How Drug Pricing Can Increase ESG Risks for Pharmaceutical Stocks

New Morningstar research highlights Big Pharma’s exposure to ESG risk. Two winners: BioMarin and Sanofi.

Drug pricing is complex and unclear. Patients rarely fully understand drug prices and can be left with frustratingly large bills. Drug pricing can potentially limit access to medicines, creating a major environmental, social, and governance risk for pharmaceutical companies and pharma stocks. Within this ambiguous and complicated pricing background, along with the lack of regulatory oversight on U.S. drug pricing, an independent, private organization—the Institute for Clinical and Economic Review, or ICER—has gained prominence and authority by assessing the cost-effectiveness of drugs. In the long term, we think cost-effectiveness analysis will have a growing influence on drug-pricing policy and negotiations, putting firms with unjustified prices for their top-selling drugs at risk.

Analyzing Pharmaceutical Companies Based on Drug Pricing

Cost-effectiveness analysis attempts to answer the question of what a drug is really worth. Using safety and efficacy data from clinical trials, ICER estimates how much these drugs can extend life or improve quality of life.

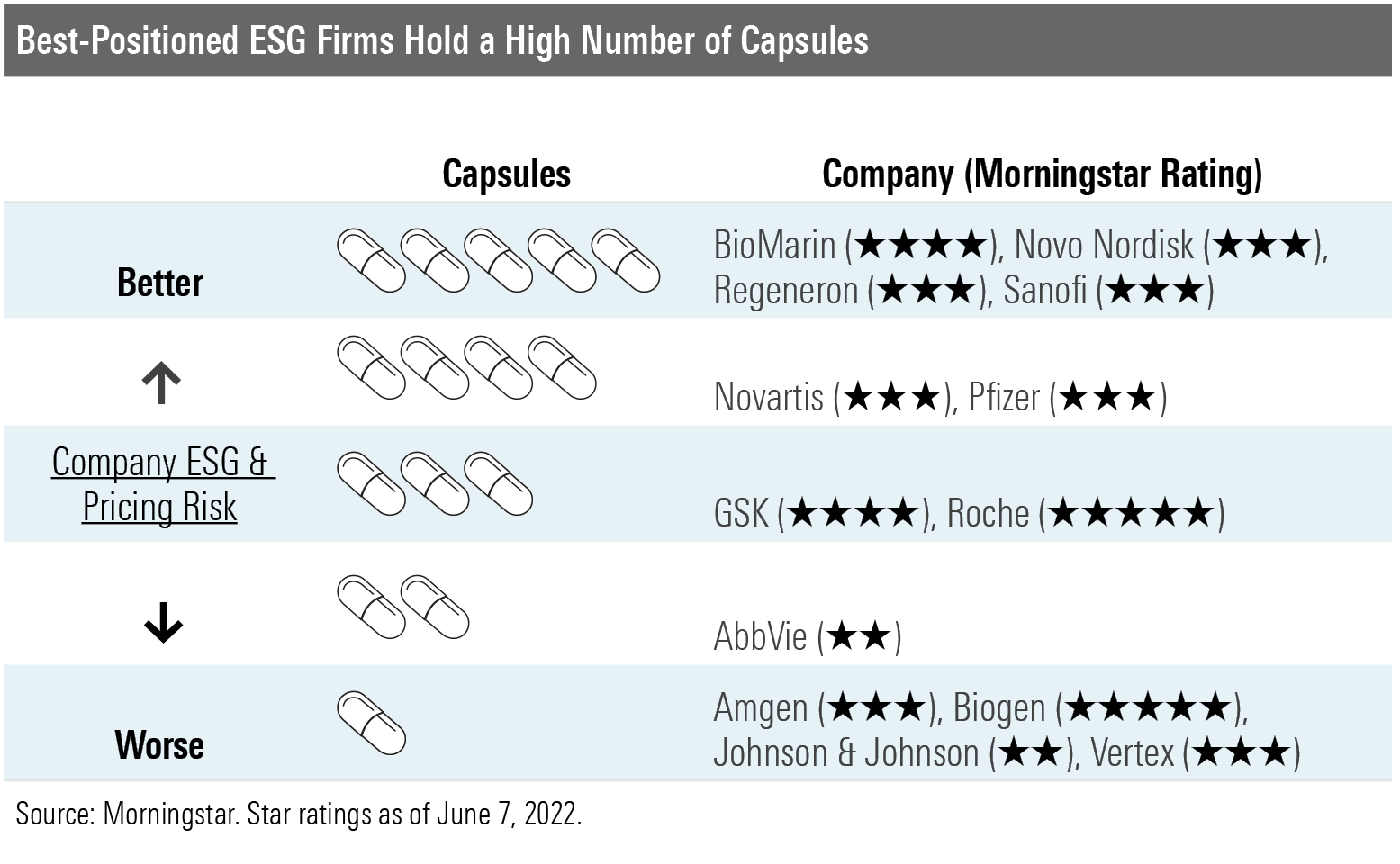

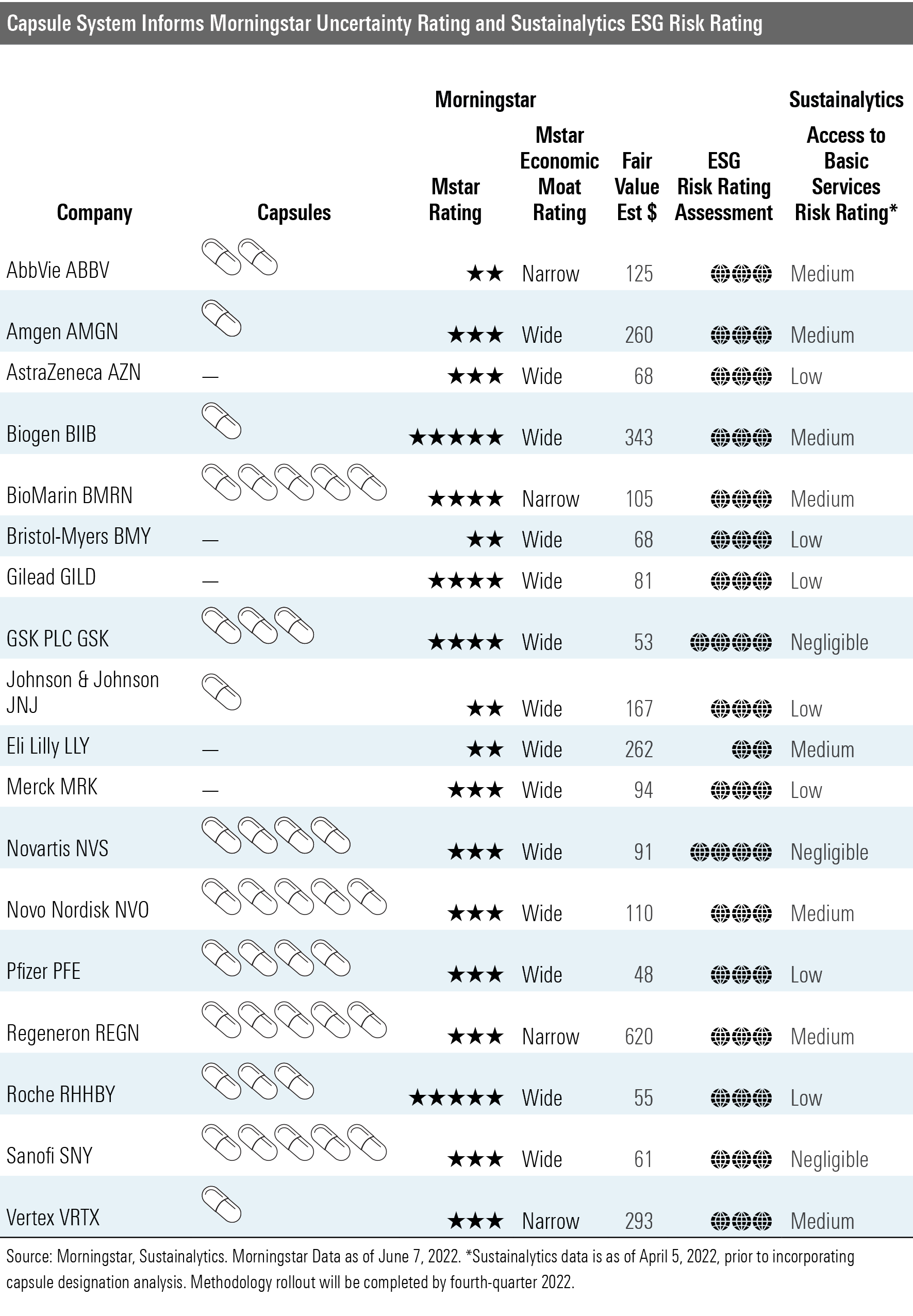

Morningstar and Morningstar Sustainalytics are now incorporating ICER’s analysis into our biopharmaceutical ratings through what we’re calling our capsule system. The system looks at how net prices for top-selling drugs differ from ICER’s cost-effective price thresholds and any significant unsupported price increases for a firm’s top drugs over the past three years. Fewer than 4 capsules serve as a red flag and can impact Sustainalytics ESG Risk Ratings and Morningstar Uncertainty Ratings. In the table below, we highlight the best- and worst-positioned firms based on the capsule system combined with our Morningstar Ratings for stocks.

Poor-Performing Pharmaceutical Stocks, Based on Our Drug-Pricing Capsule System

Using our capsule system, the following firms have the largest excessive deviations from cost-effective pricing for significant portions of their branded drug portfolios. We believe these drug-pricing practices introduce increased ESG risks for the pharma stocks.

AbbVie’s ABBV immunology drug Humira has a long history of annual price increases and net prices above cost-effective levels, and newer immunology drugs like Skyrizi and Rinvoq also appear to be slightly overpriced as well. We’ve raised AbbVie’s uncertainty rating to high from medium as a result of our capsule analysis and the company’s high reliance on U.S.-branded drug sales for its profitability.

Amgen’s AMGN immunology drugs have a history of both high prices and unsupported price increases, with the firm’s flagship immunology drug Enbrel standing out in our analysis. New asthma drug Tezspire also joins a class of biologic asthma drugs that tend to be priced above cost-effective levels at launch, although Amgen could offer discounts that lower the net price over time. We’ve raised our uncertainty rating to high from medium as a result of our capsule analysis and Amgen’s high reliance on U.S.-branded drug sales for its profitability.

Biogen’s BIIB multiple sclerosis drugs and rare disease drug Spinraza are overpriced, and ICER has analyzed a large portion of Biogen’s portfolio of drugs. Biogen’s exposure to the multiple sclerosis market is one factor in its pricing strategy; most drugs in this therapeutic area tend to have high prices, as payers have less negotiating power because of physicians’ desire to have several available treatment options for patients. However, our existing high uncertainty rating for Biogen already factors in pricing pressure going forward.

Johnson & Johnson’s JNJ immunology drugs Stelara and Tremfya adversely affect its number of capsules. Stelara is especially concerning with net pricing at close to 300% of the cost-effectiveness threshold. That said, we didn’t alter J&J’s low uncertainty rating, as the firm’s heavily diversified geographic and product portfolios limit some of our U.S. drug-pricing concerns at the company level.

Vertex VRTX stands out as the worst performer in our capsule system. Chronic therapies for rare diseases are often priced above their cost-effectiveness thresholds, and Vertex’s cystic fibrosis therapies are priced at least 3 times the level that ICER would deem to be cost-effective. We expect Vertex’s score could improve with time, particularly if the firm makes headway with gene editing (CRISPR Therapeutics-partnered CTX001 for rare blood disorders) and cell therapy (VX-880 is in clinical trials for Type 1 diabetes). We’ve raised our uncertainty rating to high from medium as a result of our capsule analysis and Vertex’s high reliance on U.S.-branded drug sales for its profitability.

Best-Positioned Pharmaceutical Companies, Based on Capsules and Valuation

- Sanofi’s SNY heavy reliance on Dupixent bodes well both from a valuation perspective and from the capsule system as the drug is priced close to the cost-effectiveness level in the atopic dermatitis indication.

- We expect BioMarin’s BMRN hemophilia gene therapy will be priced at a fair level, based on a generous review by ICER owing to the one-time nature of treatment here and strong efficacy.

Other Well-Positioned Pharmaceutical Stocks

- Regeneron REGN also benefits from the fair Dupixent pricing (the drug is co-marketed with Sanofi) as well as heavily discounted prices for Praluent, a cholesterol-lowering drug.

- Novo Nordisk’s NVO oral GLP-1 therapy Rybelsus and injectable long-acting insulin Tresiba look cost-effective for diabetes, a major societal cost.

- Novartis NVS has several covered drugs that are priced cost-effectively, from immunology drug Cosentyx to gene therapy Zolgensma.

- Pfizer’s PFE score could be more dynamic, as it is benefiting from Paxlovid’s strong cost-effectiveness in COVID-19, and our sales estimates there are more uncertain.

In the table below, we summarize the key metrics from the capsule system and the impacts on valuation and ESG.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)