Jake Fuss

– Director, Fiscal Studies, Fraser Institute

Director, Fiscal Studies, Fraser Institute

Jake Fuss is Director of Fiscal Studies for the Fraser Institute. He holds a Bachelor of Commerce and a Master’s Degree in Public Policy from the University of Calgary. Mr. Fuss has written commentaries appearing in major Canadian newspapers including the Globe and Mail, Toronto Sun, and National Post. His research covers a wide range of policy issues including government spending, debt, taxation, labour policy, and charitable giving.

Recent Research by Jake Fuss

— Apr 9, 2024

Read the Full Report

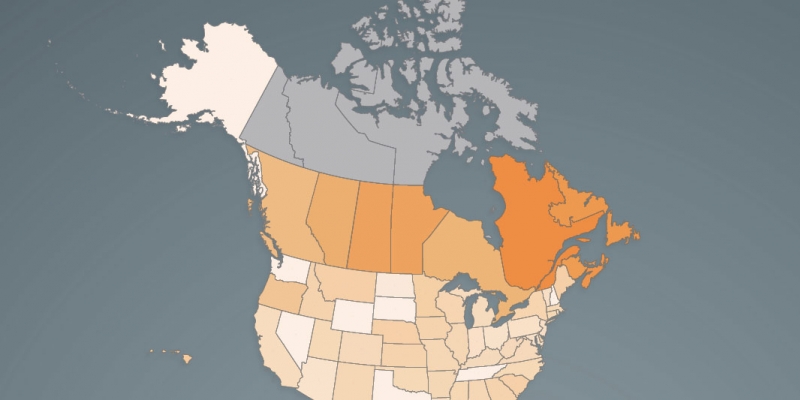

Read the Full Report View the Infographic - Income Tax Rate at CA$50,000

View the Infographic - Income Tax Rate at CA$50,000 View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$75,000

View the Infographic - Income Tax Rate at CA$75,000 View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$150,000

View the Infographic - Income Tax Rate at CA$150,000 View the Infographic - Income Tax Rate at CA$300,000

View the Infographic - Income Tax Rate at CA$300,000 Read the News Release - Canada

Read the News Release - Canada Read the News Release - Atlantic Canada

Read the News Release - Atlantic Canada

— Mar 26, 2024