Why Broader Portfolio Diversification Has Finally Started Paying Off

Diversifying beyond the basics has helped buffer losses during this year’s bearish market.

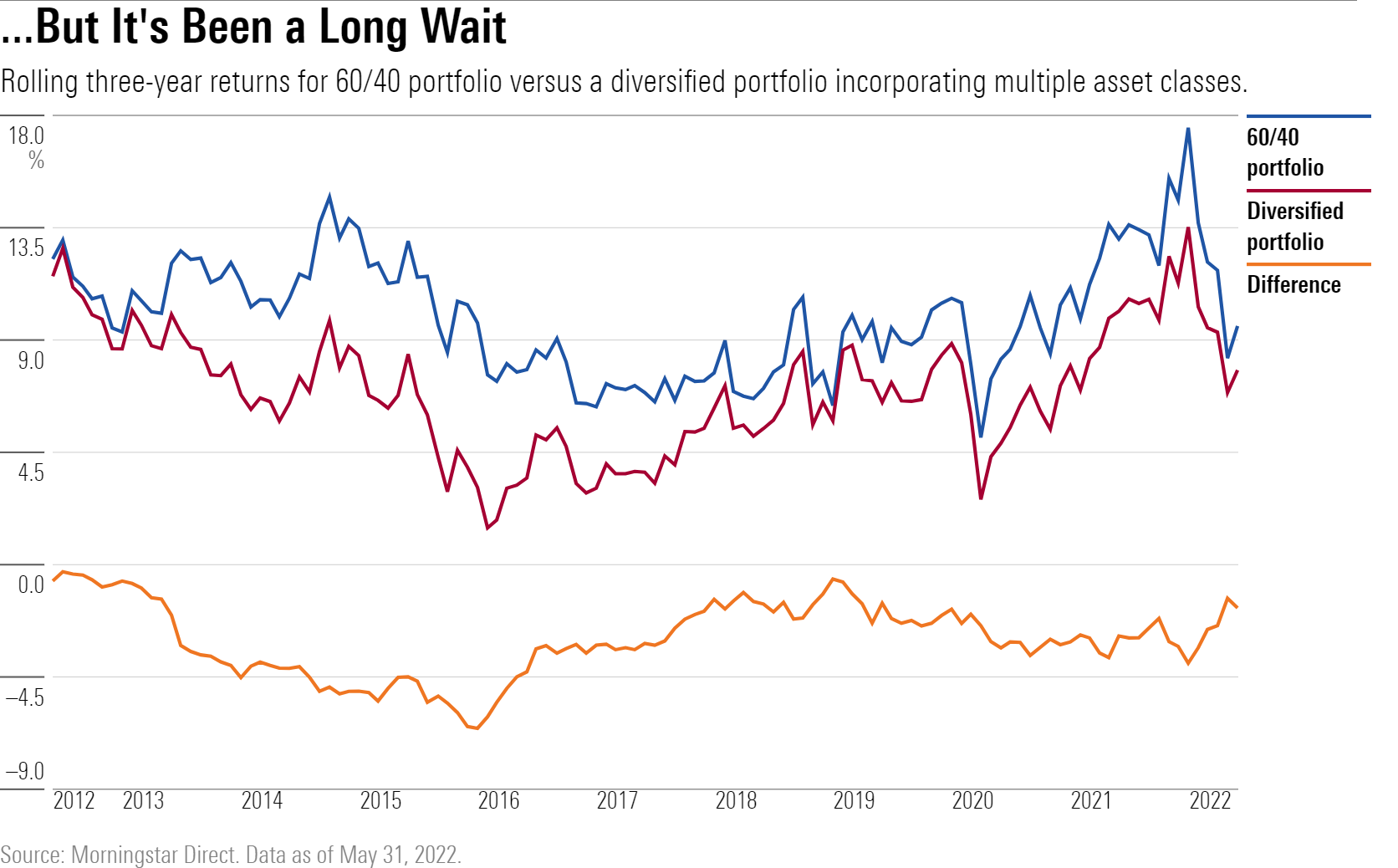

Until recently, the classic 60/40 portfolio combining U.S. stocks and investment-grade bonds was tough to beat. Domestic stocks racked up double-digit annual returns on a regular basis, and bonds provided both strong performance and compelling diversification benefits. As a result, the basic 60/40 portfolio did a far better job generating returns than more-complicated diversification strategies. This pattern held true over every rolling three-year period between June 2009 and December 2021.

But the tables have started turning. Markets have been shaken by a few different things: ongoing worries about new coronavirus variants, political instability in Eastern Europe, the sudden resurgence of inflation, and fears that rising interest rates could increase the odds of a recession. Amid this year’s market turbulence, broader portfolio diversification strategies have finally started to prove their mettle, underscoring the importance of diversification as a long-term portfolio strategy.

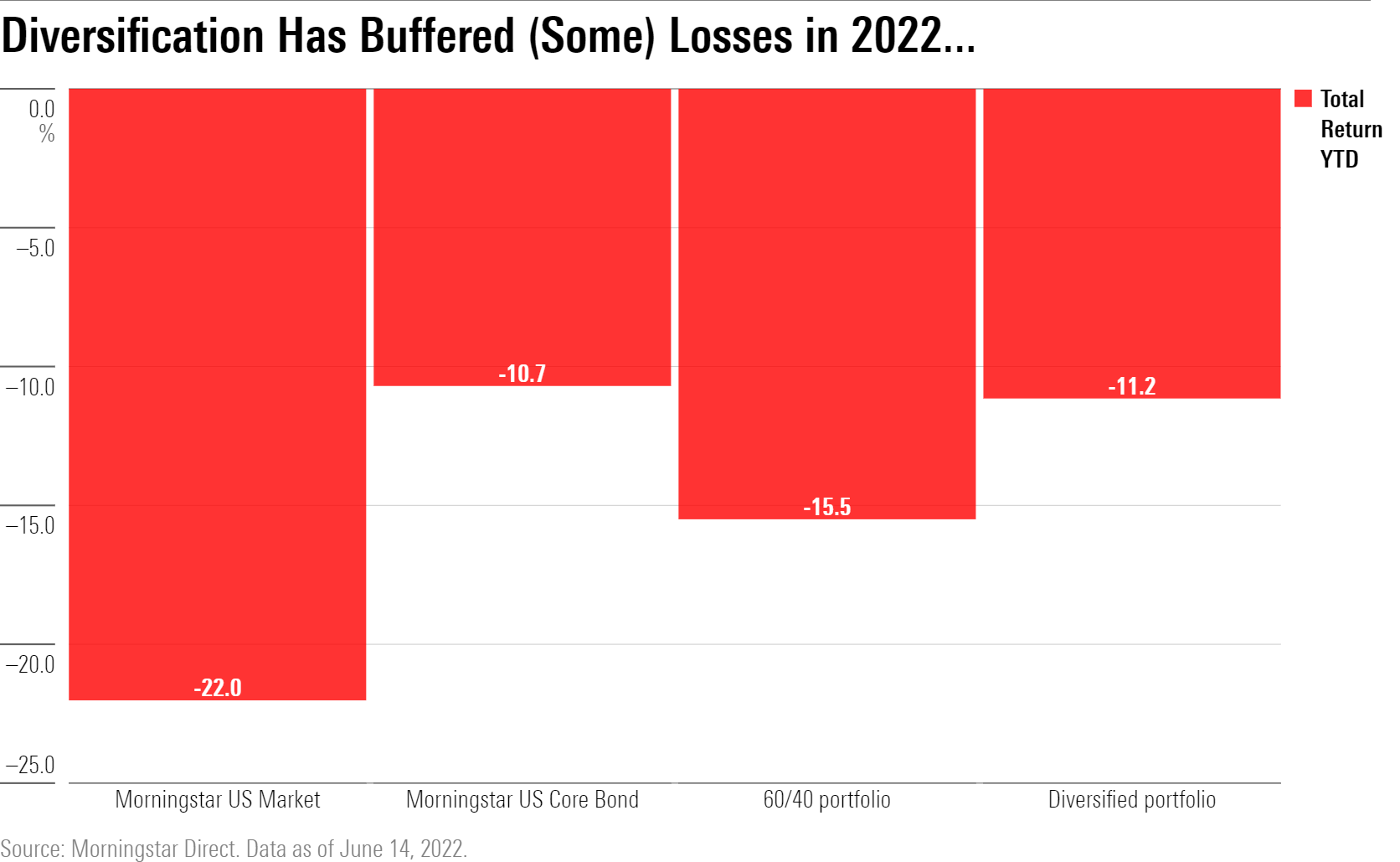

Why Diversification Has Worked So Far in 2022

This year’s market environment has proved unusually tough for both stocks and bonds. The Morningstar US Market Index has officially dropped into bear-market territory with a 22% loss for the year to date through June 14, 2022, and bonds are generating some of their deepest losses in decades. As a result, the 60/40 portfolio (down 15.5% for the same period) has also suffered one of its worst showings in many years.

The test portfolio I set up to test the value of diversification fared slightly better, with an 11.15% loss. This portfolio consists of 10 different asset classes, with 20% of the portfolio allocated to larger-cap domestic stocks; 20% to investment-grade bonds; 10% each to developed- and emerging-markets stocks, global bonds, and high-yield bonds; and 5% each to small-cap stocks, commodities, gold, and REITs.

Most of these asset classes have also dropped in value, but a few key areas helped reduce the damage. International stocks (including both developed and emerging markets) lost a few percentage points less than their domestic counterparts. But commodities and gold really saved the day: As inflation has surged to a 40-year high, the Bloomberg Commodity Index has gained nearly 35% so far this year. Gold has notched a much smaller gain of 1.4% for the year to date through June 14, but that still helped offset losses in other areas.

Why It Took So Long

As mentioned above, it’s been a while since portfolio diversification was a net positive for portfolio performance. As shown in the chart below, the basic 60/40 portfolio generated better total returns for every trailing three-year period going back to the period starting in mid-2009.

Diversification’s failure to add value mainly reflects the confluence of strong returns for plain-vanilla stocks and bonds and weaker results for more specialized areas. For example, international stocks generally lagged their domestic counterparts for a long stretch starting in 2010. Other areas—such as commodities and REITs—fared worse. Commodities suffered a string of losses between 2011 and 2015, while REITs also fell in and out of favor.

The diversified portfolio also failed to add value in risk-adjusted terms. Rolling three-year Sharpe ratios for the diversified portfolio trailed those of the basic 60/40 portfolio for every rolling three-year period starting in March 2009.

This failure to add value in risk-adjusted terms partly reflects the overall upward trend in correlations between major asset classes over the past 10 years or so, which reduced the value of diversification. Correlations between U.S. and non-U.S. stocks, for example, significantly increased over the trailing 10-year period through 2021. Even areas often touted for their diversification benefits—including REITs and some commodities—have often moved more in tandem with the broad U.S. equity market than investors might expect. In aggregate, the correlation coefficient for the diversified portfolio measured against the Morningstar US Market Index rose to 0.95 for the trailing three-year period ended in December 2021, up from as low as 0.76 in some previous periods.

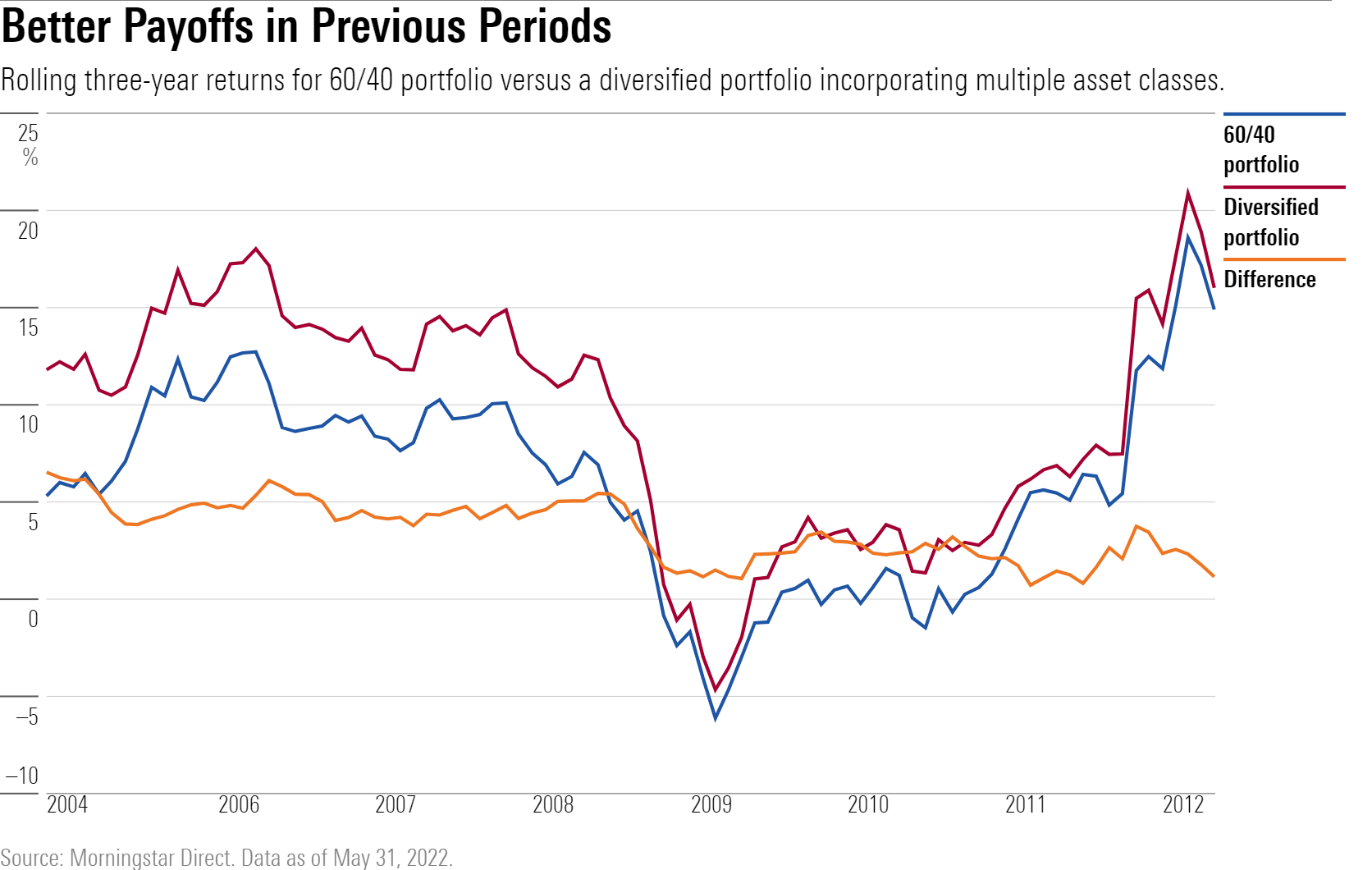

However, the diversified approach put in a more-compelling showing in some previous periods. As shown in Exhibit 3, the diversified portfolio had a consistent performance edge across all of the rolling three-year periods between December 2001 and May 2009.

On a risk-adjusted basis, the diversified portfolio also came out ahead a significant percentage of the time. Going back to 1991 (and using slightly different benchmark indexes), the diversified portfolio generated better risk-adjusted returns than the basic 60/40 portfolio in about 46% of rolling three-year periods.

What it Means for Investors

The fact that portfolio diversification doesn’t necessarily pay off the majority of the time might raise the question, Why bother? First, the limited performance history for most diversified asset classes means there’s arguably not enough data to work with. Second, the data we do have generally coincides with a particular market regime, with interest rates generally trending down and largely benign inflation. Now that both of these trends have made a clear reversal, the market environment that was so hospitable for the basic 60/40 portfolio no longer exists.

As stocks and bonds have trended down in tandem, correlations between the two major asset classes have flipped into positive territory. That makes it harder to reap diversification benefits just by adding investment-grade bonds to an all-equity portfolio. At the same time, surging inflation has been a tailwind for some diversified asset classes.

Ultimately, portfolio diversification is best viewed as an insurance policy; it has a cost and only pays off some of the time. But because market leadership is inherently uncertain and constantly changing, diversification is still a prudent strategy for long-term investors.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)