What to Do If Your Employer Cuts Its 401(k) Match

A match is a great employer benefit and a powerful wealth-building tool, but there are many reasons to keep contributing to your 401(k) even if this key benefit is suspended.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Question: My company announced that it's considering suspending its 401(k) matches. Should I stop contributing, too?

Answer: First of all, I'm sorry to hear this. It's always an unfortunate situation for employees when employers reduce benefits, but it might help to think of it in these terms: Oftentimes companies consider undertaking cost-reduction efforts like cutting the 401(k) match in difficult economic times because it helps them alleviate the need to take more drastic measures like laying employees off.

That doesn't mean it's not a bitter pill to swallow, though. Especially considering the fact that difficult economic environments often coincide with stock market downturns, which is exactly when you want to contribute more to your retirement account, not less. That's because stock market sells-offs present opportunities for long-term investors to buy stocks at cheaper prices, which improves their chances of future success.

If you find yourself in this situation, the best direction is to keep contributing to your 401(k) and consider raising your contribution amount to fill in the hole that the employer match is temporarily leaving. Read on for more on how to do that.

The Match Matters One of the biggest benefits that comes with investing in an employer-sponsored retirement plan is the employer contribution. Though traditional deductible IRAs and Roth IRAs also offer tax benefits for retirement savers--and often offer a wider choice of investment options, too--they don't offer you free money for contributing.

And free money is too enticing to pass up. Many employers match 50% or even 100% of your contributions up to a certain percentage, and you'd be you'd be hard-pressed to earn anything close to that kind of return by investing outside of your plan, as Morningstar director of personal finance Christine Benz explains in "Should You Invest in a Lousy 401(k)?"

According to data from Vanguard, which is one of the largest recordkeepers for defined-contribution plans in the United States, 95% of the plan sponsors that Vanguard serves offer some form of an employer contribution, and often that takes the form of an employer match. There is a wide range of options when it comes to designing an employer-match formula, and some companies are more generous than others.

According to Vanguard, the most common match formula is single-tier, such as $0.50 on the dollar of the first 6% contributed. Some employers match employee contributions immediately, while others delay contributions, and some employers also impose vesting schedules where employees would forfeit the employer match portion of their 401(k) balance if they left before the vesting period expired (normally a few years).

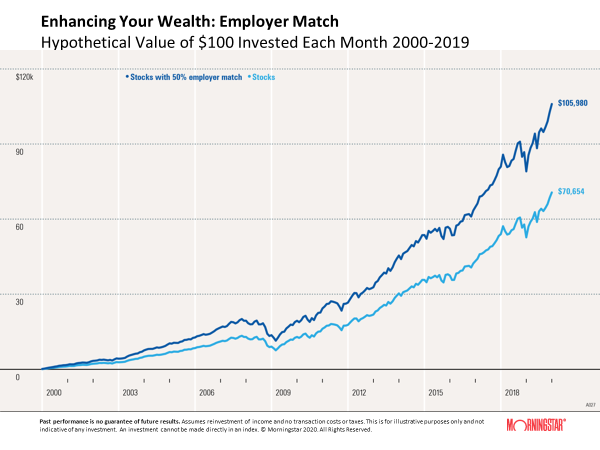

The image below shows what a big difference the match makes. The light blue line shows the growth of $100 invested in stocks at the end of each month. The dark blue line represents the same investment with a 50% employer match. (In other words, $150 invested each month as opposed to $100.) Because investment returns grow exponentially and not in a linear pattern, funding your retirement account with as much money as early as possible gives you the best growth potential.

Source: Morningstar Presentations, available in Morningstar Office.

What's Going On With Matches Now? (Is This 2008 All Over Again?) To find out what plan sponsors are saying about company matches and how it compares with 2008, I spoke to Jean Young, a senior research associate with Vanguard Investment Strategy Group. Every year, Young and her team author a research report called "How America Saves," which looks at the data from 5 million investors across 1,900 plans for which Vanguard serves as recordkeeper.

First of all, Young stresses that just because your company has announced it is considering cutting the employer match, that doesn't mean it actually will. During the global financial crisis of 2008-09, more employers announced match reduction/suspensions than actually implemented them, she said. And plan sponsors who actually did cut or reduce the employer contribution restored it fairly quickly.

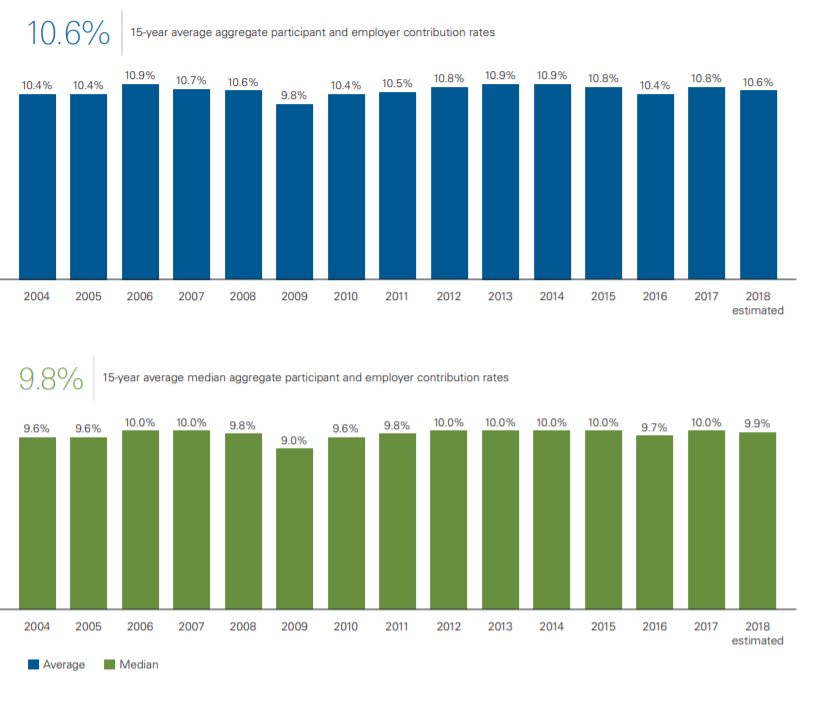

As you can see from the graphic below, which comes from the 2019 edition of "How America Saves," there was a modest reduction in employer contribution activity in 2009-10, but the contribution level bounced back fairly quickly--which is encouraging if you're looking to use 2008 as gauge for what to expect now.

A caveat: The graphic below shows total 401(k) contributions, which includes employee contributions, employer matching contributions, and nonmatching employer contributions, which are most often profit-sharing contributions. Profit-sharing plans work differently than 401(k) matches: In profit-sharing plans, employees receive a variable percentage of a company's profits, either in cash or company stock. In difficult economic times, some companies' profits contract more than others, but overall, some degree of reduction in discretionary profit-sharing contributions is to be expected during downturns.

Source: Vanguard, "How America Saves 2019."

Of course, every downturn is different. There are many reasons why the current economic environment is different than 2008. But though Morningstar analysts believe that the coronavirus shutdown will have a significant impact on the economy and business profits this year, we anticipate that the long-term impact to the economy will be minor; in fact, we think it will have a smaller long-term impact than the 2008 recession.

Though it's difficult to draw conclusions from what happened during the global financial crisis because each downturn comes with its own unique set of circumstances, there's good reason to be sanguine that employers will continue to contribute to retirement plans, and employer matches, if cut, will come back on line as businesses' outlooks improve, Young said.

"Sponsors continue to take a very thoughtful approach to their plan design and retirement benefits for participants. To date, most have not made significant plan-design changes in response to current volatility," she said.

Young urges 401(k) savers to stay the course. "You still want to participate, and you want to be participating when the match comes back on line," she said.

Reasons to Stick With Your 401(k) If your company has announced that it is temporarily suspending its 401(k) match, it's very likely that this benefit will be restored before too long. But even absent employer matches, it still makes sense to contribute to employer-sponsored plans because they offer some administrative convenience and helpful features that most IRAs don't.

One convenient benefit of 401(k)s is the fact that contributions are taken out of your paycheck pretax by your employer, so you don't have to deduct them from your taxable income when you file your tax return. And regular, automated 401(k) contributions deducted from payroll also help you stay disciplined about saving. If the money is taken directly from your paycheck and it never makes its way to your checking account, you won't be tempted to spend it.

Another benefit some 401(k)s plans offer is "auto escalation," which means that your savings rate automatically increases--often 1 percentage point per year and maxing out around 15%. This is another great feature that can help improve your retirement saving outcome: In order to make sure you will have enough money to fund your lifestyle in retirement, you need to save more money as your salary increases. (You can think of this as the "more money, more problems" paradox--as our salaries grow, our lifestyles become more expensive. To afford this higher standard of living in retirement, we need to save more now.)

And while it's true that IRAs offer a wider range of available options, more choice isn't always better. Many company retirement plans offer access to a menu of professionally vetted investment options that are available to you at a much lower cost than you could receive if you invested on your own through an IRA. Often plans have access to institutional shares that are priced much lower than those available to individual investors, and paying lower expenses means you earn higher returns, all else equal.

Prevent Lost Opportunity by Raising Your Contribution Rate A generous match is a great employer benefit and a powerful wealth-building tool. If your company has announced that it is temporarily suspending its 401(k) match, try to increase your contribution so that your savings rate stays constant, which will allow you to take full advantage of the "buyers' markets" that sell-offs provide. Here's how to do it:

Let's say that you contribute 6% of your salary to your 401(k) and your company matches the first 6% of contributions at $0.50 on the dollar. In this scenario, your savings rate is 9%, which is closer to the 10%-15% savings rate that most financial planning experts recommend. While your company is suspending its match, if it's possible for you given your personal circumstances, increase your salary deferral percentage to 9%.

When the match comes back on line, you can reassess your budget and decide whether it makes sense to keep contributing at this rate or whether it would make sense to allocate that money to paying down debt or saving for another goal instead. But if you can afford to keep this higher retirement savings rate long term, do it. It will help ensure that you can comfortably afford your lifestyle when you no longer have the desire, or possibly even the ability, to work for income.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)