Are Vaccinemakers Attractive Today?

Here are a few drugmakers we like that are undervalued.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

The development of a coronavirus vaccine has brought heightened attention to drug manufacturers, especially the major vaccine producers Pfizer PFE /BioNTech BNTX, Moderna MRNA, and Johnson & Johnson JNJ. These names will continue to dominate the news as U.S. herd immunity could be coming by the end of June 2021.

To a lesser extent, drug manufacturers have been on watch since the Democrats took control of the White House and Senate. Director of healthcare equity research Damien Conover, however, doesn’t expect any major changes to U.S. healthcare policy.

“The biopharma lobbying group holds significant power, and the government wants to avoid disrupting innovation for lifesaving research,” says Conover. As a result, drugmakers and managed-care firms still look undervalued.

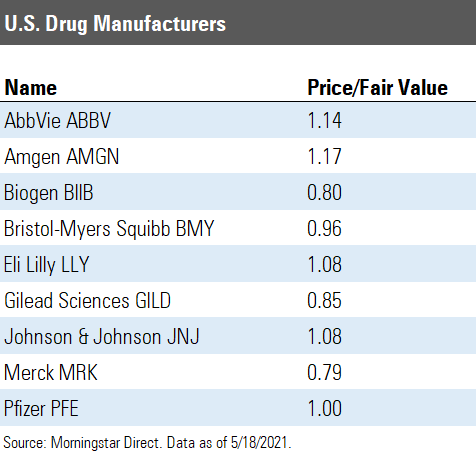

Stock investors interested in playing the healthcare-news trend may want to watch these U.S.-based drug manufacturers:

We determine the long-term intrinsic value of a stock using the Morningstar Fair Value Estimate. Stocks with price/fair value ratios less than one are undervalued, according to our analysts. Here's a look at three undervalued names. Biogen BIIB Biogen merged with drug manufacturer Idec in 2003, combining forces to market Biogen's multiple sclerosis drug Avonex and Idec's cancer drug Rituxan. Morningstar's Karen Andersen, who covers Biogen, reaffirms our $350 per share fair value estimate for the drug manufacturer--as its 2021 first-quarter results were in line with our expectations. Andersen still believes Biogen can fend off competition and earn high returns on invested capital, maintaining its wide Morningstar Economic Moat Rating. Gilead Sciences GILD Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, focused on primarily on HIV and hepatitis B and C. Andersen, who also covers Gilead, maintains our $81 per share fair value estimate. Despite 2021 first-quarter results falling slightly below our expectations, Gilead's expertise in infectious diseases is "one of the strongest intangible assets supporting the firm's wide moat." Merck MRK Merck makes pharmaceutical products to treat several conditions like cardiometabolic disease, cancer, and infections. Conover, who covers the drug manufacturer, reaffirms our $100 per share fair value estimate, despite 2021 first-quarter results falling below our expectations. Conover still believes Merck is undervalued, saying "The investment community [is] underappreciating the firm's immuno-oncology platform, led by Keytruda as well as a developing pipeline, which reinforces our wide moat rating."

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)