A year ago, BlackBerry looked in peril. An attempt to sell it to Canada’s Fairfax Holdings had foundered - and there were questions about what might happen to users of its phones if the sale did go through.

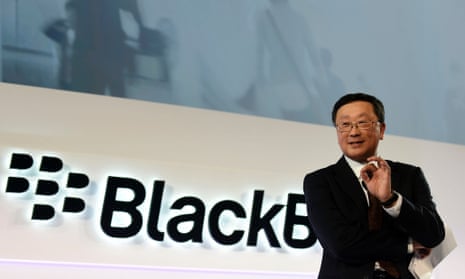

Since then, a lot has happened: then chief executive Thorsten Heins was thrown out and replaced by John Chen, a turnround specialist who had previously brought Sybase back to profitability. The company has refocussed on its government and big business (“enterprise”) base.

On Friday, it announced its second-quarter financial results (for the three months to the end of August), and Chen had an earnings call with analysts.

So what’s the story with BlackBerry now? Here are the ten things you need to know to understand the company’s situation - and prospects.

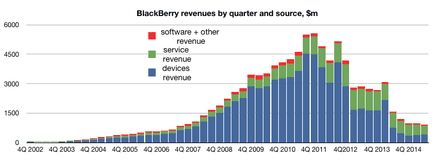

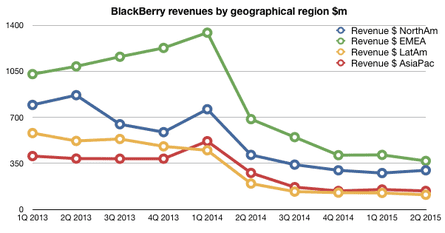

1: Revenue is still falling, and doesn’t seem to have quite bottomed out. At $916m, it’s the lowest quarterly figure since the September-November 2006 period (which was $835m), and down 42% compared to the year-ago quarter.

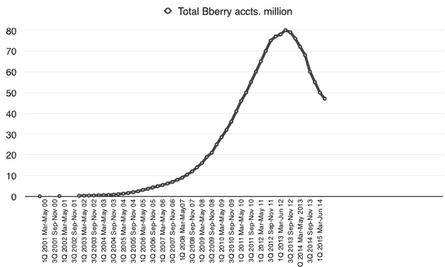

2: The number of BlackBerry subscribers is still falling: there are now about 46m, down from 50m the previous quarter. About 80% - that is, 36m - are business users, according to Chen’s comments in the analyst Q+A, where he said:

on the sub count… we were down a little bit. I think the rate of decline has slowed. We were 50 last quarter. We’re definitely less than 10% down I would say. But in terms of the ratio, I think that 80% of that is business…

At its peak, in the July-September 2012 quarter, BlackBerry had 80m subscribers.

Note that BlackBerry subscribers aren’t the same as BBM users - where the company says it had 91m monthly active users , up 6% from the previous quarter and up 44% from a year before. (The latter figure isn’t surprising: a year ago, BBM was only available on BlackBerry, not iOS or Android.)

The subscriber number is important, because BlackBerry gets a per-account payment each quarter from carriers and other customers known as the “Service Activation Fee” (SAF). Fewer subscribers mean less money from SAFs - and that gets worse if…

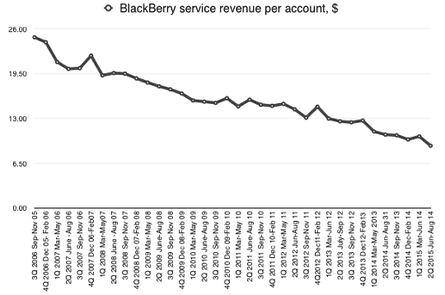

3: The amount that BlackBerry gets per subscriber is falling, and this is a big part of the company’s revenue problem. BlackBerry used to get paid handsomely by carriers for taking the load off their networks to transport BBM and email data, which it would transfer via its own Network Operations Centres (NOCs). But the carriers have improved their infrastructure, and now don’t see the point in paying BlackBerry to do what they already can.

It could also charge per-user for its BES systems. But now it faces competition from companies willing to offer similar services much more cheaply.

As a result, the per-subscriber amount that BlackBerry gets is falling rapidly. Based on the service figure in its accounts, in 2002, it was getting over $80 per subscriber. By 2010, that had fallen to just over $15. In the past quarter, it was under $9.50 if we assume a 45m subscriber base; if you assume the subscriber base is about 47m, as Chen seemed to imply, the per-subscriber figure is only just over $9.

The problem with this is that as both subscriber numbers and per-subscriber payments keep falling, Chen will have to find some other way to keep revenues up. He is talking about making software into a $250m business - but that’s small beer in the context of its annual revenues.

4: Losing subscribers and per-subscriber revenue hits profits really hard. BlackBerry built the infrastructure for its NOCs over the course of years, so they’re well-suited to carry enormous amounts of data - and the more data they deal with, the more economic (and profitable) they are. Services (especially the Service Activation Fee, or SAF) are the really profitable side of BlackBerry - arguably more so than handsets, which were a way to get subscribers on board. As that dwindles, profits become harder to find.

The bad news: BlackBerry is expecting that SAF per-subscriber revenue to keep falling - by 10% to 15% next quarter. If subscriber numbers fall too, the revenue and profit hole at the core of BlackBerry starts to get bigger. Handsets aren’t a great source of profits; they’re expensive to make and there’s continual downward price pressure. Software and services are far more profitable.

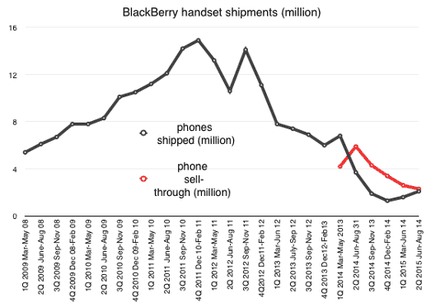

5: The handset business still isn’t out of the woods. Chen made great play of the reception for the latest Passport handset, shown off on Wednesday. But let’s be clear: the 200,000 figure he quoted was pre-orders ahead of the launch. Those are almost certain to be from carriers, in which case they could be on sale-or-return. (It’s also notable that Chen said he hadn’t been involved in the Passport’s design - that’s because the typical phone takes two years to go from design to production.) His saying (and anyone repeating) that the Passport was briefly the best-selling phone on Amazon means nothing. So was the Amazon Fire Phone once. In any case, the Passport isn’t intended for consumers. That business simply isn’t coming back.

More to the point, the handset business - which generates roughly half of the company’s revenues - is recovering, but slowly. BlackBerry shipped 2.1m phones in the financial quarter, of which 70% (or 1.47m) were running BB10 - which means 630,000 were the BB7-based BlackBerry Bold or similar. The average selling price across all the phones was just over $200 - slightly less than same period the year before, when it shipped 1.8m BB10 devices.

In other words, the company shipped fewer BB10 devices in the summer 2014 quarter than in the summer 2013 quarter - despite having more devices, such as the Z10, Q10 and Z3 to offer.

One encouraging note is that “sell-through” (the number of handsets reaching end users) is now almost the same as “shipped” handsets, meaning a huge wodge of unsold handsets has been worked out of the system. That should mean that shipments and end-user sales will come into alignment; that usually means higher selling prices, because the devices are current, not written down.

And carriers have cleared a lot of inventory: sell-through has been 22.7m in the past six quarters, against 17.4m shipped, meaning 5.3m excess handsets (almost certainly BB10s) have been cleared. For BlackBerry, that’s good news.

6: the Z3 doesn’t seem to have done as well as the publicity suggests. Ehud Gelblum at Citibank asked some sharp questions on the call, pointing to the fact that BlackBerry’s revenues in Asia fell quarter-on-quarter, and also that in the previous quarter the number of BB7-based units shipped had been a lot lower - so why did they rise?

The Z3 wasn’t sold in the US - which was the only region that recorded revenue growth. “Asia was down, and Z3 went into Asia,” Gelblum asked. “So I guess all these things I’m trying to go at and trying to understand are, why was Asia down if the Z3 was there? Why was North America up? And why does it look like your BB7 devices were up very strongly to 700,000 this quarter for probably no more than 3, 4, 500,000 last quarter, and are they all related?”

James Yersh, the chief financial officer, responded in a roundabout way that North American buyers seem to have been buying BB7 devices: “I think your math on the units is right. And if you think about what’s popular in North America would be like 900 in Bold which would drive more BB7 type of units going through there as well. You right that the Z3 wasn’t there, but effectively I think all those story hang together and drive in and around or explain the uptick in BB7 and some of the strength in devices for that.”

In other words, businesses and governments in North America which still use BlackBerry Enterprise Server (BES) seem to have laid in stock of BB7 handsets so their staff can keep using them for the next few years.

7: February 2015 is going to be an important quarter for BlackBerry - perhaps even crucial. In February this year, it announced “EZ-Pass” - a scheme that allowed businesses to upgrade to its BES 12 platform for free, for a limited time.

In February, that offer runs out - and at that point, the people using the system will have to decide whether to stick with BES 12, or go to some other MDM (Mobile Device Management) service. This might not be such a foregone conclusion: Yersh told Todd Coupland of CIBC that when you’re trying to sell software, you typically need between six and eight potential customers to get one certain sale.

This might be different for people who are already using BES 12 (though under EZ-Pass, BlackBerry effectively isn’t getting any revenue at all for now; it needs to convert them to paying customers), but it does point to a busy time for the company’s sales team after Christmas.

8: BlackBerry really, really isn’t interested in the consumer market. Chen has cut back the sales, marketing and administration drastically - from $400m the previous quarter to $195m in the reported quarter (and from $548m and $355m in the previous quarters to those). With so little being spent pushing the company, it is clear that it’s not trying to find new customers; it’s clinging on to the ones it has.

9: Even with all those cuts, it still wasn’t profitable. For the quarter, it made an operating loss of $198m - although that is enlarged by an adjustment in the value of its debentures, which are effectively a $1bn bond issued last year when it looked like everything could to go hell in a handbasket.

If you strip out the variation in debenture valuation (and inventory writedowns, including a gigantic $3.7bn writedown of the value of unsold BB10 devices when Chen took over), over the past four quarters BlackBerry’s operating performance has been, respectively:

$1,200m loss

$248m loss

$267m loss

$24m loss.

Clearly, Chen is getting the company to a point where it’s nudging towards being consistently profitable - but if services revenue keeps falling, and if there are any more missteps with handsets or inventory, it could fall hard.

10: The customers who really like BlackBerry are in the Middle East and Africa - though those which depend on it are governments and businesses around the world. The mystery to many might be that BlackBerry’s finances show that the Europe/Middle East/Africa segment generates the most revenue, not North America. That’s because it sells really well in south Africa - and the Middle East, where BBM is still popular as a means for teenagers to communicate without family oversight. But it’s the BB7 models, not the new BB10 ones, which do well there.

The question is - for how much longer?

Certainly, John Chen has made enormous strides in getting BlackBerry out of the morass it had fallen into. He’s put in all the right disciplines - and has the advantage of its core business and government base to rely on. The problem still is: is that core business enough to keep the company going at this size, or will Chen have to cut again? And if he does and that doesn’t work, the question comes back to the same one that was asked when he came aboard: will the company be able to keep going?

Comments (…)

Sign in or create your Guardian account to join the discussion