12-month sales (USD)

$0.2B

Sales growth, 2019

-4%

Female board membership

20%

CEO

Christian Hogg

Hutchison China MediTech Ltd.’s ambitions for oncology are gaining momentum with a growing portfolio of cancer treatments. Colorectal cancer drug Elunate has already been added to China’s national reimbursement listing, and two more drugs, one for neuroendocrine tumors and the other for lung cancer, are poised for 2021 launches. A planned Hong Kong IPO would strengthen Chi-Med’s balance sheet and capital access. —Cinney Zhang

Consumer Staples

China Feihe

Market value (USD)

$25.8B

3-year annualized total return

N/A

12-month sales (USD)

$2.4B

Sales growth, 2019

32%

Female board membership

N/A

CEO

Leng Youbin

Upscale products, sprawling distribution, and stable sourcing of high-quality raw milk are propelling China Feihe Ltd., already the nation’s leading seller of infant formula, toward its goal of winning 30% of that market by 2023. The coronavirus pandemic has helped Feihe capitalize on Chinese consumers’ embrace of domestic brands over those of Danone, Nestlé, and other foreign rivals. —Kevin Kim

Consumer Discretionary

China Tourism Group Duty Free

Market value (USD)

$96.3B

3-year annualized total return

91.87%

12-month sales (USD)

$6.8B

Sales growth, 2019

2%

Female board membership

17%

CEO

Chen Guoqiang

With 90% of China’s duty-free retail sales, China Tourism Group Duty Free Corp. offers investors a chance to tap into the rapid growth of travel and tourism in the country. It holds licenses for stores at airports, border crossings, and downtown locations, giving it a strong position as the government seeks to encourage citizens to buy luxury goods at home rather than on vacation. Hainan, an island in southern China, is CTG’s top profit generator; the popularity of the booming duty-free shopping destination has only increased during the pandemic, as it’s been harder for mainlanders to travel abroad. China in July more than tripled the annual duty-free shopping quota for visitors to Hainan, to 100,000 yuan ($15,289) per person. A duty-free limit of 8,000 yuan for any single product was also removed, which should boost sales of high-margin luxury goods. In the Hainan city of Sanya, the world’s largest duty-free shopping mall is also poised to benefit CTG after its owners doubled its size and added museums, restaurants, and other leisure offerings, lengthening the time visitors typically spend there. —Angela Hanlee

TMT

Cisco Systems

Market value (USD)

$191.7B

3-year annualized total return

6.82%

12-month sales (USD)

$48.1B

Sales growth, 2019

-5%

Female board membership

20%

CEO

Charles “Chuck” Robbins

Years spent beefing up its software have positioned Cisco Systems Inc. to capitalize on the migration to next-generation networks and to weather the changing dynamics of the corporate office. Broader acceptance of flexible workplaces increases the allure of the company's WebEx Collaboration, Wi-Fi, and remote access connectivity and security tools. —Woo Jin Ho

Industrials

CNH Industrial

Market value (USD)

$18.3B

3-year annualized total return

-2.21%

12-month sales (USD)

$25.2B

Sales growth, 2019

-5%

Female board membership

33%

CEO

Scott Wine

After last year’s surprise executive departures at the industrial-equipment conglomerate CNH Industrial NV, Wine must navigate the company’s breakup, starting with the spinoff of its commercial & specialty vehicles and powertrain segments. —Christopher Ciolino

Financials

Credicorp

Market value (USD)

$15.6B

3-year annualized total return

-5.76%

12-month sales (USD)

$5.5B

Sales growth, 2019

10%

Female board membership

13%

CEO

Walter Bayly Llona

Progress on Covid vaccines makes midyear profits look probable for Peru’s largest financial holding company. Credicorp Ltd. is likely to benefit significantly from the most aggressive government stimulus underway in Latin America, as well as an expected GDP increase of 8% to 10%. —Nathan Dean

TMT

CrowdStrike

Market value (USD)

$51.4B

3-year annualized total return

N/A

12-month sales (USD)

$0.8B

Sales growth, 2019

93%

Female board membership

11%

CEO

George Kurtz

Momentum for CrowdStrike Holdings Inc. in the cloud security business is building as it adds customers and sells existing clients on new products. While Cisco, Palo Alto, and other peers are trying to catch up with acquisitions, CrowdStrike remains an investor favorite thanks to its broad product offerings and ease of deployment. —Mandeep Singh

Consumer Staples

Delivery Hero

Market value (USD)

$33.5B

3-year annualized total return

60.17%

12-month sales (USD)

$1.9B

Sales growth, 2019

86%

Female board membership

33%

CEO

Niklas Oestberg

Delivery Hero SE’s acquisition of South Korean online food delivery leader Woowa, expected to close in early 2021, will further consolidate the sector and fulfill the company’s ambition to expand beyond meals and groceries into delivering merchandise and ingredients. That should enhance Delivery Hero’s appeal to restaurants vs. rivals such as Just Eat Takeaway. —Diana Gomes

Financials

Deutsche Wohnen

Market value (USD)

$18.2B

3-year annualized total return

7%

12-month sales (USD)

$1.7B

Sales growth, 2019

17%

Female board membership

N/A

CEO

Michael Zahn

After Berlin imposed a five-year rent freeze in February 2020, many shareholders soured on Deutsche Wohnen SE, Germany’s No. 2 residential property owner. But Berlin property owners have turned to judges in an effort to overturn the law, and the country’s high court is expected to render a ruling in the second quarter. A favorable decision could restore confidence in Berlin’s home-rental market and the value of the company’s properties. —Iwona Hovenko

Energy/Utilities

Energy Transfer

Market value (USD)

$18.4B

3-year annualized total return

-19%

12-month sales (USD)

$42.6B

Sales growth, 2019

N/A

Female board membership

N/A

CEO

Mackie McCrea & Tom Long

With capital markets closed to high-debt oil and gas pipeline operators, Energy Transfer LP is at a crossroads between aggressive growth plans and dividend cuts. The controversial Dakota Access Pipeline faces renewed legal challenges, and investors remain at odds over majority holder Kelcy Warren’s reluctance to abandon ET’s partnership structure. —Michael Kay

Financials

ESR Cayman

Market value (USD)

$10.7B

3-year annualized total return

N/A

12-month sales (USD)

$0.4B

Sales growth, 2019

41%

Female board membership

N/A

CEO

Stuart Gibson & Jinchu “Jeffrey” Shen

Asia’s leading warehouse developer has aggressively bought properties in China, Japan, and South Korea in recent years, putting ESR Cayman Ltd. in a strong position as e-commerce companies bulk up and need distribution infrastructure. The company’s business managing those assets provides income stability even if demand for new development slackens. —Mohsen Crofts

Consumer Discretionary

EssilorLuxottica

Market value (USD)

$69.1B

3-year annualized total return

6.10%

12-month sales (USD)

$16.4B

Sales growth, 2019

61%

Female board membership

44%

CEO

Francesco Milleri

The eyeglass giant recently settled on Francesco Milleri to be its single interim CEO, easing one of the biggest problems dating from the 2018 merger that created EssilorLuxottica SA. But he’ll hold the job only until May, when the company needs a permanent CEO to help it integrate faster and overcome legal and regulatory hurdles for its €7 billion-plus ($8.5 billion) bid for optical retailer GrandVision. —Diana Gomes

Industrials

GFL Environmental

Market value (USD)

$9.6B

3-year annualized total return

N/A

12-month sales (USD)

$2.9B

Sales growth, 2019

81%

Female board membership

N/A

CEO

Patrick Dovigi

GFL Environmental Inc.’s rapid expansion—it’s now the fourth-largest North American waste company—shows no sign of slowing. The company has leveraged itself to acquire more businesses, but if it can integrate them properly, it can expect growth of 30% or more. —Scott Levine

Materials

Graphic Packaging

Market value (USD)

$4.9B

3-year annualized total return

5%

12-month sales (USD)

$6.4B

Sales growth, 2019

2%

Female board membership

22%

CEO

Michael Doss

Graphic Packaging Holding Co. is one of the big winners so far in the shift away from plastic packaging toward more ecologically friendly paperboard. Investors are also on the brink of benefiting from gains in productivity, resulting largely from capital projects. —Joshua Zaret

Consumer Staples

Henkel

Market value (USD)

$44.3B

3-year annualized total return

-5.68%

12-month sales (USD)

N/A

Sales growth, 2019

1%

Female board membership

38%

CEO

Carsten Knobel

Better known for home- and personal-care goods, Henkel AG also has a dominant 25% market share in industrial adhesives. Its expertise in the field puts it at the center of the green-products revolution. The company’s adhesives are optimal for recyclable packaging, more efficient batteries, and lighter car and jet bodies. —Duncan Fox

Health Care

Intercept Pharmaceuticals

Market value (USD)

$1B

3-year annualized total return

-17.28%

12-month sales (USD)

$0.3B

Sales growth, 2019

40%

Female board membership

10%

CEO

Jerome “Jerry” Durso

In 2020, Intercept Pharmaceuticals Inc. suffered from the surprise rejection by the U.S. Food and Drug Administration of its front-running treatment for a liver condition called nonalcoholic steatohepatitis. The drug's best-case scenario calls for resubmission in 2021. Approval this year would still leave the company well-positioned to build a sizable lead in this area of high unmet medical need. —Michael Shah

Financials

Intercontinental Exchange

Market value (USD)

$66B

3-year annualized total return

18.1

12-month sales (USD)

$5.7B

Sales growth, 2019

4%

Female board membership

27%

CEO

Jeffrey Sprecher

Intercontinental Exchange Inc.’s ability to digitize markets, including mortgages and fixed-income trading, sustains its growth. Its next expansion, into data and analytics, should offer a steadier revenue stream that’s less dependent on commissions. —Paul Gulberg

Consumer Staples

Kroger

Market value (USD)

$24.2B

3-year annualized total return

6.77%

12-month sales (USD)

$130.7B

Sales growth, 2019

N/A

Female board membership

33%

CEO

W. Rodney McMullen

An exclusive partnership with British online grocer Ocado Group will let Kroger Co., the largest traditional supermarket chain in the U.S., profitably accelerate e-commerce sales. Kroger will open the first of its Ocado-branded automated fulfillment centers this year, and it has the right to operate as many as 20 such facilities. Access to Ocado’s technology should help Kroger expand its market share and digital capabilities while reducing costs. Fulfilling orders using the system is faster than putting them together in stores, and they typically require fewer substitutions, making each transaction more profitable. The rapid expansion of online grocery ordering and repeat usage means these centers are likely to generate sufficient volume to quickly ramp up operations. The Ocado facilities can also help Kroger manage inventory in its physical locations, especially for slow-selling items, resulting in more productive and better-stocked stores. Kroger has focused on keeping prices low, advertised the strength of its fresh-food business, expanded its personalization capabilities, and improved the customer experience, all of which should aid loyalty and sales. Recent forays into media and personal finance could further pad its revenue growth. —Jennifer Bartashus

Materials

LG Chem

Market value (USD)

$61.8B

3-year annualized total return

32.20%

12-month sales (USD)

$24.3B

Sales growth, 2019

2%

Female board membership

N/A

CEO

Shin Hak-Cheol

LG Chem Ltd. is on the verge of becoming the top global battery producer, with segment revenue projected to climb an average of 30% annually through 2023. A deal to supply Tesla Inc.’s Model Y should boost profits, offsetting the costs of recent battery recalls. —Horace Chan

Financials

Link REIT

Market value (USD)

$18.8B

3-year annualized total return

3.55%

12-month sales (USD)

$1.4B

Sales growth, 2019

7%

Female board membership

33%

CEO

Hongchoy “George” Kwok Lung

Asia’s largest REIT is burdened with a portfolio that, though vast and lucrative, is focused almost exclusively on increasingly unstable Hong Kong. In 2020, Link’s asset managers bought properties in London and Sydney, and the business has almost $2 billion more to put to work overseas. Its ultimate goal is to invest 10% of its capital outside mainland China. —Patrick Wong

Energy/Utilities

NextEra Energy

Market value (USD)

$156.1B

3-year annualized total return

31.81%

12-month sales (USD)

$18.2B

Sales growth, 2019

15%

Female board membership

23%

CEO

James “Jim” Robo

NextEra Energy Inc., the dominant U.S. generator of wind and solar power, is better positioned to grow than its competitors, especially in Florida. It would also stand to benefit from a less-sure thing: infrastructure support from the Biden administration. —Kit Konolige

TMT

Nintendo

Market value (USD)

$84.1B

3-year annualized total return

17.10%

12-month sales (USD)

$15.2B

Sales growth, 2019

9%

Female board membership

11%

CEO

Shuntaro Furukawa

On track to release a new version of its Switch gaming system, Nintendo Co. is poised to beat the revenue consensus for the fiscal year ending March 2022. Homegrown titles such as a new Zelda and possible ultra-high-definition remasters of other Switch games will likely drive adoption of the new hardware. —Matthew Kanterman

TMT

PayPal

Market value (USD)

$278.3B

3-year annualized total return

42.91%

12-month sales (USD)

$20.3B

Sales growth, 2019

15%

Female board membership

33%

CEO

Daniel “Dan” Schulman

Soon the wallet you reach for will be digital and likely built by PayPal Holdings Inc., the market leader by far. The use of digital wallets accelerated along with e-commerce and demand for contactless payments during the pandemic. PayPal can sustain 20%-plus growth as it takes its secure online wallet into stores and adds bill pay, QR code payments, and other financial services. —Julie Chariell

Energy/Utilities

Petrobras

Market value (USD)

$73.9B

3-year annualized total return

24.67%

12-month sales (USD)

$58.7B

Sales growth, 2019

-3%

Female board membership

30%

CEO

Roberto da Cunha Castello Branco

Petróleo Brasileiro SA could capture market share from OPEC+ and U.S. shale producers as the Brazilian company invests through the downturn. Asset sales reduced its leverage and helped leave it better equipped to grow in a potential recovery than most European and U.S. peers. —Fernando Valle

Financials

PNC Financial Services

Market value (USD)

$67.5B

3-year annualized total return

5.51%

12-month sales (USD)

$19.5B

Sales growth, 2019

8%

Female board membership

31%

CEO

William Demchak

PNC Financial Services Group Inc. operates from a position of strength after the sale of its stake in BlackRock Inc. It now has the capital to weather an uneven economic recovery and use M&A to become one of the five biggest U.S. banks. Its deal for BBVA USA is a big step in that direction, expanding its operations into Texas and elsewhere in the Sun Belt. —Herman Chan

Energy/Utilities

Repsol

Market value (USD)

$16.8B

3-year annualized total return

-12%

12-month sales (USD)

$41.4B

Sales growth, 2019

-1%

Female board membership

33%

CEO

Josu Jon Imaz San Miguel

The pandemic has punished Repsol SA, but the Spanish oil company stands to benefit in 2021 from gradual recoveries in crude pricing and fuel demand. With its early embrace of sustainability and a goal of reaching net zero carbon emissions by 2050, Repsol has the industry’s most ambitious emissions targets. —Salih Yilmaz

Financials

Rocket Companies

Market value (USD)

$39.4B

3-year annualized total return

N/A

12-month sales (USD)

$5.3B

Sales growth, 2019

22%

Female board membership

43%

CEO

Jay Farner

Rocket Companies Inc.’s technological edge and huge spending on client acquisition are distinct advantages in the fragmented U.S. market for mortgage origination. The company will have to stay on its toes to guard against its rivals, however, because ultralow interest rates continue to make it much easier to catch up. —Ben Elliott

TMT

Safaricom

Market value (USD)

$12.6B

3-year annualized total return

13.11

12-month sales (USD)

$2.5B

Sales growth, 2019

5%

Female board membership

33%

CEO

Peter Ndegwa

Suspending fees for small mobile money transfers through its M-Pesa service as a pandemic-relief measure may have been a blessing in disguise for Safaricom Plc, Kenya’s No. 1 cellphone carrier and an innovator in virtual banking. The move turned more consumers on to the benefits of mobile finance and could result in significant gains for M-Pesa, which generates a third of the company’s operating profit. —John Davies

Materials

Saint-Gobain

Market value (USD)

$27.9B

3-year annualized total return

-1.29%

12-month sales (USD)

$42.7B

Sales growth, 2019

2%

Female board membership

43%

CEO

Pierre-André de Chalendar

The French maker of construction materials has the financial heft and environment-friendly products to capitalize on the global movement toward carbon-neutral buildings. The company’s two-year “Transform & Grow” program, completed in 2020, simplified its business model and should boost the profitability of a giant that operates in almost 70 countries but has underperformed smaller, nimbler peers. Compagnie de Saint-Gobain ranks No. 1 globally in the renovation industry, which is underpinned by energy efficiency mandates and tax incentives in many countries. The European Union is especially prominent in promoting the adaptation of existing buildings as part of the European Green Deal and a post-pandemic economic recovery. Saint-Gobain, whose remodeling business accounts for 45% of its revenue, has broad expertise and innovative products for interior and exterior work such as thermal windows and insulation. Energy efficiency improvements for windows boost the company’s long-term growth prospects, particularly for its flat-glass business, which makes up 14% of revenue. New construction, both residential and nonresidential, accounts for a third of sales, and Saint-Gobain is particularly strong in fast-growing emerging markets such as Brazil. —Sonia Baldeira

Health Care

Seagen

Market value (USD)

$32.3B

3-year annualized total return

51.45%

12-month sales (USD)

$1.9B

Sales growth, 2019

40%

Female board membership

22%

CEO

Clay Siegall

Growing acceptance of antibody-drug conjugates, a relatively new class of cancer medications, is great news for Seagen Inc., which won approval for breast cancer and bladder cancer treatments in 2020 and is on track to receive approval for a cervical cancer treatment in 2021. Seagen is rapidly expanding its commercial operations. —Marc Engelsgjerd

Financials

SL Green Realty

Market value (USD)

$4.4B

3-year annualized total return

-9.40%

12-month sales (USD)

$1.1B

Sales growth, 2019

1%

Female board membership

22%

CEO

Marc Holliday

SL Green Realty Corp., Manhattan’s largest office-building real estate investment trust, is depending heavily on office workers returning to their desks in 2021. To secure future cash flow, it needs to lease the rest of One Vanderbilt, the megatower recently completed across the street from Grand Central Terminal. —Jeffrey Langbaum

Energy/Utilities

SunPower

Market value (USD)

$5B

3-year annualized total return

70%

12-month sales (USD)

$1.7B

Sales growth, 2019

8%

Female board membership

11%

CEO

Tom Werner

After spinning off its manufacturing unit in August, SunPower Corp. can better focus on high-growth home and commercial solar installations. California’s mandate for solar panels on new homes and the integration of battery storage systems are poised to accelerate the company’s sales. —James Evans

Health Care

Teladoc

Market value (USD)

$32B

3-year annualized total return

91%

12-month sales (USD)

$0.9B

Sales growth, 2019

32%

Female board membership

9%

CEO

Jason Gorevic

While the pandemic has radically accelerated adoption of telehealth, Teladoc Health Inc., the market leader, has been working to build on those gains. Its $18.5 billion purchase of health-monitoring company Livongo gives it a way to tackle chronic care, most notably diabetes and hypertension. —Jonathan Palmer

Health Care

Tenet Healthcare

Market value (USD)

$4.8B

3-year annualized total return

41.33%

12-month sales (USD)

$17.5B

Sales growth, 2019

1%

Female board membership

30%

CEO

Ronald “Ron” Rittenmeyer

Tenet Healthcare Corp. has kept pace with its turnaround despite the chaos of the pandemic. The sizable corps of surgeons the hospital system hired in 2020 will amplify its profitability starting in the second half of 2021, once the next wave of Covid-19 cases is under control. —Glen Losev

TMT

Twilio

Market value (USD)

$54.6B

3-year annualized total return

140.91%

12-month sales (USD)

$1.5B

Sales growth, 2019

75%

Female board membership

38%

CEO

Jeff Lawson

Twilio Inc. is the most convenient and effective software option for businesses working to unify their online and offline advertising, marketing, and other communications, a $62 billion market known as omnichannel. —Amine Bensaid

Industrials

UPS

Market value (USD)

$139.9B

3-year annualized total return

10.22%

12-month sales (USD)

$80.3B

Sales growth, 2019

3%

Female board membership

25%

CEO

Carol Tomé

United Parcel Service Inc. has suffered from the pandemic-era shift toward lower-margin consumer deliveries. New CEO Carol Tome’s investments in customer service, offset to some extent by peak-season surcharges and cuts elsewhere, represent a starting point for shareholders eager to see returns improve. —Lee Klaskow

TMT

Vivendi

Market value (USD)

$37.8B

3-year annualized total return

5.96%

12-month sales (USD)

$17.8B

Sales growth, 2019

14%

Female board membership

55%

CEO

Arnaud Roy de Puyfontaine

Vivendi SA’s portfolio of media assets such as Universal Music, Canal+, and Havas may look very different by the end of 2021 as the French giant resolves disputes over minority stakes in Mediaset, Lagardère, and Telecom Italia. Plans for an IPO by Universal Music by 2022 could be accelerated after the unit secured a follow-on investment from China’s Tencent that augurs new sales opportunities in Asia. —Matthew Bloxham

Industrials

Weichai Power

Market value (USD)

$20.8B

3-year annualized total return

26.51%

12-month sales (USD)

$27.8B

Sales growth, 2019

9%

Female board membership

N/A

CEO

Tan Xuguang

Tighter emissions standards are a boon to Weichai Power Co., China’s top maker of electric drive systems for vehicles and machinery. The nation’s e-commerce growth, and Alibaba and JD.com’s warehouse expansions, support the company’s plan for additional capacity to build greener forklifts and its desire to control 40% of the heavy-truck engine market. —Michelle Leung

Financials

Wizz Air

Market value (USD)

$5.8B

3-year annualized total return

5.21

12-month sales (USD)

$1.7B

Sales growth, 2019

19%

Female board membership

20%

CEO

Jozsef Varadi

Wizz Air Holdings Plc was the fastest-growing European airline before the pandemic, and once the virus fades, the carrier is well positioned to return to growth. Wizz Air is unencumbered by unions or significant debt, and it has the lowest cost profile in BI’s peer group, which should facilitate expansion once demand recovers. —Rob Barnett

Consumer Discretionary

Zalando

Market value (USD)

$29.8B

3-year annualized total return

28.75%

12-month sales (USD)

$8.3B

Sales growth, 2019

20%

Female board membership

33%

CEO

Robert Gentz, David Schneider, & Rubin Ritter

Zalando SE’s shift from wholesale to a more profitable marketplace model should cement its position as Western Europe’s go-to online fashion retailer and keep its growth above 20%. A recent bond sale gives it the firepower to consolidate the sector, improve its capabilities, and add brands as customers stuck at home in the pandemic have become more selective about where they shop. —Tatiana Lisitsina

Financials

ZhongAn Insurance

Market value (USD)

$7.1B

3-year annualized total return

-20.26%

12-month sales (USD)

$2.4B

Sales growth, 2019

57%

Female board membership

8%

CEO

Jiang Xing

China’s largest online seller of insurance offers simple, low-cost medical policies that satisfy increasing demand for coverage among working-class Chinese. That and a deal with e-commerce giant Alibaba to sell its policies have put ZhongAn Online P&C Insurance Co. on track for an underwriting profit this year for the first time since its founding in 2013. —Steven Lam