Most stocks fall, tech holds up as markets digest Fed moves

The Standard & Poor’s 500 ended Thursday barely changed after stocks sloshed around in mixed trading, as investors make preparations for a future in which the Federal Reserve is no longer doing everything it can to keep interest rates super low.

Markets around the world were mixed but mostly calm after investors in Asia and Europe got their first chance to react to the Federal Reserve’s signaling on Wednesday that it may start raising short-term interest rates by late 2023. Fed Chair Jerome H. Powell also said it began discussing the possibility of slowing its bond-buying program. Such support has been a key reason for the stock market’s resurgence to records, with the most recent coming Monday.

The S&P 500 slipped 1.84 points, or less than 0.1%, to 4,221.86 after earlier meandering from a 0.2% gain to a 0.7% loss. Most of the stocks in the index and across Wall Street were lower, but gains for Apple, Microsoft and a few other tech heavyweights helped offset the losses.

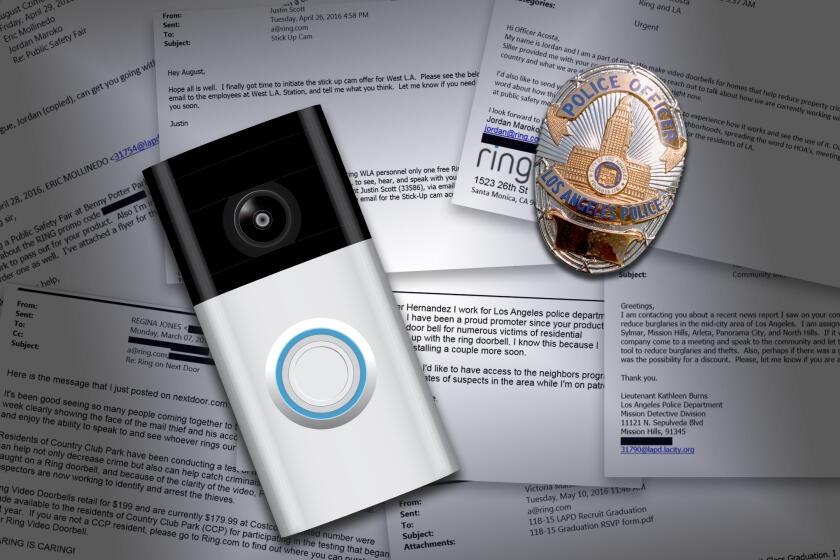

Ring provided at least 100 LAPD officers with free devices or discounts and encouraged them to endorse and recommend its doorbell and security cameras to police and members of the public.

The Dow Jones industrial average dropped 210.22 points, or 0.6%, to 33,823.45, while the Nasdaq composite rose 121.67 points, or 0.9%, to 14,161.35, lifted by the gains for tech and other high-growth stocks.

In the bond market, the yield on the 10-year Treasury note gave back nearly all of its spurt from a day before. It fell back to 1.51% from 1.57% late Wednesday.

The two-year yield, which tends to move more with expectations for Fed actions, was steadier. It rose to 0.22% from 0.21%.

The first action the Fed is likely to take would be a slowdown in its $120 billion of monthly bond purchases, which are helping to keep mortgages cheap, but Powell said such a tapering is still probably “a ways away.”

Any easing up on the Fed’s aid for the economy would be a big change for markets, which have feasted on easy conditions after the central bank slashed short-term rates to zero and brought in other emergency programs.

The economy has begun to explode out of its coma as more widespread vaccinations help the world get closer to normal. At the same time, surging prices for raw materials are forcing companies across the economy to raise their own prices for customers, in sectors as varied as fast food and used cars.

That’s fueling concerns about inflation. Much of the concern is whether rising inflation will be temporary, as the Fed expects, or more long-lasting. The reality could be mixed. The rise in commodity prices is probably tied to increases in demand as the economy recovers, but rising wages will probably be longer lasting as employers increase pay in order to attract workers, said Stephanie Link, chief investment strategist and portfolio manager at Hightower.

Investors got a bit of disappointing economic news when the Labor Department said the number of Americans who filed for unemployment benefits last week rose slightly. The total of 412,000 workers filing for jobless benefits was higher than economists expected. If it proves to be a trend rather than an aberration, it could push the Fed to hold the line longer on its support for the economy.

Stocks of companies whose profits are most closely tied to the strength of the economy and to interest rates had some of the market’s sharpest losses.

Energy stocks in the S&P 500 fell 3.5% after the price of crude oil sagged.

Banks struggled after the drop in longer-term yields hurt prospects for the profits they can make from lending. Bank of America fell 4.4%, and JPMorgan Chase lost 2.9%.

Raw-material producers were also weak, with miner Newmont down 7% after the price of gold fell 4.7%. Gold tends to struggle when the Federal Reserve is raising interest rates.

On the winning side were big tech-oriented companies, which have dominated the stock market for years as they’ve continued to grow almost regardless of the economy’s strength. Amazon rose 2.2%, Microsoft gained 1.4% and Apple added 1.3%.

Home builder Lennar rose 3.6% after reporting second-quarter profit and revenue that beat Wall Street forecasts.

In Europe, German and French stocks ticked modestly higher, while the FTSE 100 in London slipped 0.4%. In Asia, Japan’s Nikkei 225 fell 0.9%, and South Korea’s Kospi lost 0.4%, but Hong Kong’s Hang Seng rose 0.4%.